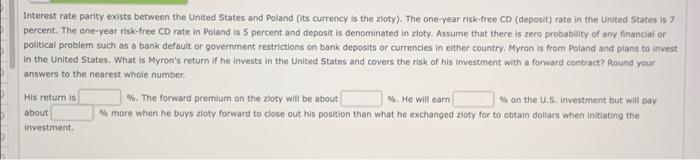

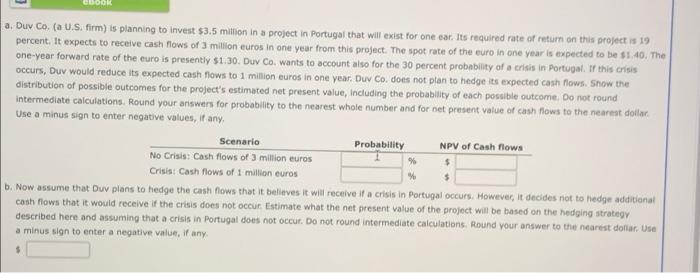

Interest rate parity exists between the United States and Poland (its currency is the zloty). The one-year risk-free CD (deposit) rate in the United States is 7 percent. The one year risk-free CD rate in Poland is 5 percent and deposit is denominated in zloty. Assume that there is zero probability of any financial or political problem such as a bank default or government restrictions on bank deposits or currencies in either country. Myron is from Poland and plans to invest in the United States. What is Myron's return if he invests in the United States and covers the risk of his investment with a forward contract? Round your answers to the nearest whole number His return is %. The forward premium on the zoty will be about %. He will earn % on the U.S. Investment but will pay 4 more when he buys zloty forward to close out his position than what he exchanged Zloty for to obtain dollars when initiating the investment about CUDO a. Duv Co. (a U.S. firm) is planning to invest $3.5 million in a project in Portugal that will exist for one eat. Its required rate of return on this project is 19 percent. It expects to receive cash flows of 3 milion euros in one year from this project. The spot rate of the euro in one year is expected to be $1.40. The one-year forward rate of the euro is presently $1.30. Duv Co. wants to account also for the 30 percent probability of a crisis in Portugal. If this crisis occurs, Duv would reduce its expected cash flows to 1 million euros in one year. Duv Co does not plan to hedge its expected cash flows. Snow the distribution of possible outcomes for the project's estimated net present value, including the probability of each possible outcome. Do not round intermediate calculations. Round your answers for probability to the nearest whole number and for net present value of cash flows to the nearest dollar. Use a minus sign to enter negative values, if any, Scenario Probability NPV of Cash flows No Crisis: Cash flows of 3 million euros % $ Crisis: Cash flows of 1 million euros b. Now assume that Duv plans to hedge the cash flows that it believes it will receive it a crisis in Portugal occurs. However, it decides not to hedge additionat cash flows that it would receive if the crisis does not occur. Estimate what the net present value of the project will be based on the hedging strategy described here and assuming that a crisis in Portugal does not occur. Do not round Intermediate calculations. Round your answer to the nearest doftar Use a minus sign to enter a negative value, if any. $