Answered step by step

Verified Expert Solution

Question

1 Approved Answer

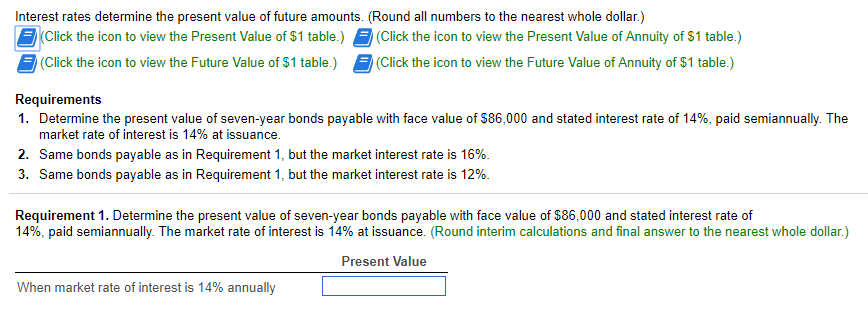

Interest rates determine the present value of future amounts.? (Round all numbers to the nearest whole? dollar.) Requirements 1. Determine the present value of seven?-year

Interest rates determine the present value of future amounts.? (Round all numbers to the nearest whole? dollar.)

Requirements

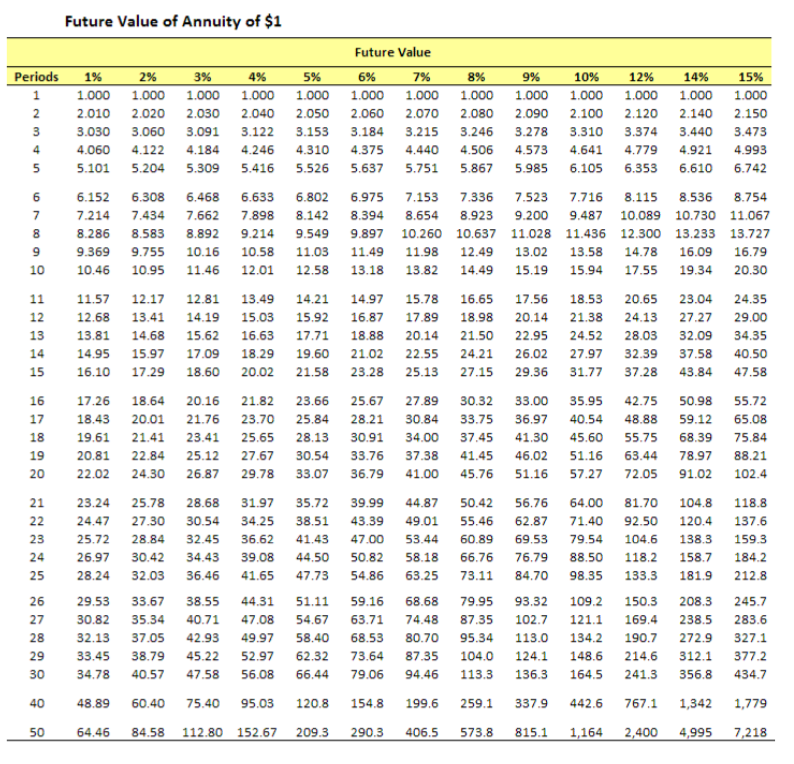

| 1. | Determine the present value of seven?-year bonds payable with face value of $86,000 and stated interest rate of 14?%, paid semiannually. The market rate of interest is 14?% at issuance.

|

| 2. | Same bonds payable as in Requirement? 1, but the market interest rate is 16?%.

|

| 3. | Same bonds payable as in Requirement? 1, but the market interest rate is 12?%.

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started