Answered step by step

Verified Expert Solution

Question

1 Approved Answer

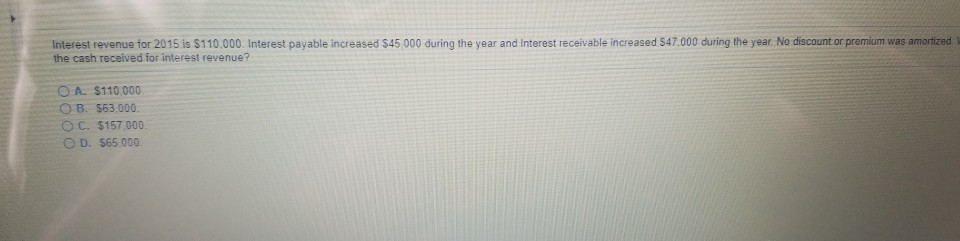

Interest revenue for 2015 is $110.000. Interest payable increased $45 000 during the year and Interest receivable Increased $47.000 during the year. No discount or

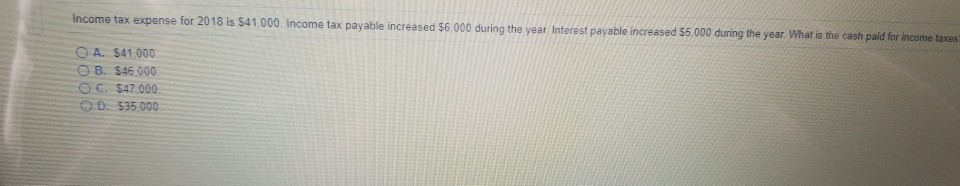

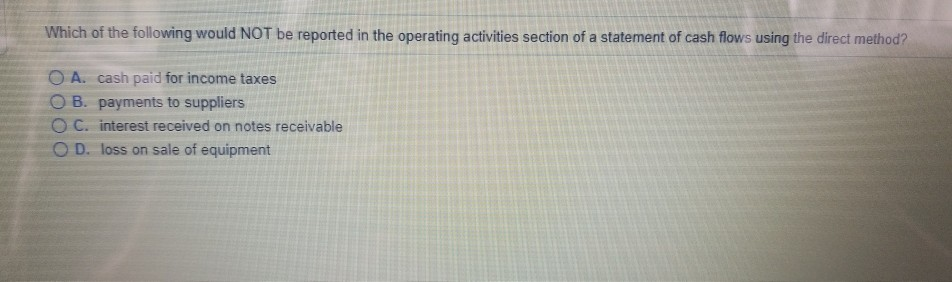

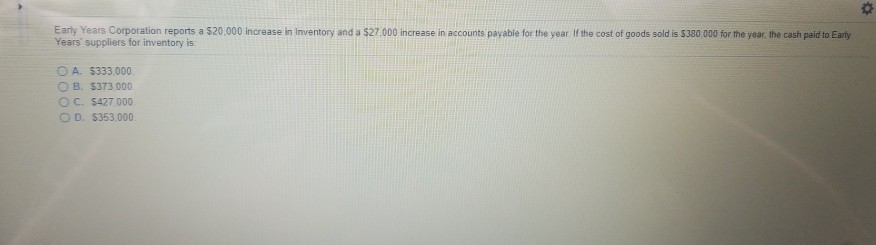

Interest revenue for 2015 is $110.000. Interest payable increased $45 000 during the year and Interest receivable Increased $47.000 during the year. No discount or premium was amortized the cash received for interest revenue? O A. $110.000 OB. 563.000 OC. $157.000 OD. 565.000 Income tax expense for 2018 is 541,000 Income tax payable increased $6,000 during the year. Interest payable increased 55,000 during the year. What is the cash paid for income taxes O A. $41000 OB. $46.000 OC. $47.000 D. 535.000 Which of the following would NOT be reported in the operating activities section of a statement of cash flows using the direct method? O A. cash paid for income taxes O B. payments to suppliers OC. interest received on notes receivable OD. loss on sale of equipment Early Years Corporation reports a 520.000 increase in Inventory and a $27.000 increase in accounts payable for the year. If the cost of goods sold is 5380 000 for the year the cash paid to Eat Years suppliers for inventory is O A 5333.000 OB. 5373,000 O C. 5427 000 OD. $353,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started