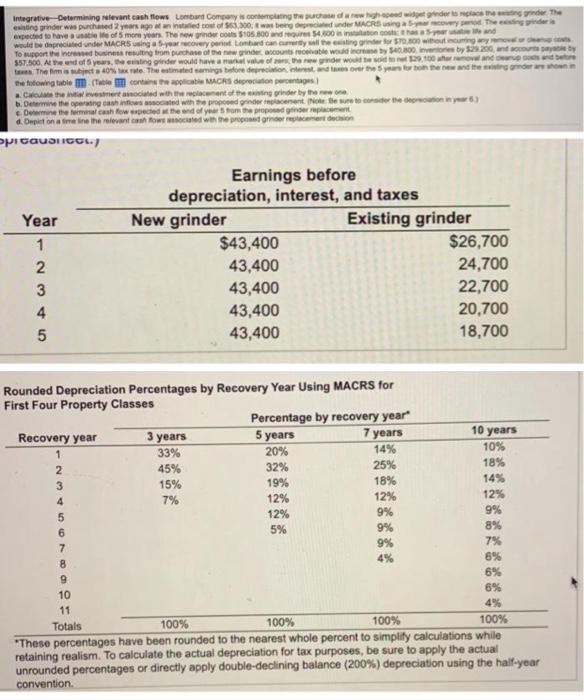

Integrative Determining relevant cash flows Loband Company is coming the charged with the The i grinder we purchased 2 years ago and cost of 30 was beg under MACRS expected to have at of more years. The word $105.00 54.00 ton end would be deprecated under MACRS using a 5-year overy Den Lombard and all the singer for 70,00 withouting To support the resulting from purchase of the wind rivale di 40.800.9.200, and by 557.500. And of years. sing ginder would have the new wodom 120.000 rando tes. The first 40% la rue. The estimated coming for deres over the years to the new and the words who The following table (le contain the police MACRS decontages Cac the veteranociated with the replacement of the singer by the 6.Demi a portretanowe nocled we propondonderneement. Note the store the decision wo) Determine thermal cash rowspected the end of strom the proposed and replacement d. Depict on a line the relevant cash fowed onder picaUSICOLI Year 1 2 3 4 5 Earnings before depreciation, interest, and taxes New grinder Existing grinder $43,400 $26,700 43,400 24,700 43,400 22,700 43,400 20,700 43,400 18,700 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplity calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention Integrative Determining relevant cash flows Loband Company is coming the charged with the The i grinder we purchased 2 years ago and cost of 30 was beg under MACRS expected to have at of more years. The word $105.00 54.00 ton end would be deprecated under MACRS using a 5-year overy Den Lombard and all the singer for 70,00 withouting To support the resulting from purchase of the wind rivale di 40.800.9.200, and by 557.500. And of years. sing ginder would have the new wodom 120.000 rando tes. The first 40% la rue. The estimated coming for deres over the years to the new and the words who The following table (le contain the police MACRS decontages Cac the veteranociated with the replacement of the singer by the 6.Demi a portretanowe nocled we propondonderneement. Note the store the decision wo) Determine thermal cash rowspected the end of strom the proposed and replacement d. Depict on a line the relevant cash fowed onder picaUSICOLI Year 1 2 3 4 5 Earnings before depreciation, interest, and taxes New grinder Existing grinder $43,400 $26,700 43,400 24,700 43,400 22,700 43,400 20,700 43,400 18,700 Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6% 11 Totals 100% 100% 100% 100% "These percentages have been rounded to the nearest whole percent to simplity calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention