Answered step by step

Verified Expert Solution

Question

1 Approved Answer

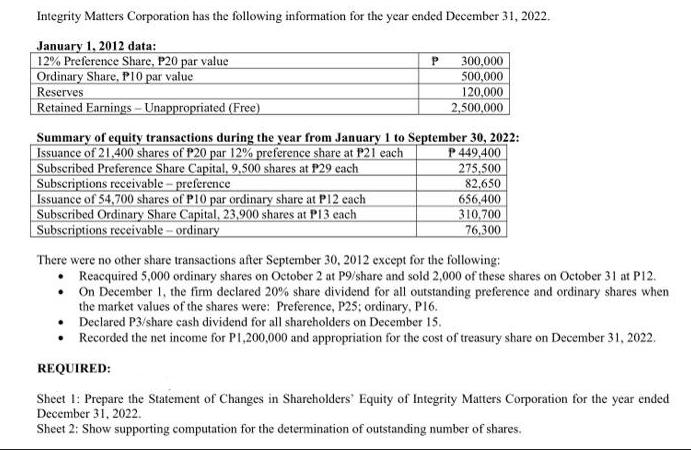

Integrity Matters Corporation has the following information for the year ended December 31, 2022. January 1, 2012 data: 12% Preference Share, P20 par value

Integrity Matters Corporation has the following information for the year ended December 31, 2022. January 1, 2012 data: 12% Preference Share, P20 par value Ordinary Share, P10 par value Reserves Retained Earnings - Unappropriated (Free) P Issuance of 54,700 shares of P10 par ordinary share at P12 each Subscribed Ordinary Share Capital, 23,900 shares at P13 each Subscriptions receivable-ordinary 300,000 500,000 120,000 2,500,000 Summary of equity transactions during the year from January 1 to September 30, 2022: Issuance of 21,400 shares of P20 par 12% preference share at P21 each P 449,400 Subscribed Preference Share Capital, 9,500 shares at P29 each Subscriptions receivable-preference 275,500 82,650 656,400 310,700 76,300 There were no other share transactions after September 30, 2012 except for the following: Reacquired 5,000 ordinary shares on October 2 at P9/share and sold 2,000 of these shares on October 31 at P12. On December 1, the firm declared 20% share dividend for all outstanding preference and ordinary shares when the market values of the shares were: Preference, P25; ordinary, P16. Declared P3/share cash dividend for all shareholders on December 15. Recorded the net income for P1,200,000 and appropriation for the cost of treasury share on December 31, 2022. REQUIRED: Sheet 1: Prepare the Statement of Changes in Shareholders' Equity of Integrity Matters Corporation for the year ended December 31, 2022. Sheet 2: Show supporting computation for the determination of outstanding number of shares.

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Sheet 1 Statement of Changes in Shareholders Equity Integrity Matters Corporation Statement of Chang...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started