Answered step by step

Verified Expert Solution

Question

1 Approved Answer

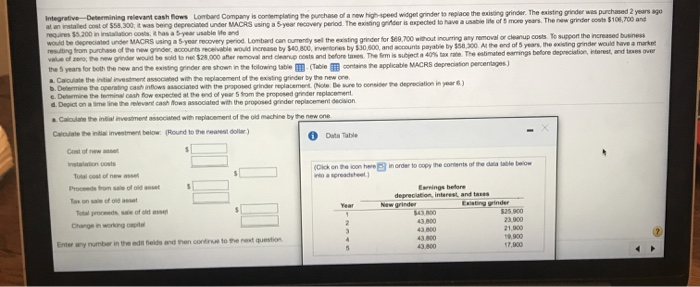

Integrative Determining relevant cash flows Lombard Company is contemplating the purchase of a new highspeed widget grinder to replace the existing grinder. The existing grinder

Integrative Determining relevant cash flows Lombard Company is contemplating the purchase of a new highspeed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago stan stated cost of $58,300, it was being deprecated under MACRS using a 5 year recovery period. The existing ger is expected to have a bit of more years. The new grinder costs $108,700 and requires 15.200 in installation coul, has a year usable and would be depreciated under MACRS using a 5-year recovery period. Lombard can currently sell the existing grinder for 9,700 without incurring any removal or cleanup costs. To support the increased business resting from purchase of the new onder accounts receivable would increase by 540,800, vertones by 550,000, and accounts payable by $50.00. Al the end of 5 years, the exciting grinder would have a market value of the wider would be sold to not $28.000 after removal and costs and before me. The firm is subject 40% tax rate. The estimated earrings before depreciation, interest, and from over the years for both the new and the existing prindere shown in the following table Table contains the applicable MACRS depreciation percentages) a. Calculate the investment associated with the replacement of the existing gider by the new one. b. Determine the operating cash infows sociated with the proposed grinder replacement. Note the sure to considere depreciation in year 6) e. Demine the terminal cash flow expected at the end of years from the proposed rider replacement d. Depict on aime in the relevant cash Pows associated with the proposed grinder replacement decision Calculate the initial investment associated with replacement of the old machine by the new one Calculate the investment below Round to the rear dolar) Data Table Cost of $ Total cost of new Proceeds from sale of Text one of To process of Change in woning (Click on the moon in order to copy the corners of the datatable below na sred Enige before depreciation interest and tas Year New grinder Existing prinder 1 525.00 2 43.800 230 43.800 43.800 9.000 43.800 Entry number in the defends and then continue to the next question Integrative Determining relevant cash flows Lombard Company is contemplating the purchase of a new highspeed widget grinder to replace the existing grinder. The existing grinder was purchased 2 years ago stan stated cost of $58,300, it was being deprecated under MACRS using a 5 year recovery period. The existing ger is expected to have a bit of more years. The new grinder costs $108,700 and requires 15.200 in installation coul, has a year usable and would be depreciated under MACRS using a 5-year recovery period. Lombard can currently sell the existing grinder for 9,700 without incurring any removal or cleanup costs. To support the increased business resting from purchase of the new onder accounts receivable would increase by 540,800, vertones by 550,000, and accounts payable by $50.00. Al the end of 5 years, the exciting grinder would have a market value of the wider would be sold to not $28.000 after removal and costs and before me. The firm is subject 40% tax rate. The estimated earrings before depreciation, interest, and from over the years for both the new and the existing prindere shown in the following table Table contains the applicable MACRS depreciation percentages) a. Calculate the investment associated with the replacement of the existing gider by the new one. b. Determine the operating cash infows sociated with the proposed grinder replacement. Note the sure to considere depreciation in year 6) e. Demine the terminal cash flow expected at the end of years from the proposed rider replacement d. Depict on aime in the relevant cash Pows associated with the proposed grinder replacement decision Calculate the initial investment associated with replacement of the old machine by the new one Calculate the investment below Round to the rear dolar) Data Table Cost of $ Total cost of new Proceeds from sale of Text one of To process of Change in woning (Click on the moon in order to copy the corners of the datatable below na sred Enige before depreciation interest and tas Year New grinder Existing prinder 1 525.00 2 43.800 230 43.800 43.800 9.000 43.800 Entry number in the defends and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started