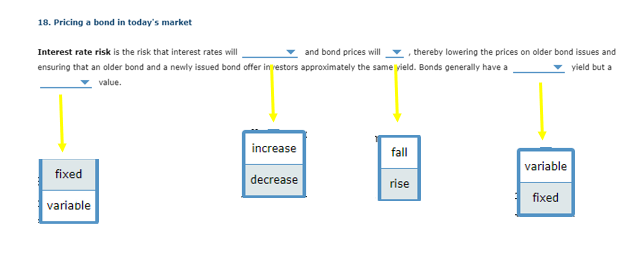

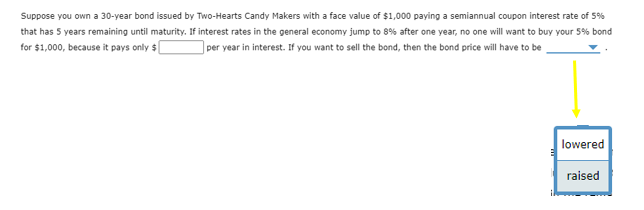

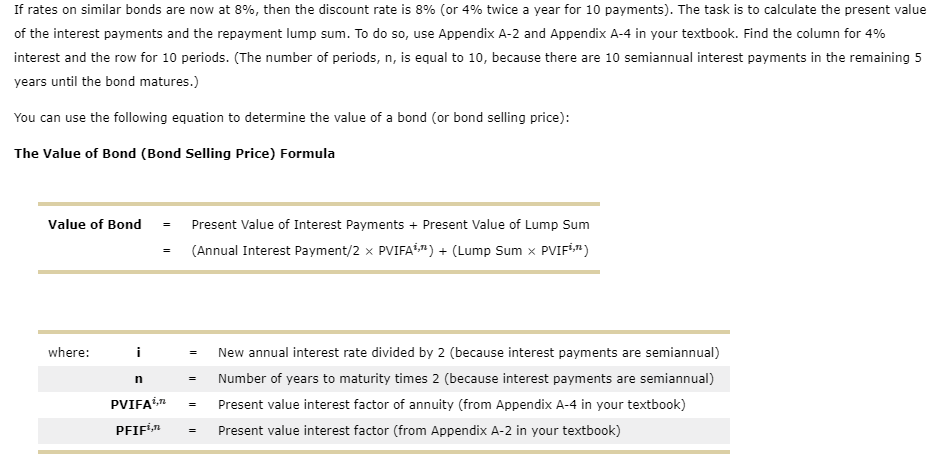

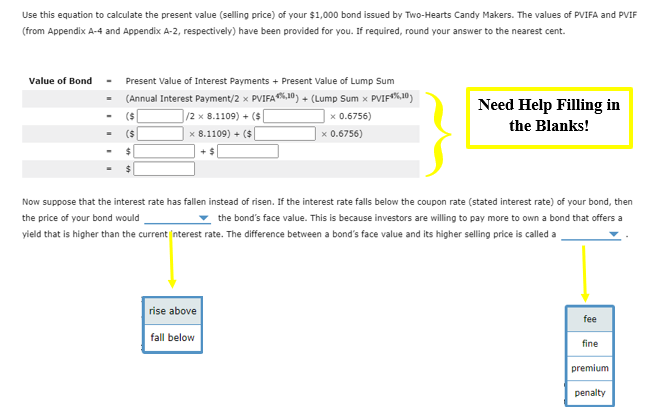

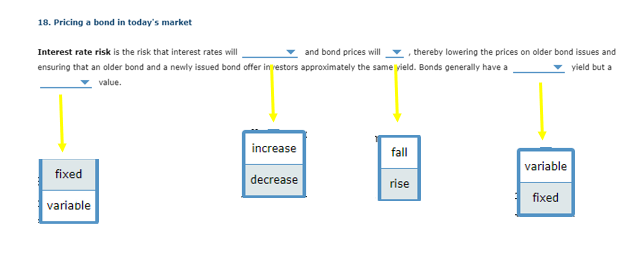

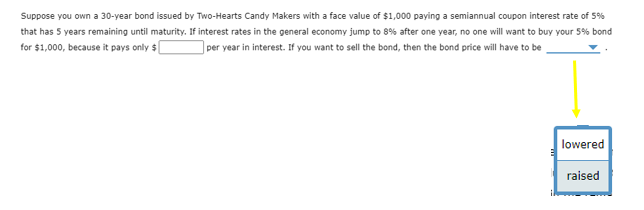

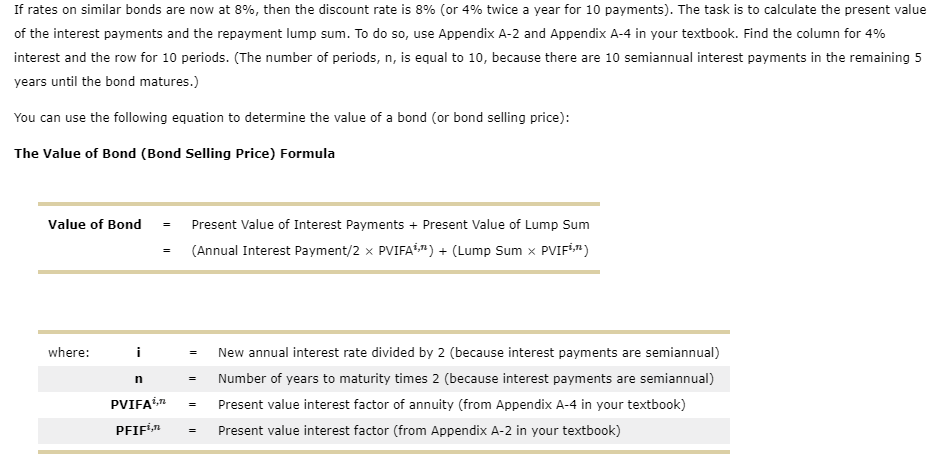

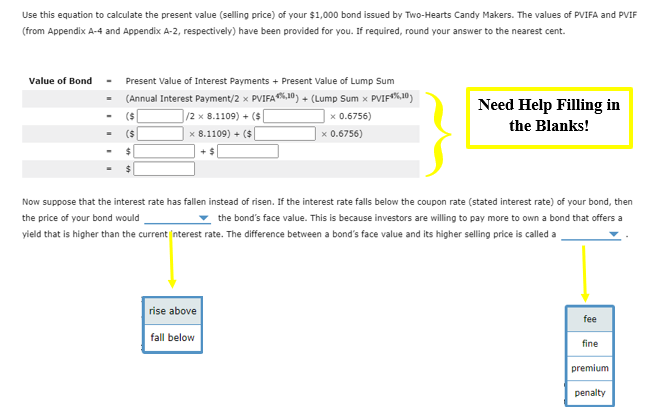

Interest rate risk is the risk that interest rates will and bond prices will , thereby lowering the prices on older bond issues and ensuring that an older bond and a newly issued bond offer in restors approximately the same yield. Bonds generally have a yield but a Suppose you own a 30-year bond issued by Two-Hearts Candy Makers with a face value of $1,000 paying a semiannual coupon interest rate of 5% that has 5 years remaining until maturity. If interest rates in the general economy jump to 8% after one year, no one will want to buy your 5% bond for $1,000, because it pays only $ per year in interest. If you want to sell the bond, then the bond price will have to be If rates on similar bonds are now at 8%, then the discount rate is 8% (or 4% twice a year for 10 payments). The task is to calculate the present value of the interest payments and the repayment lump sum. To do so, use Appendix A-2 and Appendix A-4 in your textbook. Find the column for 4% interest and the row for 10 periods. (The number of periods, n, is equal to 10 , because there are 10 semiannual interest payments in the remaining 5 years until the bond matures.) You can use the following equation to determine the value of a bond (or bond selling price): The Value of Bond (Bond Selling Price) Formula Value of Bond = Present Value of Interest Payments + Present Value of Lump Sum = (Annual Interest Payment /2 PVIFA i,n)+( Lump Sum PVIF i,n) where: i = New annual interest rate divided by 2 (because interest payments are semiannual) nPVIFAi,nPFIFi,n=Numberofyearstomaturitytimes2(becauseinterestpaymentsaresemiannual)=Presentvalueinterestfactorofannuity(fromAppendixA-4inyourtextbook)=Presentvalueinterestfactor(fromAppendixA-2inyourtextbook) Use this equation to calculate the present value (selling price) of your $1,000 bond issued by Two-Hearts Candy Makers. The values of PVIFA and PVIF (from Appendix A-4 and Appendix A-2, respectively) have been provided for you. If required, round your answer to the nearest cent. Need Help Filling in the Blanks! Now suppose that the interest rate has fallen instead of risen. If the interest rate falls below the coupon rate (stated interest rate) of your bond, then the price of your bond would the bond's face value. This is because investors are willing to pay more to own a bond that offers a yield that is higher than the current 'nterest rate. The difference between a bond's face value and its higher selling price is called a Interest rate risk is the risk that interest rates will and bond prices will , thereby lowering the prices on older bond issues and ensuring that an older bond and a newly issued bond offer in restors approximately the same yield. Bonds generally have a yield but a Suppose you own a 30-year bond issued by Two-Hearts Candy Makers with a face value of $1,000 paying a semiannual coupon interest rate of 5% that has 5 years remaining until maturity. If interest rates in the general economy jump to 8% after one year, no one will want to buy your 5% bond for $1,000, because it pays only $ per year in interest. If you want to sell the bond, then the bond price will have to be If rates on similar bonds are now at 8%, then the discount rate is 8% (or 4% twice a year for 10 payments). The task is to calculate the present value of the interest payments and the repayment lump sum. To do so, use Appendix A-2 and Appendix A-4 in your textbook. Find the column for 4% interest and the row for 10 periods. (The number of periods, n, is equal to 10 , because there are 10 semiannual interest payments in the remaining 5 years until the bond matures.) You can use the following equation to determine the value of a bond (or bond selling price): The Value of Bond (Bond Selling Price) Formula Value of Bond = Present Value of Interest Payments + Present Value of Lump Sum = (Annual Interest Payment /2 PVIFA i,n)+( Lump Sum PVIF i,n) where: i = New annual interest rate divided by 2 (because interest payments are semiannual) nPVIFAi,nPFIFi,n=Numberofyearstomaturitytimes2(becauseinterestpaymentsaresemiannual)=Presentvalueinterestfactorofannuity(fromAppendixA-4inyourtextbook)=Presentvalueinterestfactor(fromAppendixA-2inyourtextbook) Use this equation to calculate the present value (selling price) of your $1,000 bond issued by Two-Hearts Candy Makers. The values of PVIFA and PVIF (from Appendix A-4 and Appendix A-2, respectively) have been provided for you. If required, round your answer to the nearest cent. Need Help Filling in the Blanks! Now suppose that the interest rate has fallen instead of risen. If the interest rate falls below the coupon rate (stated interest rate) of your bond, then the price of your bond would the bond's face value. This is because investors are willing to pay more to own a bond that offers a yield that is higher than the current 'nterest rate. The difference between a bond's face value and its higher selling price is called a