Answered step by step

Verified Expert Solution

Question

1 Approved Answer

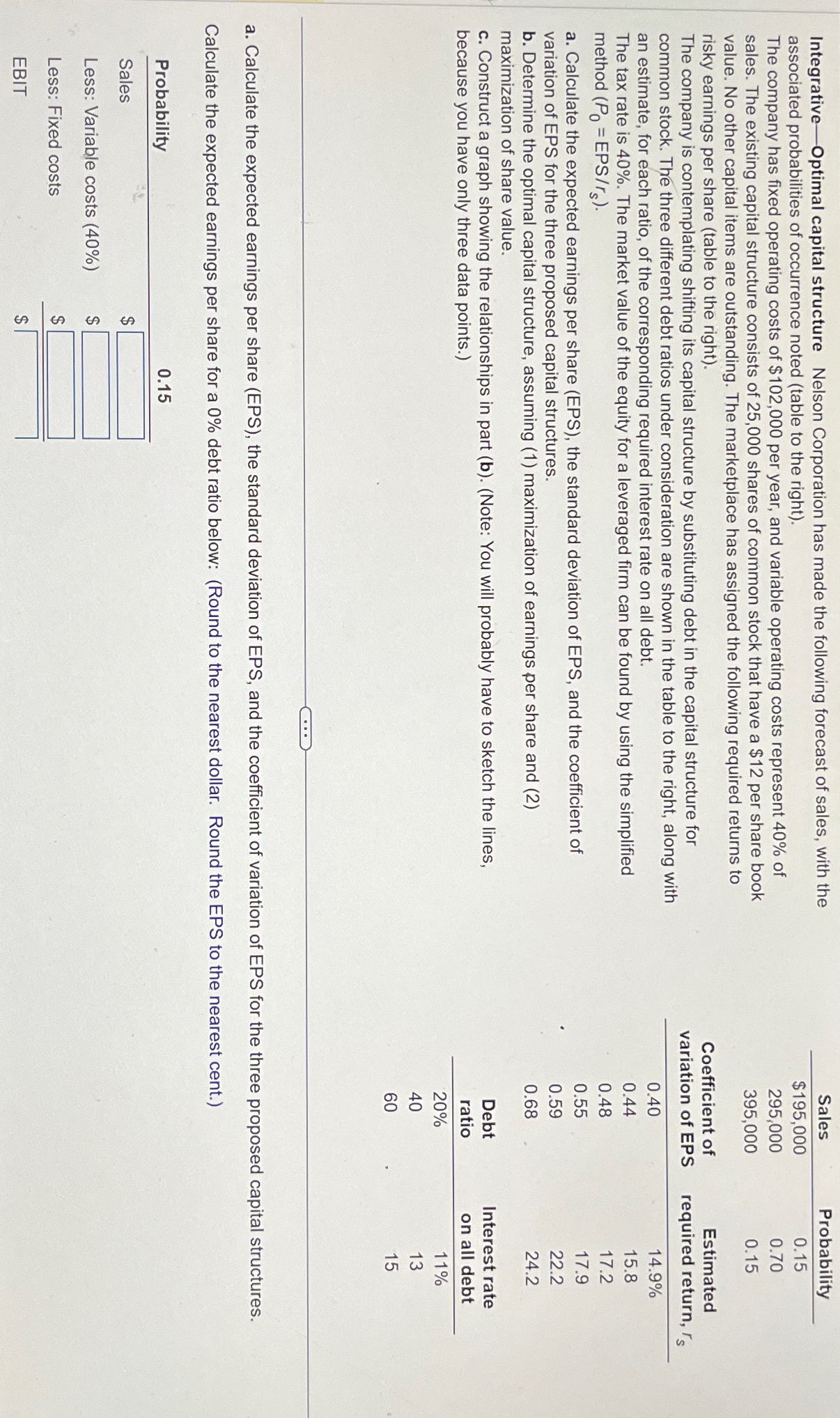

Integrative - Optimal capital structure Nelson Corporation has made the following forecast of sales, with the associated probabilities of occurrence noted ( table to the

Integrative Optimal capital structure Nelson Corporation has made the following forecast of sales, with the associated probabilities of occurrence noted table to the right

The company has fixed operating costs of $ per year, and variable operating costs represent of sales. The existing capital structure consists of shares of common stock that have a $ per share book value. No other capital items are outstanding. The marketplace has assigned the following required returns to risky earnings per share table to the right

The company is contemplating shifting its capital structure by substituting debt in the capital structure for common stock. The three different debt ratios under consideration are shown in the table to the right, along with an estimate, for each ratio, of the corresponding required interest rate on all debt.

The tax rate is The market value of the equity for a leveraged firm can be found by using the simplified method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started