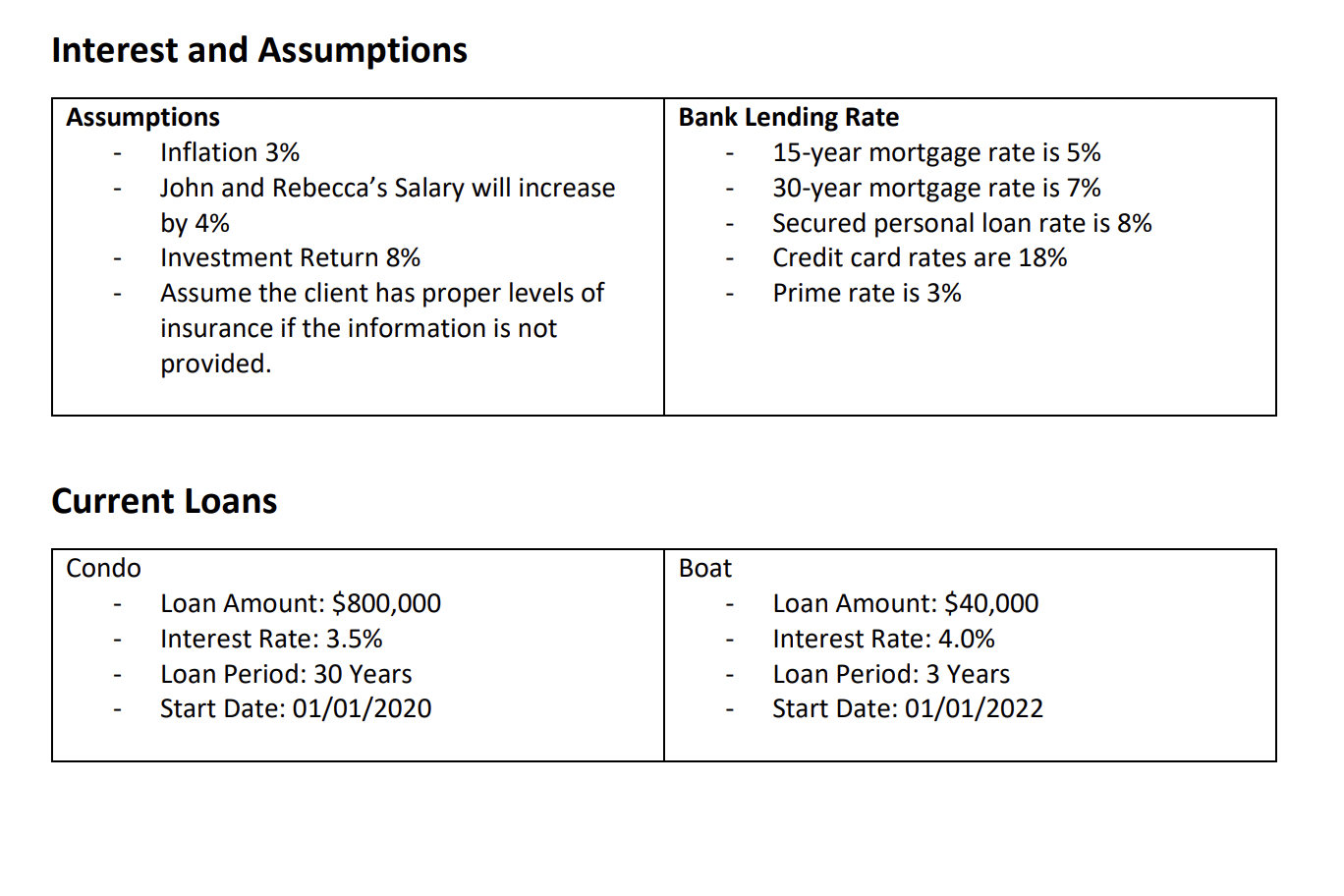

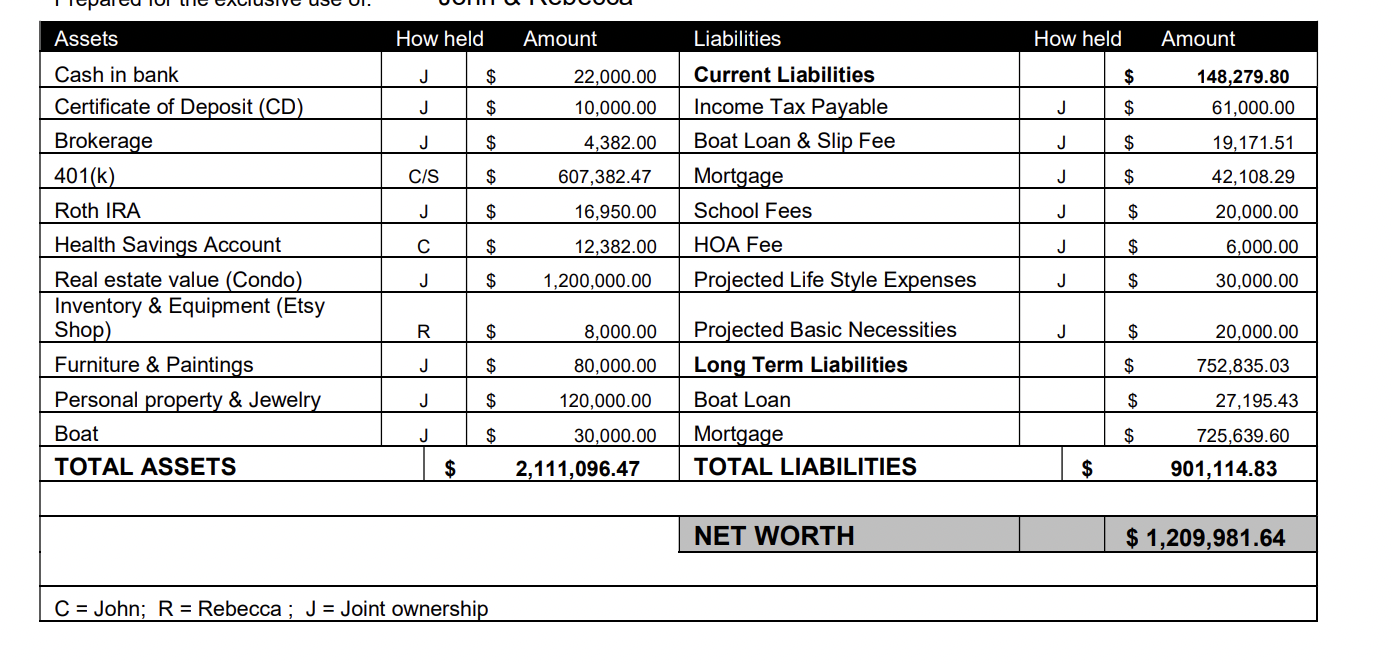

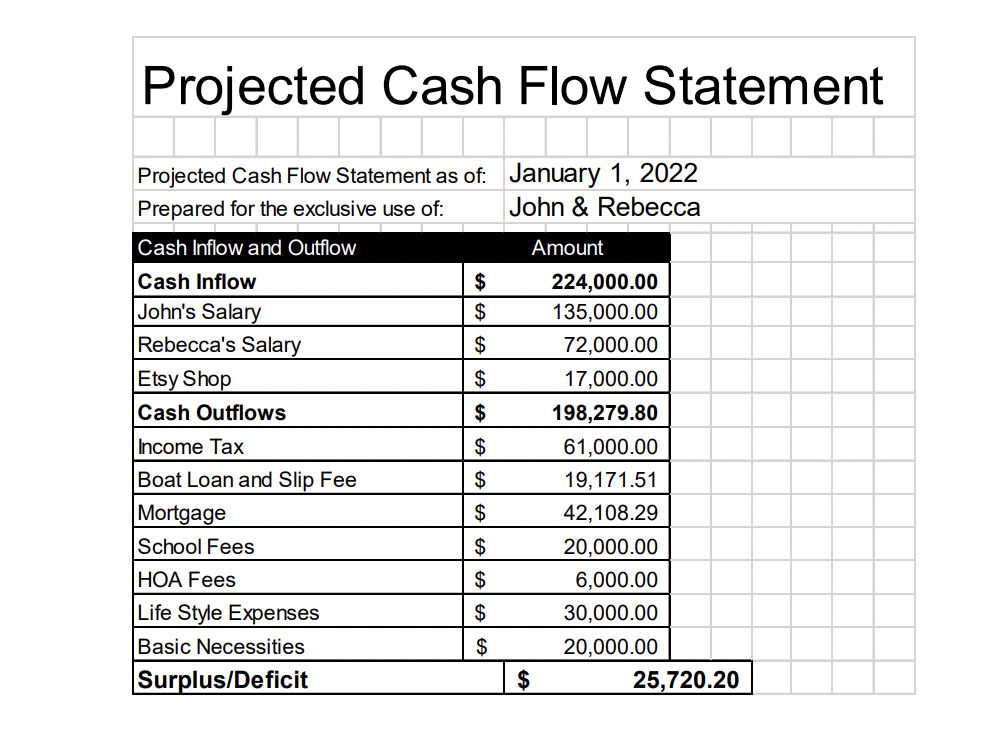

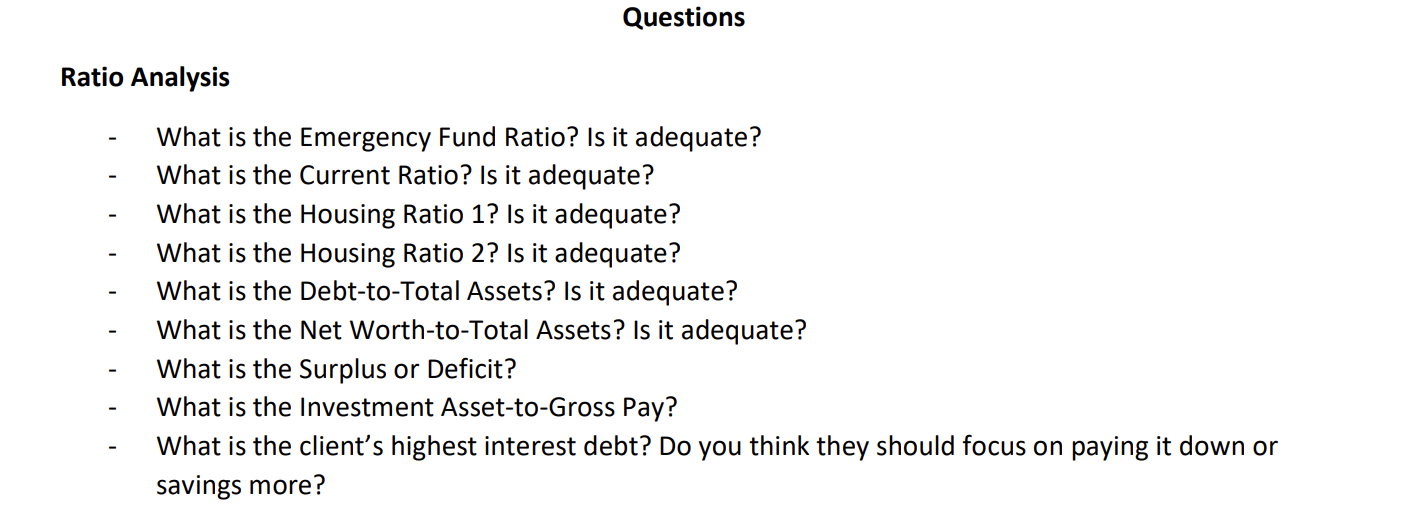

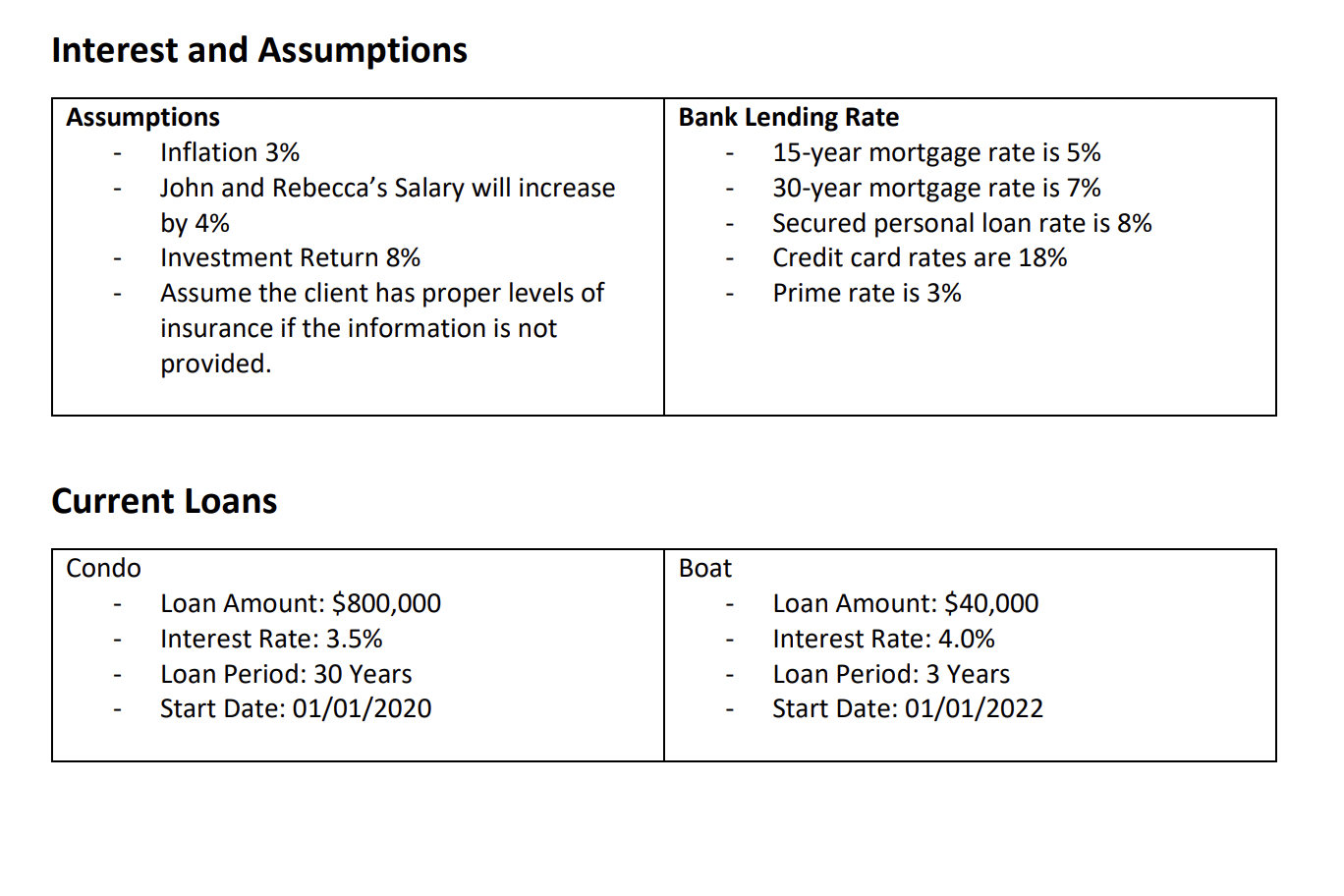

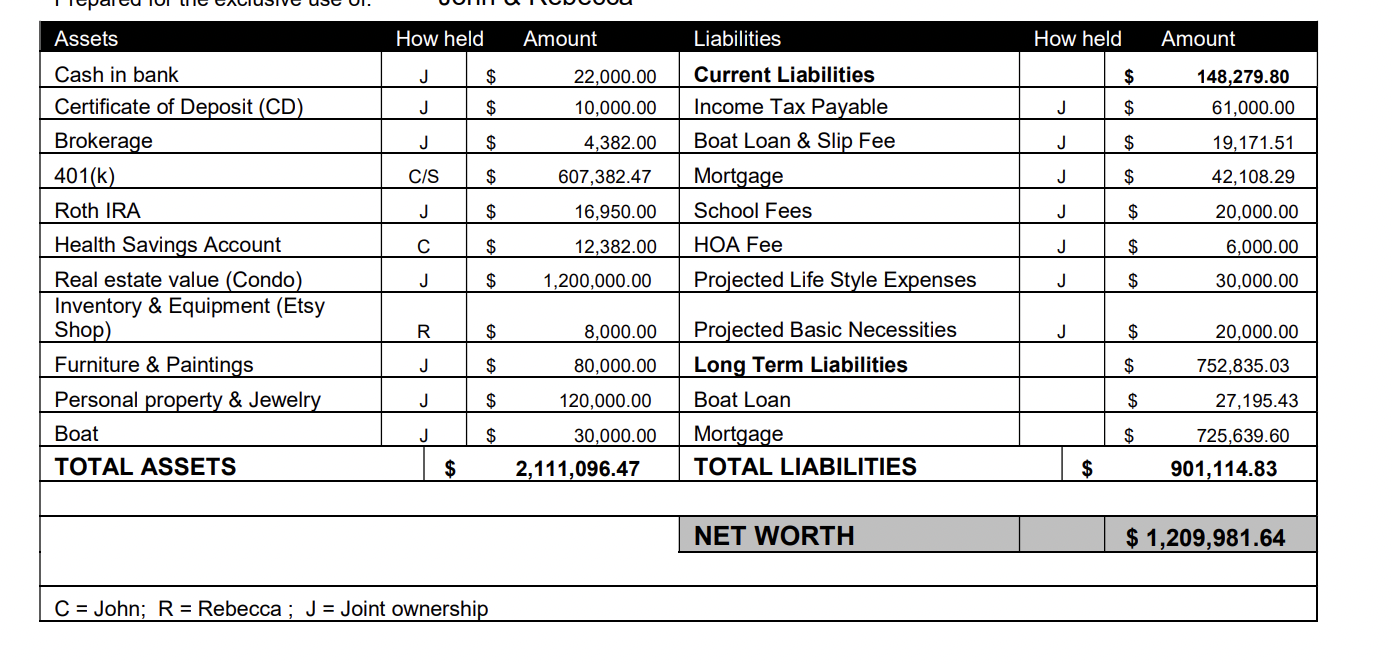

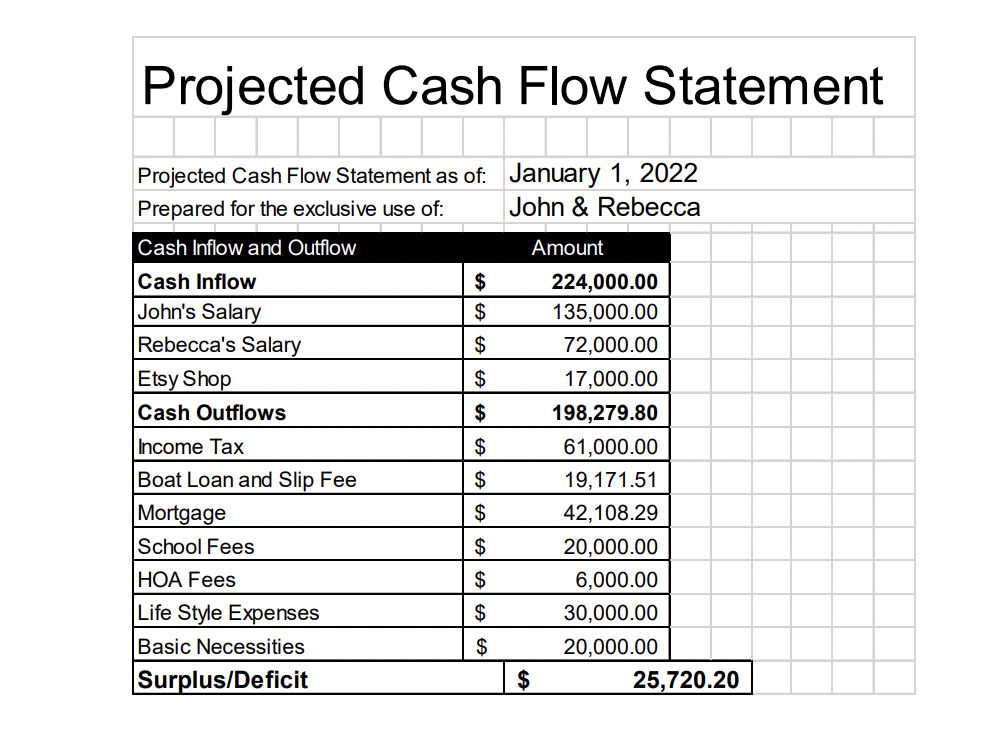

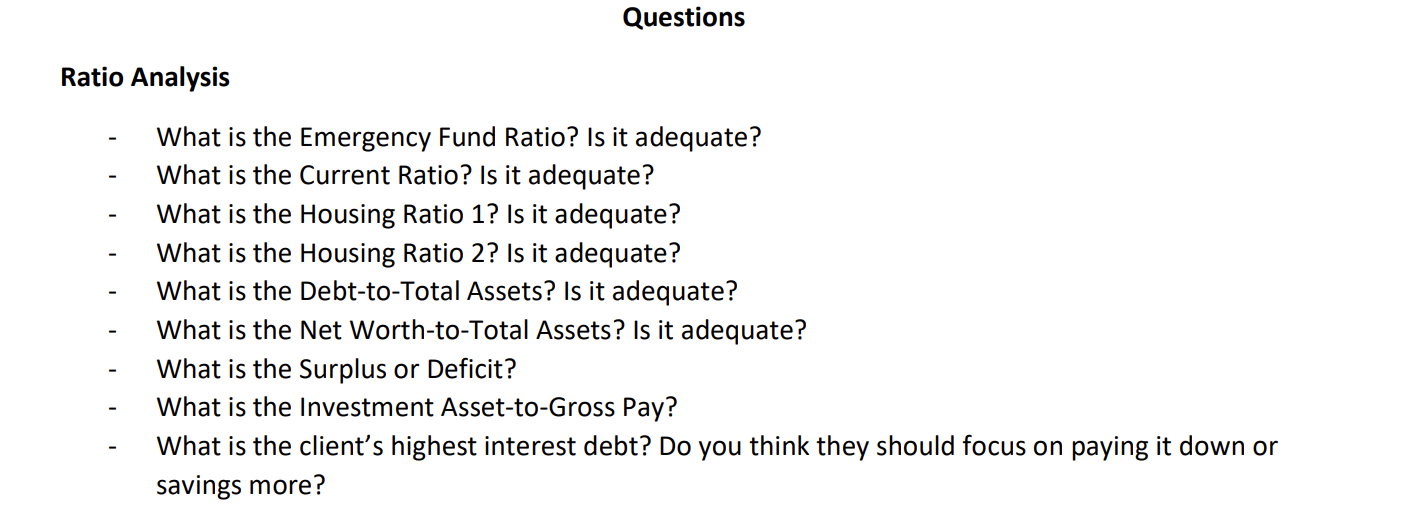

Interest and Assumptions C= John; Projected Cash Flow Statement \begin{tabular}{|l|lc|} \hline Projected Cash Flow Statement as of: & January 1, 2022 \\ \hline Prepared for the exclusive use of: & John \& Rebecca \\ \hline Cash Inflow and Outflow & \multicolumn{2}{c|}{ Amount } \\ \hline Cash Inflow & $ & 224,000.00 \\ \hline John's Salary & $ & 135,000.00 \\ \hline Rebecca's Salary & $ & 72,000.00 \\ \hline Etsy Shop & $ & 17,000.00 \\ \hline Cash Outflows & $ & 198,279.80 \\ \hline Income Tax & $ & 61,000.00 \\ \hline Boat Loan and Slip Fee & $ & 19,171.51 \\ \hline Mortgage & $ & 42,108.29 \\ \hline School Fees & $ & 20,000.00 \\ \hline HOA Fees & $ & 6,000.00 \\ \hline Life Style Expenses & $ & 30,000.00 \\ \hline Basic Necessities & $ & 20,000.00 \\ \hline Surplus/Deficit & & $25,720.20 \\ \hline \end{tabular} Ratio Analysis - What is the Emergency Fund Ratio? Is it adequate? - What is the Current Ratio? Is it adequate? - What is the Housing Ratio 1? Is it adequate? - What is the Housing Ratio 2? Is it adequate? - What is the Debt-to-Total Assets? Is it adequate? - What is the Net Worth-to-Total Assets? Is it adequate? - What is the Surplus or Deficit? - What is the Investment Asset-to-Gross Pay? - What is the client's highest interest debt? Do you think they should focus on paying it down or savings more? Interest and Assumptions C= John; Projected Cash Flow Statement \begin{tabular}{|l|lc|} \hline Projected Cash Flow Statement as of: & January 1, 2022 \\ \hline Prepared for the exclusive use of: & John \& Rebecca \\ \hline Cash Inflow and Outflow & \multicolumn{2}{c|}{ Amount } \\ \hline Cash Inflow & $ & 224,000.00 \\ \hline John's Salary & $ & 135,000.00 \\ \hline Rebecca's Salary & $ & 72,000.00 \\ \hline Etsy Shop & $ & 17,000.00 \\ \hline Cash Outflows & $ & 198,279.80 \\ \hline Income Tax & $ & 61,000.00 \\ \hline Boat Loan and Slip Fee & $ & 19,171.51 \\ \hline Mortgage & $ & 42,108.29 \\ \hline School Fees & $ & 20,000.00 \\ \hline HOA Fees & $ & 6,000.00 \\ \hline Life Style Expenses & $ & 30,000.00 \\ \hline Basic Necessities & $ & 20,000.00 \\ \hline Surplus/Deficit & & $25,720.20 \\ \hline \end{tabular} Ratio Analysis - What is the Emergency Fund Ratio? Is it adequate? - What is the Current Ratio? Is it adequate? - What is the Housing Ratio 1? Is it adequate? - What is the Housing Ratio 2? Is it adequate? - What is the Debt-to-Total Assets? Is it adequate? - What is the Net Worth-to-Total Assets? Is it adequate? - What is the Surplus or Deficit? - What is the Investment Asset-to-Gross Pay? - What is the client's highest interest debt? Do you think they should focus on paying it down or savings more