Intercompany Transfers of Depreciable Assets Placer Industries acquired all of the voting stock of SAS Shoes several years ago. Placer and SAS have made

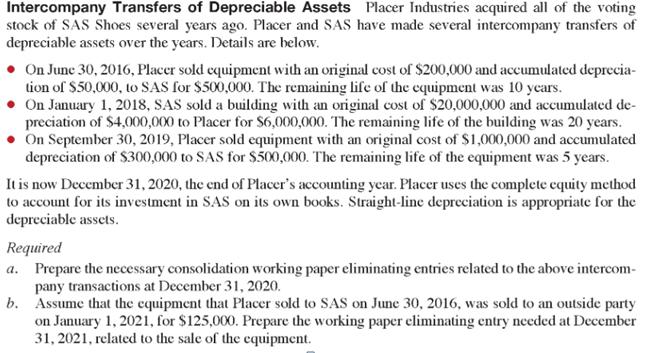

Intercompany Transfers of Depreciable Assets Placer Industries acquired all of the voting stock of SAS Shoes several years ago. Placer and SAS have made several intercompany transfers of depreciable assets over the years. Details are below. On June 30, 2016, Placer sold equipment with an original cost of $200,000 and accumulated deprecia- tion of $50,000, to SAS for $500,000. The remaining life of the equipment was 10 years. On January 1, 2018, SAS sold a building with an original cost of $20,000,000 and accumulated de- preciation of $4,000,000 to Placer for $6,000,000. The remaining life of the building was 20 years. On September 30, 2019, Placer sold equipment with an original cost of $1,000,000 and accumulated depreciation of $300,000 to SAS for $500,000. The remaining life of the equipment was 5 years. Itis now December 31, 2020, the end of Placer's accounting year. Placer uses the complete cquity method to account for its investment in SAS on its own books. Straight-line depreciation is appropriate for the depreciable assets. Required a. Prepare the necessary consolidation working paper eliminating entries related to the above intercom- pany transactions at December 31, 2020. b. Assume that the equipment that Placer sold to SAS on June 30, 2016, was sold to an outside party on January 1, 2021, for $125,000. Prepare the working paper eliminating entry needed at December 31, 2021, related to the sale of the cquipment.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started