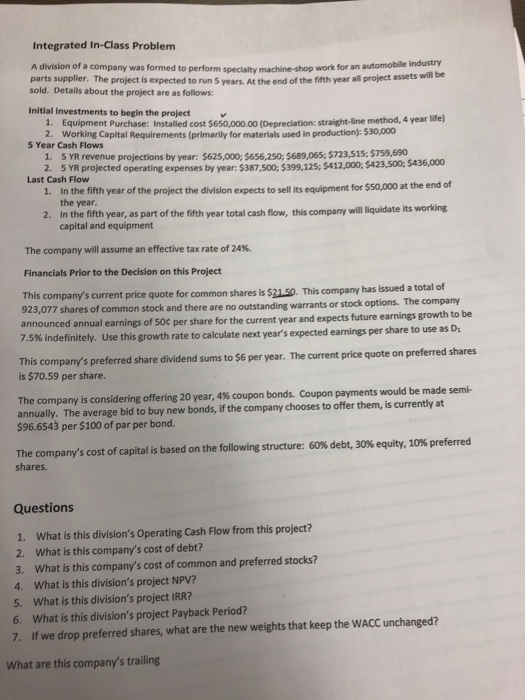

Integrated In-Class Problem A division of a company was formed to perform specialty machine-shop work for an automobile industry parts supplier. The project is expected to run 5 years. At the end of the fifth year all prob sold. Details about the project are as follows assets will Initial investments to begin the project 1. Equipment Purchase: Installed cost $650,000.00 (Depreciation: straight-line method, 4 year life) 2. Working Capital Requirements (primarily for materials used in production): $30,000 1. 5 YR revenue projections by year: $625,000, $656,250, $689,065, 5723,515; $759,690 2. 5 Y projected operating expenses by year: $387,500, $399,125, $412,000, $423,500, $436,000 1. In the fifth year of the project the division expects to sell its equipment for $50,000 at the end of 5 Year Cash Flows Last Cash Flow the year 2. In the fifth year, as part of the fifth year total cash flow, this company will liquidate its working capital and equipment The company will assume an effective tax rate of 24%. Financials Prior to the Decision on this Project company's current price quote for common shares is $21.50. This company has issued a total of stock options. The compamy 923,077 shares of common stock and there are no outstanding warrants or announced annual earnings of soc per share for the current year 7.5% indefinitely. Use this growth rate to calculate next year's expected ea Th and expects future earnings growth to be is company's preferred share dividend sums to $6 per year. The current price quote on preferred shares is $70.59 per share. The company is considering offering 20 year, 4% coupon bonds. Coupon payments would be made semi- annually. The average bid to buy new bonds, if the company chooses to offer them, is currently at $96.6543 per $100 of par per bond. The company's cost of capital is based on the following structure: 60% debt, 30% equity, 10% preferred shares. Questions 1. What is this division's Operating Cash Flow from this project? 2. What is this company's cost of debt? 3. What is this company's cost of common and preferred stocks? 4. What is this division's project NPV? 5. What is this division's project IRR? 6. What is this division's project Payback Period 7. If we drop preferred shares, what are the new weights that keep the WACC unchanged? What are this company's trailing