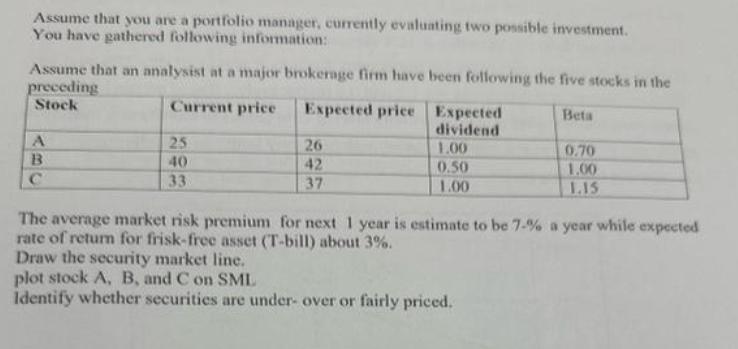

Assume that you are a portfolio manager, currently evaluating two possible investment. You have gathered following information: Assume that an analysist at a major

Assume that you are a portfolio manager, currently evaluating two possible investment. You have gathered following information: Assume that an analysist at a major brokerage firm have been following the five stocks in the preceding Stock Current price A B C 25 40 33 Expected price Expected dividend 26 42 37 1.00 0.50 1.00 Beta Draw the security market line. plot stock A, B, and C on SML Identify whether securities are under- over or fairly priced. 0.70 1.00 1.15 The average market risk premium for next 1 year is estimate to be 7-% a year while expected rate of return for frisk-free asset (T-bill) about 3%.

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Okay here are the steps to solve this problem 1 Draw the security market l...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started