Question

Integrated Systems Solutions (ISS), Inc. projects unit sales for a new state-of-the-art network router system will begin with 2,200 units in year 1, growing by

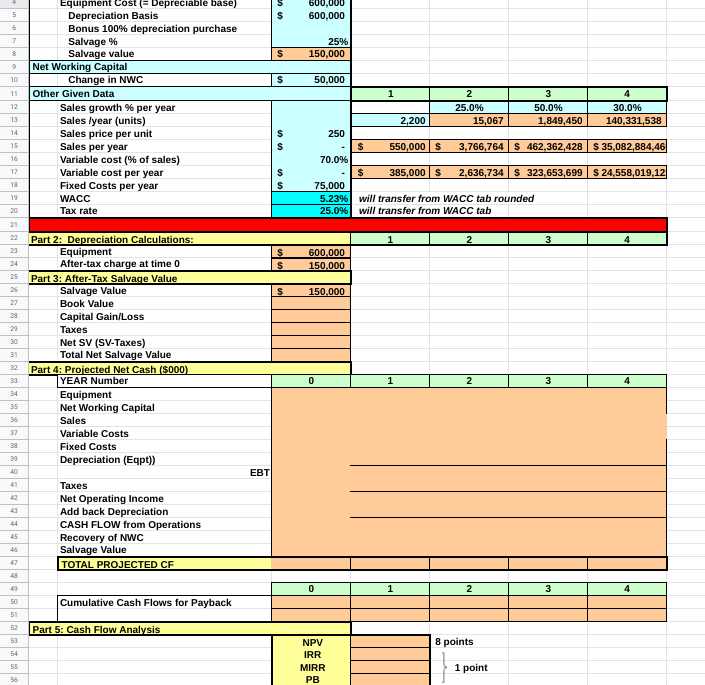

Integrated Systems Solutions (ISS), Inc. projects unit sales for a new state-of-the-art network router system will begin with 2,200 units in year 1, growing by 25% in year 2, by 50% in year 3 and by 30% in year 4. The system will require $50,000 in net working capital to start. Total fixed costs are estimated to be $75,000 per year, variable production costs are expected to be 70% of sales and the units will be priced at $250 each. The equipment needed to begin production has an installed cost of $600,000. The equipment will be installed at the end of year 0 and qualifies for full depreciation at the time of purchase. In four years the equipment can be sold for 25 percent of its installed cost. ISS is in the 25 percent marginal tax bracket.

DELIVERABLES: Use the CAPEX Excel Template on the second tab Full cash flow estimation worksheet for years 0 through 4 with all line items for each year NPV IRR MIRR Payback

DELIVERABLES: Use the CAPEX Excel Template on the second tab Full cash flow estimation worksheet for years 0 through 4 with all line items for each year NPV IRR MIRR Payback

5 S 600,000 600,000 6 7 25% 150,000 B S 9 10 S 11 12 Equipment Cost Depreciable base) Depreciation Basis Bonus 100% depreciation purchase Salvage % Salvage value Net Working Capital Change in NWC Other Given Data Sales growth % per year Sales Iyear (units) Sales price per unit Sales per year Variable cost (% of sales) Variable cost per year Fixed Costs per year WACC Tax rate 13 14 15 50,000 1 2 3 4 25.0% 50.0% 30.0% 2,200 15,067 1,849,450 140,331,538 250 $ 550,000 $ 3,766,764 S 462,362,428 $ 35,082,884,46 70.0% $ 385,000 $ 2,636,734 S 323,653,699 s 24,558,019,12 75,000 5.2396 will transfer from WACC tab rounded 25.096 will transfer from WACC tab 16 17 18 S 19 20 21 2 3 S S 24 600.000 150.000 25 $ 26 27 150.000 30 31 32 Part 2: Depreciation Calculations: Equipment After-tax charge at time 0 Part 3: After-Tax Salvage Value Salvage Value Book Value Capital Gain/Loss Taxes Net SV (SV-Taxes) Total Net Salvage Value Part 4: Projected Net Cash (5000) YEAR Number Equipment Net Working Capital Sales Variable Costs Fixed Costs Depreciation (Eqpt)) 33 0 2 3 4 34 35 36 37 38 39 40 41 43 Taxes Net Operating Income Add back Depreciation CASH FLOW from Operations Recovery of NWC Salvage Value TOTAL PROJECTED CF 45 46 47 49 49 0 2 50 Cumulative Cash Flows for Payback 51 52 Part 5: Cash Flow Analysis 8 points 53 54 55 NPV IRR MIRR PB 1 point 56

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started