Question

Intermediate 2 Terry Part #2: Chapter 18 To practice correcting the financial statements for different revenue recognition situations. (See Topic Guides IFO 4 and 23).

Intermediate 2 Terry Part #2: Chapter 18

To practice correcting the financial statements for different revenue recognition situations. (See Topic Guides IFO 4 and 23).

Information:

Terry determined early in its history that it was more effective for them to build their own specialized production equipment than for them to share their proprietary production data with a construction company. While this process leads to a larger upfront cost for new equipment, the special production methods used by the company have earned much more than the initial extra outlay.

While the company has historically kept this production process in-house, they have recently been approached by a local university with a request to provide a set of machinery that the university can use to produce their own specialty bags. Since many members of Terry's Board of Directors (and several large shareholders) are alumni of this university, Terry's management has decided that they will go through with the sale of a three machine system to the university.

As part of the deal, Terry's management has insisted that the university also purchase a 3-year maintenance contract (which will begin as soon as the last machine is installed). This requirement will allow Terry's engineers and machinists to take care of the equipment, reducing the chance of losing their competitive advantage. The total contract price for the machines and the maintenance contract is $660,000.

As part of the contract, both parties have agreed that the university will have the right to return the equipment if they are not satisfied with the performance of the machines. Terry will also provide an additional refund for the maintenance contract if the company returns the equipment within the next few years.

While Terry has never sold its equipment before, machinery for making bags can be purchased from many other companies. In addition, many of those companies also provide service contracts to care for the machines they sell. Other versions of the machines typically sell for $165,000; $130,000; and $300,000. A 3-year maintenance contract sells, on average, for $72,000.

By the end of Year 3, Terry had installed the first and second machines and the university has paid $293,000. Terry's management team anticipates that the final machine will be installed in January of Year 4, and the maintenance contract will begin immediately after the final installation. The university will pay the balance of the contract once the last one is installed.

Terry's management would like to know the effect of the sale on the following ratios:

Profit Margin Current Ratio ROA

Calculations

1. Calculate each of the three (3) ratios before you make any adjustments.

2. Make the appropriate journal entries, if any, to account for the installation of the machines (including any necessary changes to income tax expense) and the first payment by the university. Assume that the first machine cost Terry $132,000, the second $117,000, and the third $210,000. The average cost of the maintenance contract is $22,000. Terry's work building these machines has already been appropriately recorded in inventory. Please see the hints for rounding instructions for these calculations.

3. Make any necessary changes to the financial statements.

4. Calculate the three (3) ratios after you make any adjustments.

Critical Thinking

5. What do you think investors' reaction will be to the sale of these proprietary machines to a university (if any)? In other words, based on your changes to the financial statements and the change in the ratios, do you think investors will be happy with management's choice to enter into this agreement? Why or why not?

6. Who might be affected by the Terry's decision to give in to the Board's demands and sell their proprietary machines to the university?

Hints:

Make sure that you include only the amount the client has paid!

Is this correct:

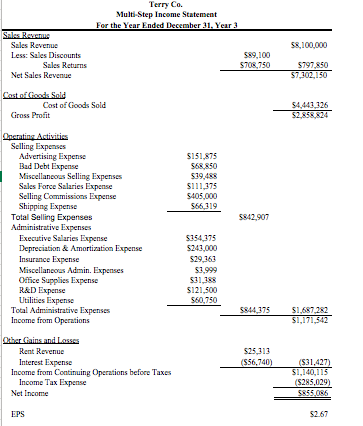

Profit Margin Ratio before change: (855,086/7,302,150) = 0.117

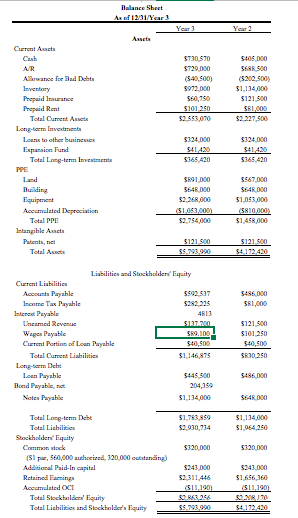

Current Ratio before change: (2,553,070/1,146,875) = 2.226

ROA before change: (855,086/4,983,205) = 0.172

Profit margin Ratio after change:

Current Ratio after change:

ROA after change:

If I got any of these wrong, please show me what I did wrong/how to do it right.

Journal Entries:

12/31/year 3:

Cash 293,000 dr

Sales Revenue 290.400 cr (165,000+125,400)

Contract Liability 2,600 cr (293,000-290,400)

COGS 249,000 dr (132,000 + 117,000)

Inventory 249,000 cr

(completion of machines 1 & 2 installation)

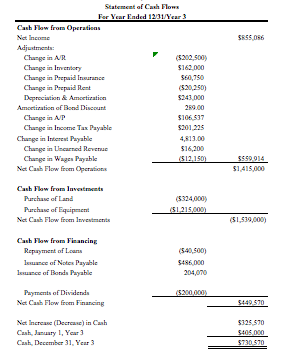

** If income tax rate is 25%, do I add the 293,000 to Cash AND the 290,400 of Sales Revenue to the balance sheet? How do I do the Journal Entry to record income tax expense/payable?

January/year 2 (after Machine 3 is installed, maintenance contract is now in effect & client has paid)

Cash 367,000 dr (660,000-293,000) ** I am unsure about this part

Sales Revenue 367,000 cr

COGS 232,000 dr (210,000 + 22,000)

Inventory 232,000 Cr *** would a maintenance contract come out of inventory? Or would that portion of 22,000 be a credit to contract liability?

** Again, I am uncertain as to how to relay this new information to the balance sheet and thus calculate the new ratios. Any help is appreciated!!

Terry Co. MultiStep Income Statement For the Year Ended December 31, Year 3 S8,100,000 Sales Revue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue $89.100 $700.750 5797 850 57,302,150 Castaldies Sold Cost of Goods Sold Gross Profit 54 441 126 $2.858 76 5151.875 519.408 S111175 5405.000 S66,319 5842.907 Anemia Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellanc Admin. Expenses Office Supplies Expense BAD Expense Utilities Expense Total Administrative Expenses Income from Operations 5134 175 5241.000 529 162 52.999 531188 5121.500 560.750 58.44 175 51.687782 $1,171,542 525,313 (556.740) (531,427) Other Gains and Lasses Rent Revenue Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income S1,140,115 (5285,029) 5R55.086 PS 52.67 Balance Sheet As of 1231/sar Assets Current Assets AR Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Rent Total Current Assets Long-term Investments Loans to other business Expansion Fund Total Langler I nte S730 570 $729.000 (540.500) 5972.000 560,750 S10150 $2.501,070 5405 000 S68R 500 5200.500) $1,134,000 5121 500 $1.000 52.227.500 5124000 $134000 541,420 $365 420 5368 420 Equipment Accumulated Depreciation Total PPE Intangible Assets $99.000 564R DOO 52.260.000 (51.053,000) $2.754,000 S$67.000 564R DOO 51,093.000 5810,000) 51.450.000 $121.500 SS.793.900 $121,500 54.72.430 Total Art 5496.000 SR1000 Liabilities in Stockholders' Equity Current Llabilities Accounts Payable sgp 537 Income Tax Payable Interest Payable Uncamed Revenue Wages Payable $99.100 Current Portion of Loan Payable Total Current Liabilities $1146875 Long-term Debt Lean Payable Bond Payablet 204,359 Notes Payable $1,134,000 5121 500 $101.250 540,500 5810350 5486,000 564.000 Total Long-term Debt Total Liabilities Stockholders' liquity $1,783.959 $2.930,734 $1,134,000 51 06250 $320,000 $320.000 5243.000 52311.446 5243.000 $1.656 360 (SIP, 560,000 authorized 320.000 outstanding) Additional Paid In capital Retained aming Accumulated OCI Total Stockholm Equity Total Liabilities and Stockholder's Equity SORA 54.192.430 SRS5056 Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income Adjustments: Change in AIR (5200.500) Change in Inventory $160.000 Change in Prepaid Insurance 560.750 Change in Prepaid Rent 520,250) Deprecision Ametiration 5241.000 Amortization of Band Discount 299.00 Change in AP $106.537 Change in nome Tax Payable 5201215 Change in Interi Payable Change in Ucard Revenue $16,200 Change in Wapes Payable (512,150) Net Cash Flow from Operations 5669.014 $1.416,000 534000 Cash Flow from lavestment Purchase of Land Purchase of liquipment Net Cash Flow from Investments (51,539,000) Cash Flow from Financing Repayment of t.com lunce of Notes Payable lexuance of led Payable (540,000 5486 000 204,070 18200.000 Payments of Dividends Net Cash Flow from Financing 5:49.570 Net Increase (Decrease in Cash $325 570 Cash, December 31, Year 3 Terry Co. MultiStep Income Statement For the Year Ended December 31, Year 3 S8,100,000 Sales Revue Sales Revenue Less: Sales Discounts Sales Returns Net Sales Revenue $89.100 $700.750 5797 850 57,302,150 Castaldies Sold Cost of Goods Sold Gross Profit 54 441 126 $2.858 76 5151.875 519.408 S111175 5405.000 S66,319 5842.907 Anemia Activities Selling Expenses Advertising Expense Bad Debt Expense Miscellaneous Selling Expenses Sales Force Salaries Expense Selling Commissions Expense Shipping Expense Total Selling Expenses Administrative Expenses Executive Salaries Expense Depreciation & Amortization Expense Insurance Expense Miscellanc Admin. Expenses Office Supplies Expense BAD Expense Utilities Expense Total Administrative Expenses Income from Operations 5134 175 5241.000 529 162 52.999 531188 5121.500 560.750 58.44 175 51.687782 $1,171,542 525,313 (556.740) (531,427) Other Gains and Lasses Rent Revenue Interest Expense Income from Continuing Operations before Taxes Income Tax Expense Net Income S1,140,115 (5285,029) 5R55.086 PS 52.67 Balance Sheet As of 1231/sar Assets Current Assets AR Allowance for Bad Debts Inventory Prepaid Insurance Prepaid Rent Total Current Assets Long-term Investments Loans to other business Expansion Fund Total Langler I nte S730 570 $729.000 (540.500) 5972.000 560,750 S10150 $2.501,070 5405 000 S68R 500 5200.500) $1,134,000 5121 500 $1.000 52.227.500 5124000 $134000 541,420 $365 420 5368 420 Equipment Accumulated Depreciation Total PPE Intangible Assets $99.000 564R DOO 52.260.000 (51.053,000) $2.754,000 S$67.000 564R DOO 51,093.000 5810,000) 51.450.000 $121.500 SS.793.900 $121,500 54.72.430 Total Art 5496.000 SR1000 Liabilities in Stockholders' Equity Current Llabilities Accounts Payable sgp 537 Income Tax Payable Interest Payable Uncamed Revenue Wages Payable $99.100 Current Portion of Loan Payable Total Current Liabilities $1146875 Long-term Debt Lean Payable Bond Payablet 204,359 Notes Payable $1,134,000 5121 500 $101.250 540,500 5810350 5486,000 564.000 Total Long-term Debt Total Liabilities Stockholders' liquity $1,783.959 $2.930,734 $1,134,000 51 06250 $320,000 $320.000 5243.000 52311.446 5243.000 $1.656 360 (SIP, 560,000 authorized 320.000 outstanding) Additional Paid In capital Retained aming Accumulated OCI Total Stockholm Equity Total Liabilities and Stockholder's Equity SORA 54.192.430 SRS5056 Statement of Cash Flows For Year Ended 12/31/Year 3 Cash Flow from Operations Net Income Adjustments: Change in AIR (5200.500) Change in Inventory $160.000 Change in Prepaid Insurance 560.750 Change in Prepaid Rent 520,250) Deprecision Ametiration 5241.000 Amortization of Band Discount 299.00 Change in AP $106.537 Change in nome Tax Payable 5201215 Change in Interi Payable Change in Ucard Revenue $16,200 Change in Wapes Payable (512,150) Net Cash Flow from Operations 5669.014 $1.416,000 534000 Cash Flow from lavestment Purchase of Land Purchase of liquipment Net Cash Flow from Investments (51,539,000) Cash Flow from Financing Repayment of t.com lunce of Notes Payable lexuance of led Payable (540,000 5486 000 204,070 18200.000 Payments of Dividends Net Cash Flow from Financing 5:49.570 Net Increase (Decrease in Cash $325 570 Cash, December 31, Year 3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started