Question: Integrated Excel - Tax Problem - Marginal Tax Rate Sgt . Barnes is a veteran police officer filing as Head of Household. Currently, her taxable

Integrated Excel Tax Problem Marginal Tax Rate

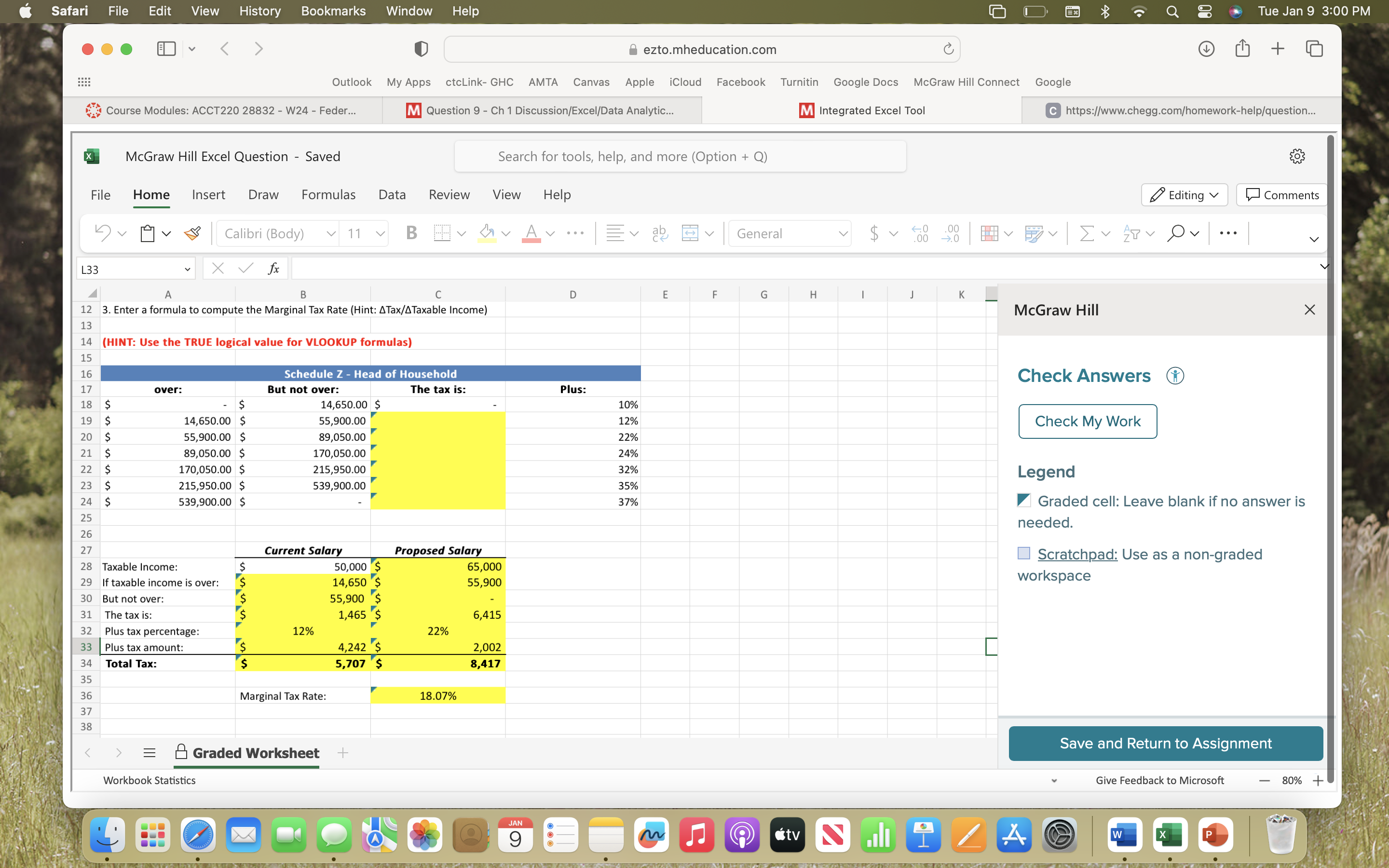

Sgt Barnes is a veteran police officer filing as Head of Household. Currently, her taxable income is $ but has been asked to sit for the Leutenant's exam. She is excited about the opportunity as the pay raise will give her an additional $ of taxable income. Sgt Barnes would like to know what the tax implication will be with the promotion and raise. Sgt Barnes also moonlights as a private security guard for major sporting events and is concerned the promotion and raise will have an adverse impact on her marginal tax rate.

Required:

Complete the "The tax is: column for each filing status table using a formula. Please show each individual formula in the sheet.

Prepare the Current Salary and Proposed Salary tax calculations using VLOOKUP formulas to the tax brackets. Please show each individual formula in the sheet.

Enter a formula to compute the Marginal Tax Rate Hint: Delta TaxDelta Taxable Income

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock