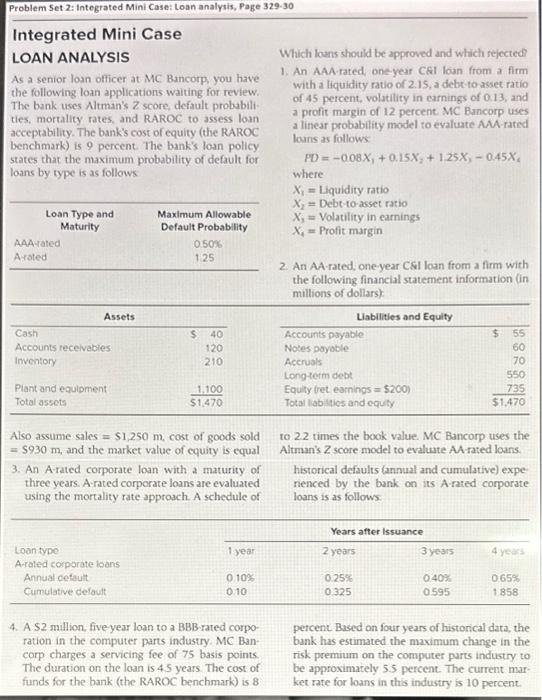

Integrated Mini Case LOAN ANALYSIS Which louns should be approved and which rejected? As a senior loan officer at MC. Bancorp, you have the following loan applications waiting for review. The bank uses Altman's Z score, default probabili- 1. An AAArated, oneyear CEI loan from a firm ties, mortality rates, and RAROC to assess loan with a liquidity ratio of 2.15, a debt to asset ratio acceptability. The bank's cost of equity (the RAROC of 45 percent, volatility in earnings of 0.13, and benchmark) is 9 percent. The bank's loan policy states that the maximum probability of default for a profit margin of 12 percent. MC Bancorp uses loans by type is as follows a linear probability model to evaliate AA-rated loans as follows: FD=0.08X1+0.15X2+125X30.45X4 where X3=LiquidityratioX2=Debt-to-assetratioX3=VolatilityinearningsX4=Profitmargin 2. An AA-rated, one-year CSI loan from a firm with the following financial statement information (in millions of dollarsk: 4. A $2 mallion, five year loan to a BBB rated corpo-_ percent. Based on four years of historical data, the ration in the computer parts industry. MC Ban : bank has estimated the maximum change in the corp charges a servicing fee of 75 basis points. risk premium on the computer parts industry to The duration on the loan is 4.5 years. The cost of be approximately 5.5 percent. The current marfunds for the bank (the RAROC benchmark) is 8 ket rate for loans in this industry is 10 percent. Integrated Mini Case LOAN ANALYSIS Which louns should be approved and which rejected? As a senior loan officer at MC. Bancorp, you have the following loan applications waiting for review. The bank uses Altman's Z score, default probabili- 1. An AAArated, oneyear CEI loan from a firm ties, mortality rates, and RAROC to assess loan with a liquidity ratio of 2.15, a debt to asset ratio acceptability. The bank's cost of equity (the RAROC of 45 percent, volatility in earnings of 0.13, and benchmark) is 9 percent. The bank's loan policy states that the maximum probability of default for a profit margin of 12 percent. MC Bancorp uses loans by type is as follows a linear probability model to evaliate AA-rated loans as follows: FD=0.08X1+0.15X2+125X30.45X4 where X3=LiquidityratioX2=Debt-to-assetratioX3=VolatilityinearningsX4=Profitmargin 2. An AA-rated, one-year CSI loan from a firm with the following financial statement information (in millions of dollarsk: 4. A $2 mallion, five year loan to a BBB rated corpo-_ percent. Based on four years of historical data, the ration in the computer parts industry. MC Ban : bank has estimated the maximum change in the corp charges a servicing fee of 75 basis points. risk premium on the computer parts industry to The duration on the loan is 4.5 years. The cost of be approximately 5.5 percent. The current marfunds for the bank (the RAROC benchmark) is 8 ket rate for loans in this industry is 10 percent