Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Interest Accruals Adjusting Entries Practice Set A. XYZ, Inc., a corporation in the film industry, made a short-term loan to one of their employees

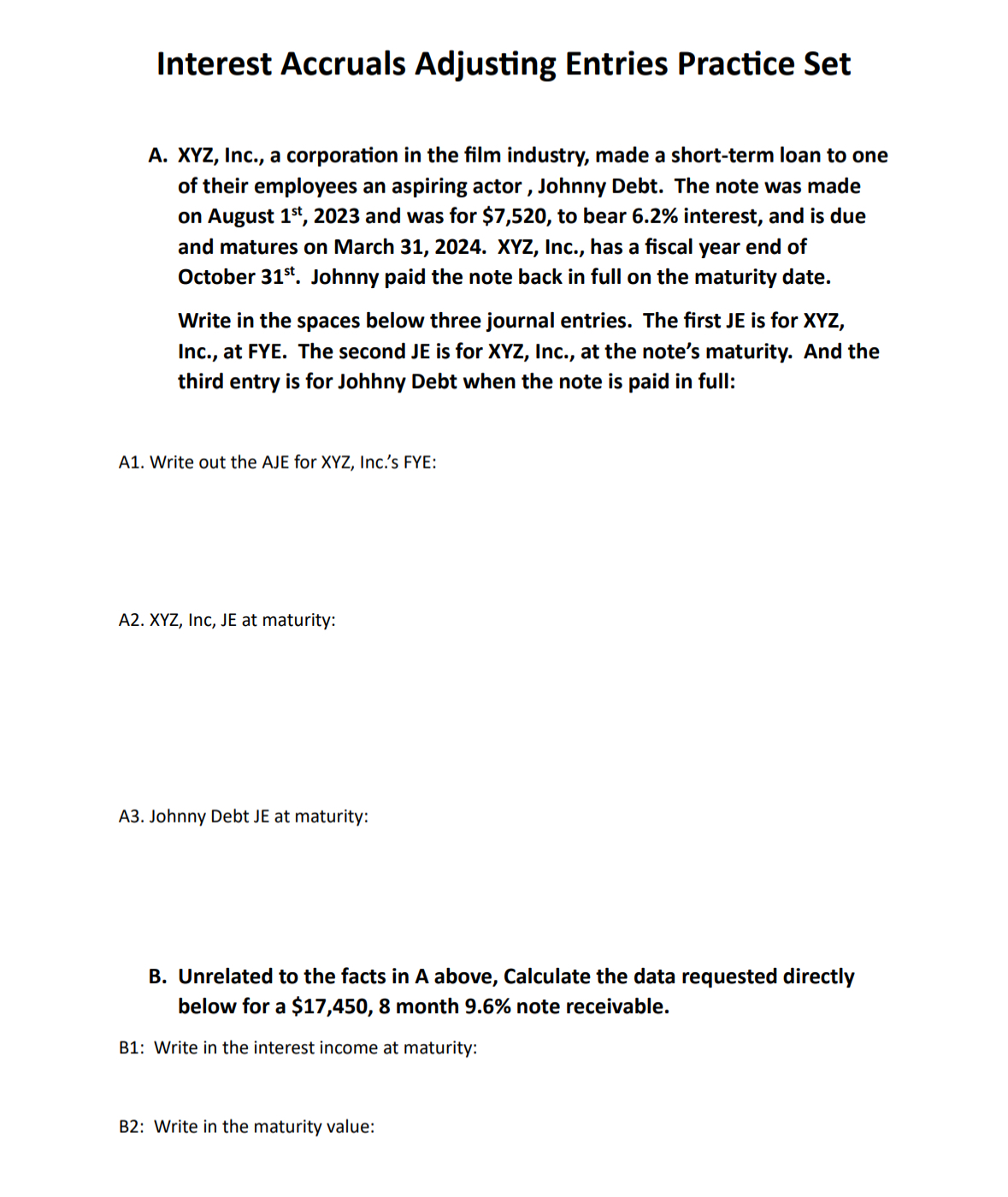

Interest Accruals Adjusting Entries Practice Set A. XYZ, Inc., a corporation in the film industry, made a short-term loan to one of their employees an aspiring actor, Johnny Debt. The note was made on August 1st, 2023 and was for $7,520, to bear 6.2% interest, and is due and matures on March 31, 2024. XYZ, Inc., has a fiscal year end of October 31st. Johnny paid the note back in full on the maturity date. Write in the spaces below three journal entries. The first JE is for XYZ, Inc., at FYE. The second JE is for XYZ, Inc., at the note's maturity. And the third entry is for Johhny Debt when the note is paid in full: A1. Write out the AJE for XYZ, Inc.'s FYE: A2. XYZ, Inc, JE at maturity: A3. Johnny Debt JE at maturity: B. Unrelated to the facts in A above, Calculate the data requested directly below for a $17,450, 8 month 9.6% note receivable. B1: Write in the interest income at maturity: B2: Write in the maturity value:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets analyze the problem and provide solutions Understanding the Problem We are asked to prepare journal entries for a shortterm loan made by XYZIncto an employeeJohnny DebtAdditionallywe need to calc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started