Answered step by step

Verified Expert Solution

Question

1 Approved Answer

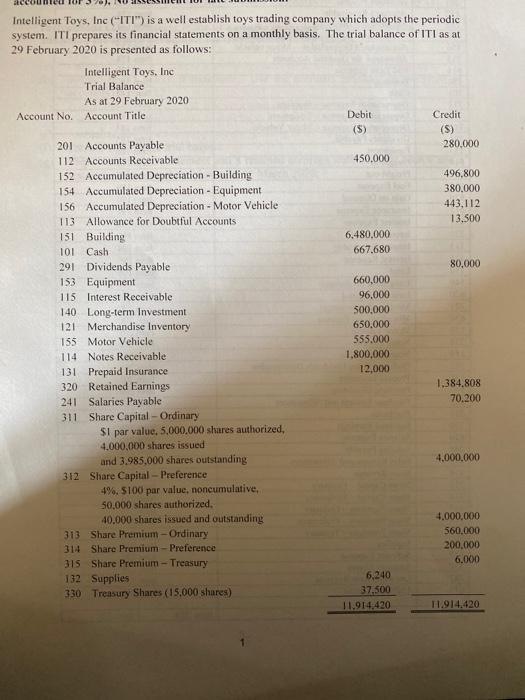

Intelligent Toys, Inc (ITI) is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly

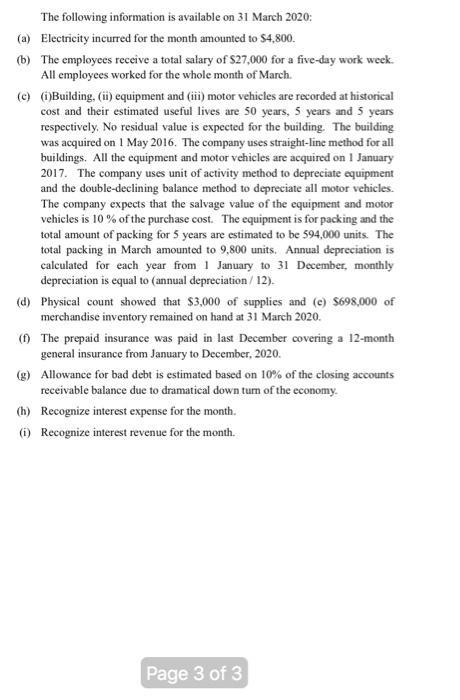

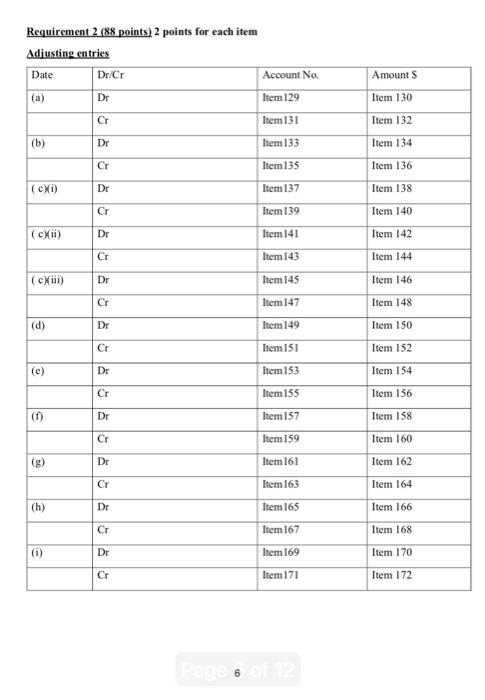

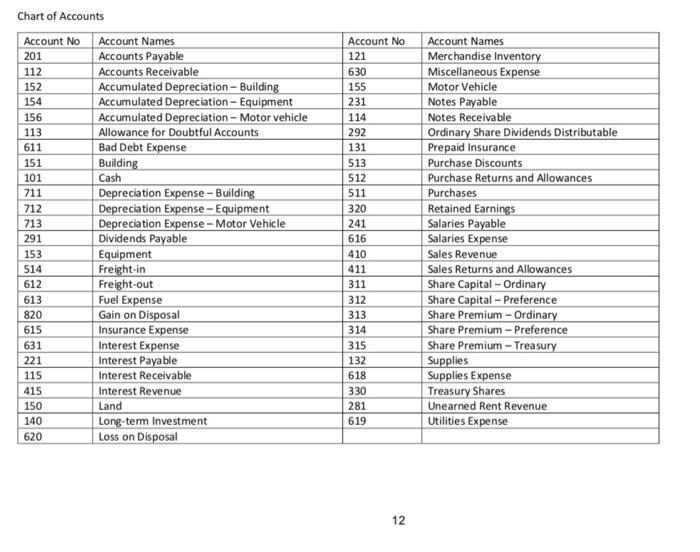

Intelligent Toys, Inc ("ITI") is a well establish toys trading company which adopts the periodic system. ITI prepares its financial statements on a monthly basis. The trial balance of ITI as at 29 February 2020 is presented as follows: Intelligent Toys, Ine Trial Balance As at 29 February 2020 Account No. Account Title Debit Credit (S) (S) 201 Accounts Payable 280,000 112 Accounts Receivable 450.000 496,800 152 Accumulated Depreciation - Building 154 Accumulated Depreciation - Equipment 156 Accumulated Depreciation - Motor Vehicle 113 Allowance for Doubtful Accounts 151 Building 101 Cash 291 Dividends Payable 380,000 443,112 13,500 6,480,000 667.680 80,000 660,000 153 Equipment 115 Interest Receivable 96.000 500,000 140 Long-term Investment Merchandise Inventory 121 650,000 155 Motor Vehicle 555.000 1,800,000 12,000 114 Notes Receivable 131 Prepaid Insurance 320 Retained Earnings 241 Salaries Payable 311 Share Capital - Ordinary 1,384.808 70.200 SI par value, 5,000.000 shares authorized, 4,000,000 shares issued and 3,985,000 shares outstanding 4,000,000 312 Share Capital - Preference 4%, S100 par value, noncumulative, 50.000 shares authorized, 40,000 shares issued and outstanding 4.000,000 313 Share Premium - Ordinary 560.000 200,000 314 Share Premium- Preference 6.000 315 Share Premium - Treasury 132 Supplies 330 Treasury Shares (15,000 shares) 6,240 37,500 11.914,420 H.914,420 The following information is available on 31 March 2020: (a) Electricity incurred for the month amounted to $4,800. (b) The employees receive a total salary of $27,000 for a five-day work week. All employees worked for the whole month of March. (c) Building, (ii) equipment and (iii) motor vehicles are recorded at historical cost and their estimated useful lives are 50 years, 5 years and 5 years respectively. No residual value is expected for the building. The building was acquired on 1 May 2016. The company uses straight-line method for all buildings. All the equipment and motor vehicles are acquired on 1 January 2017. The company uses unit of activity method to depreciate equipment and the double-declining balance method to depreciate all motor vehicles. The company expects that the salvage value of the equipment and motor vehicles is 10 % of the purchase cost. The equipment is for packing and the total amount of packing for 5 years are estimated to be 594,000 units. The total packing in March amounted to 9,800 units. Annual depreciation is calculated for each year from 1 January to 31 December, monthly depreciation is equal to (annual depreciation / 12). (d) Physical count showed that $3,000 of supplies and (e) S698,000 of merchandise inventory remained on hand at 31 March 2020. () The prepaid insurance was paid in last December covering a 12-month general insurance from January to December, 2020. (g) Allowance for bad debt is estimated based on 10% of the closing accounts receivable balance due to dramatical down turm of the economy. (h) Recognize interest expense for the month. (i) Recognize interest revenue for the month. Page 3 of 3 Requirement 2 (88 points) 2 points for each item Adjusting entries Date Dr/Cr Account No. Amount S (a) Dr Item129 Item 130 Cr Item131 Item 132 (b) Dr Item 133 Item 134 Cr Item135 Item 136 (cXi) Dr Item137 Item 138 Cr Item 139 Item 140 (cXii) Dr Item141 Item 142 Cr Item 143 Item 144 (cxi) Dr Item 145 Item 146 Cr Item147 Item 148 (d) Dr Ihem149 Item 150 Cr Item 151 Item 152 (e) Dr Item153 Item 154 Cr Item155 Item 156 (1) Dr Item157 Item 158 Cr Item159 Item 160 (g) Dr Item 161 Item 162 Cr Item 163 Item 164 (h) Dr Item 165 Item 166 Cr Item167 Item 168 (i) Dr Item169 Item 170 Cr Item 171 Item 172 Page 6 of 12 Chart of Accounts Account No 201 Account Names Account No Account Names Accounts Payable Accounts Receivable Accumulated Depreciation - Building Accumulated Depreciation - Equipment Merchandise Inventory Miscellaneous Expense Motor Vehicle Notes Payable 121 112 630 152 155 154 231 Notes Receivable Ordinary Share Dividends Distributable Prepaid Insurance Purchase Discounts Purchase Returns and Allowances Purchases Retained Earnings Salaries Payable Salaries Expense 156 Accumulated Depreciation - Motor vehicle Allowance for Doubtful Accounts Bad Debt Expense Building Cash 114 113 292 611 131 151 513 101 512 Depreciation Expense - Building Depreciation Expense - Equipment Depreciation Expense - Motor Vehicle Dividends Payable 711 511 712 320 713 241 291 616 153 Equipment Freight-in Freight-out Fuel Expense Gain on Disposal Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue 410 Sales Revenue 514 411 Sales Returns and Allowances Share Capital - Ordinary Share Capital Preference Share Premium - Ordinary Share Premium - Preference Share Premium - Treasury Supplies Supplies Expense Treasury Shares Unearned Rent Revenue Utilities Expense 612 311 613 312 820 313 615 314 631 315 221 132 115 618 415 330 150 Land 281 Long-term Investment Loss on Disposal 140 619 620 12

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Account Title Explanation Debit Credit Electricity Expenses 4800 a Cash 4800 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started