Question

Interactive Investments has one of its new clients, Jason Todd, recently sign up with the firm to manage his portfolio. Jason recently came into an

Interactive Investments has one of its new clients, Jason Todd, recently sign up with the firm to manage his portfolio.

Jason recently came into an inheritance of $1,250,000 that he wants to have invested.

Jason had several requirements for his portfolio:

1) A minimum of 40% of funds should be invested in aviation, pharmaceutical, and tech firms.

2) Bonds should be a minimum of 20% of the total portfolio.

3) No more than 50% of the amount invested in bonds should be placed in Dollarama stock

4) Only bonds with an investment grade credit rating should be considered for investment (use Moody's or S&P ratings)

5) Only stocks whose last period holding return is greater than 6% should be considered for investment.

Jason's objective is to maximize his expected return on investments. Ignore tax consequences on return.

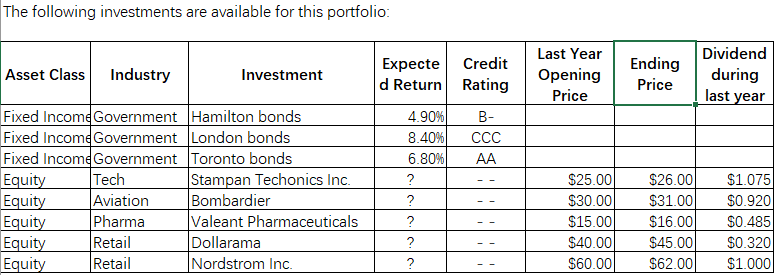

The following investments are available for this portfolio: Last Year Dividend Asset Class Industry Investment Expecte Credit d Return Rating Ending Opening during Price Price last year Equity Tech Equity Aviation Fixed Income Government Hamilton bonds Fixed Income Government Fixed Income Government Toronto bonds Stampan Techonics Inc. Bombardier 4.90% B- London bonds 8.40% CCC 6.80% AA ? -- $25.00 $26.00 $1.075 ? $30.00 $31.00 $0.920 Equity Pharma Valeant Pharmaceuticals ? $15.00 $16.00 $0.485 Equity Retail Dollarama ? $40.00 $45.00 $0.320 Equity Retail Nordstrom Inc. ? $60.00 $62.00 $1.000

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Heres a sample portfolio for Jason Todd based on the provided information and his inves...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started