Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intel Inc is looking to acquire a new equipment for a project that will last for eight years. The after-tax required rate of return of

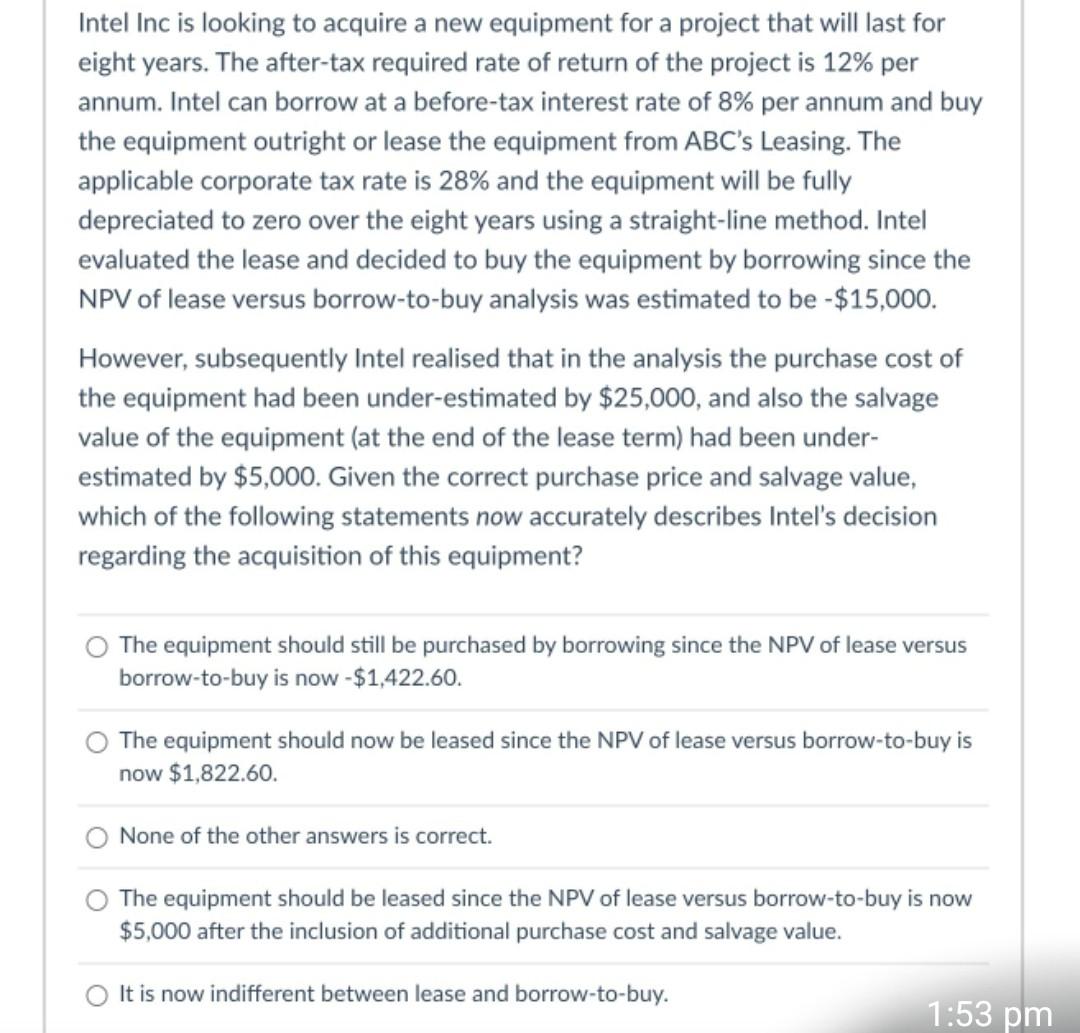

Intel Inc is looking to acquire a new equipment for a project that will last for eight years. The after-tax required rate of return of the project is 12% per annum. Intel can borrow at a before-tax interest rate of 8% per annum and buy the equipment outright or lease the equipment from ABC's Leasing. The applicable corporate tax rate is 28% and the equipment will be fully depreciated to zero over the eight years using a straight-line method. Intel evaluated the lease and decided to buy the equipment by borrowing since the NPV of lease versus borrow-to-buy analysis was estimated to be $15,000. However, subsequently Intel realised that in the analysis the purchase cost of the equipment had been under-estimated by $25,000, and also the salvage value of the equipment (at the end of the lease term) had been under- estimated by $5,000. Given the correct purchase price and salvage value, which of the following statements now accurately describes Intel's decision regarding the acquisition of this equipment? The equipment should still be purchased by borrowing since the NPV of lease versus borrow-to-buy is now - $1,422.60. The equipment should now be leased since the NPV of lease versus borrow-to-buy is now $1,822.60. None of the other answers is correct. The equipment should be leased since the NPV of lease versus borrow-to-buy is now $5,000 after the inclusion of additional purchase cost and salvage value. It is now indifferent between lease and borrow-to-buy. 1:53 pm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started