Question

Sub Co is a 90% owned subsidiary of Parent Co, acquired for $94,500 cash on July 1, 2016, when Subs net assets consisted of $100,000

Sub Co is a 90% owned subsidiary of Parent Co, acquired for $94,500 cash on July 1, 2016, when Sub’s net assets consisted of $100,000 capital stock and $5,000 retained earnings. The cost of Parent Co.’s 90% interest in Sun was equal to book value and fair value of the interest acquired. Parent Co sells inventory items to Sub Co on a regular basis, and the intercompany transaction data for 2019 are as follows:

Sales to Sub Co in 2019 (cost $15,000), selling price | $20,000 |

Unrealized profit in Sub Co.'s inventory at December 31, 2018 | |

(inventory was sold during 2019) | 2,000 |

Unrealized profit in Sub Co.'s inventory at December 31, 2019 | 2,500 |

Sub Co.'s accounts payable to Parent Co at December 31, 2019 | 10,000 |

At December 31, 2018, Parent Co.'s investment in subsidiary account had a balance of $128,500. This balance consisted of Parent Co's 90% equity in Sub's $145,000 net assets on that date less $2,000 unrealized profit in Sub's December 31, 2018 inventory. During 2019 Parent Co made the following entries in its records for its investment in Sub:

DR | CR | |

Cash | 9,000 | |

Investment in subsidiary | 9,000 | |

To record dividends from Sub Co ($10,000 * 90%) | ||

Investment in subsidiary | 26,500 | |

Income from subsidiary | 26,500 | |

To record income from Sub Co for 2019 as follows: Equity in Sub Co.’s net income ($30,000 * 90%) $27,000 Add: 2018 inventory profit recognized in 2019 2,000 Less: 2019 inventory profit deferred at year-end (2,500) Total $26,500 | ||

The 2018 intercompany sales that led to the unrealized inventory profits were recognize in 2019 and the full amount of the unrealized inventory profit originating in 2019 is deferred at December 31, 2019. Parent Co.’s investment in Sub Co increased from $128,500 at January 1, 2019 to $146,000 at December 31, 2019, the entire change consisting of $26,500 income less $9,000 dividends for the year.

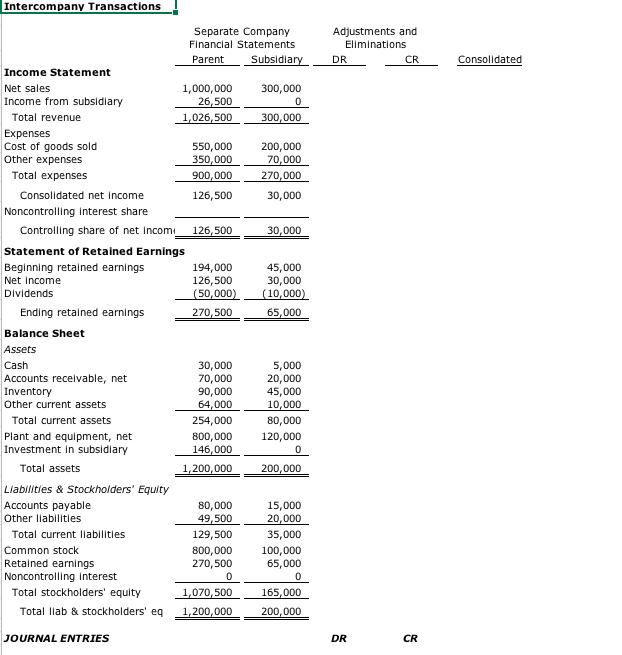

Required: Using the Excel file “Case 1 - Advanced accounting topics” and the worksheet “Intercompany,” prepare and show the required adjusting and eliminating journal entries (in journal entry form) and complete the worksheet, posting the journal entries to the worksheet and completing the Consolidated column with the totals.

Intercompany Transactions Separate Company Financial Statements Adjustments and Eliminations Parent Subsidiary DR CR Consolidated Income Statement Net sales 1,000,000 26,500 300,000 Income from subsidiary Total revenue 1,026,500 300,000 Expenses Cost of goods sold Other expenses 550,000 350,000 200,000 70,000 Total expenses 900,000 270,000 Consolidated net income 126,500 30,000 Noncontrolling interest share Controlling share of net Incom 126,500 30,000 Statement of Retained Earnings Beginning retalned earnings Net income Dividends 194,000 126,500 (50,000) 45,000 30,000 (10,000) Ending retalned earnings 270,500 65,000 Balance Sheet Assets Cash 30,000 70,000 90,000 64,000 5,000 Accounts receivable, net Inventory 20,000 45,000 10,000 80,000 Other current assets Total current assets 254,000 Plant and equipment, net Investment in subsidiary 800,000 146,000 120,000 Total assets 1,200,000 200,000 Llabilities & Stockholders' Equity Accounts payable Other liabilities 80,000 49,500 15,000 20,000 Total current llabilitles 129,500 35,000 Common stock 800,000 270,500 100,000 65,000 Retained earnings Noncontrolling interest Total stockholders' equity 1,070,500 165,000 Total llab & stockholders' eq 1,200,000 200,000 JOURNAL ENTRIES DR CR

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries 1 Adjust for errors Omission None 2 Eliminate intercompany profits and losses Particulars Debit Credit Sales 20000 Cost of Goods sold ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started