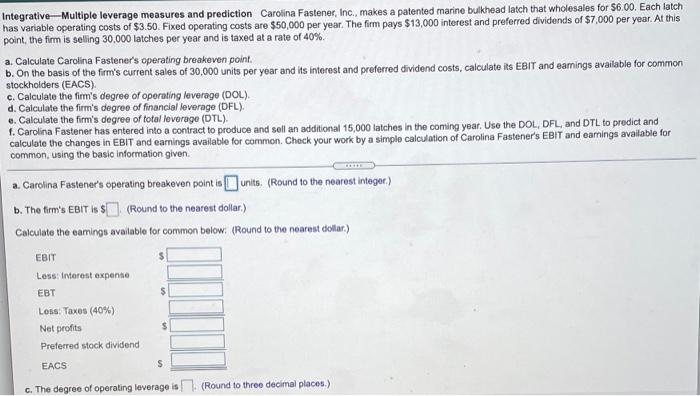

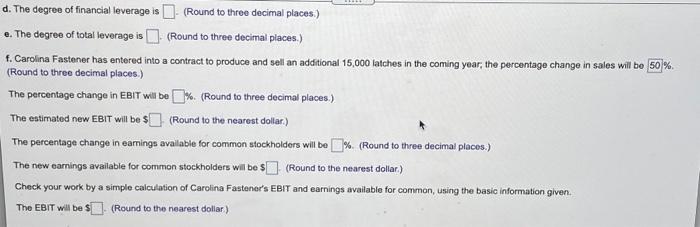

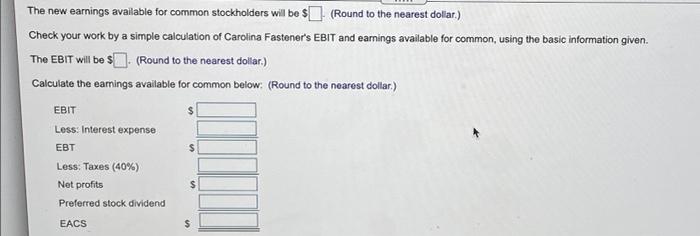

Integrative-Multiple leverage measures and prediction Carolina Fastener, Inc., makes a patented marine bulkhead latch that wholesales for $6.00. Each latch has variable operating costs of $3.50. Fixed operating costs are $50,000 per year. The firm pays $13,000 interest and preferred dividends of $7,000 per year. At this point, the firm is selling 30,000 latches per year and is taxed at a rate of 40% a. Calculate Carolina Fastener's operating breakeven point b. On the basis of the firm's current sales of 30,000 units per year and its interest and preferred dividend costs, calculate its EBIT and eamings available for common stockholders (EACS) c. Calculate the firm's degree of operating leverage (DOL). d. Calculate the firm's degree of financial leverage (DFL), e. Calculate the firm's degree of total leverage (DTL). f. Carolina Fastener has entered into a contract to produce and soll an additional 15,000 latches in the coming year. Use the DOL, DFL, and DTL to predict and calculate the changes in EBIT and earnings available for common. Check your work by a simple calculation of Carolina Fastener's EBIT and eamings available for common, using the basic information given a. Carolina Fastener's s operating breakeven point is units. (Round to the nearest Integer) b. The firm's EBIT is $(Round to the nearest dollar) Calculate the comings available for common below. (Round to the nearest dollar.) EBIT Less: Interest expense EBT Loss: Taxes (40%) Net profits Preferred stock dividend $ EACS $ c. The degree of operating leverage is (Round to three decimal places.) d. The degree of financial leverage is (Round to three decimal places.) e. The degree of total leverage is (Round to three decimal places.) f. Carolina Fastener has entered into a contract to produce and sell an additional 15,000 latches in the coming year, the percentage change in sales will be 50% (Round to three decimal places.) The percentage change in EBIT will be % (Round to three decimal places.) The estimated new EBIT will be $ (Round to the nearest dollar) The percentage change in earnings available for common stockholders will be % (Round to three decimal places.) The new earnings available for common stockholders will be $(Round to the nearest dollar) Check your work by a simple calculation of Carolina Fastener's EBIT and earnings available for common, using the basic information given. The EBIT will be $ (Round to the nearest dollar) The new earnings available for common stockholders will be $(Round to the nearest dollar) Check your work by a simple calculation of Carolina Fastener's EBIT and eamings available for common, using the basic information given. The EBIT will be $1. (Round to the nearest dollar.) Calculate the earnings available for common below (Round to the nearest dollar) $ EBIT Less: Interest expense EBT Less: Taxes (40%) Net profits Preferred stock dividend $ EACS $