Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Intermediate Accounting I Case due Thursday Horizon Corporation manufactures personal computers. The company began operations in 2012 and reported profits for the years 2012

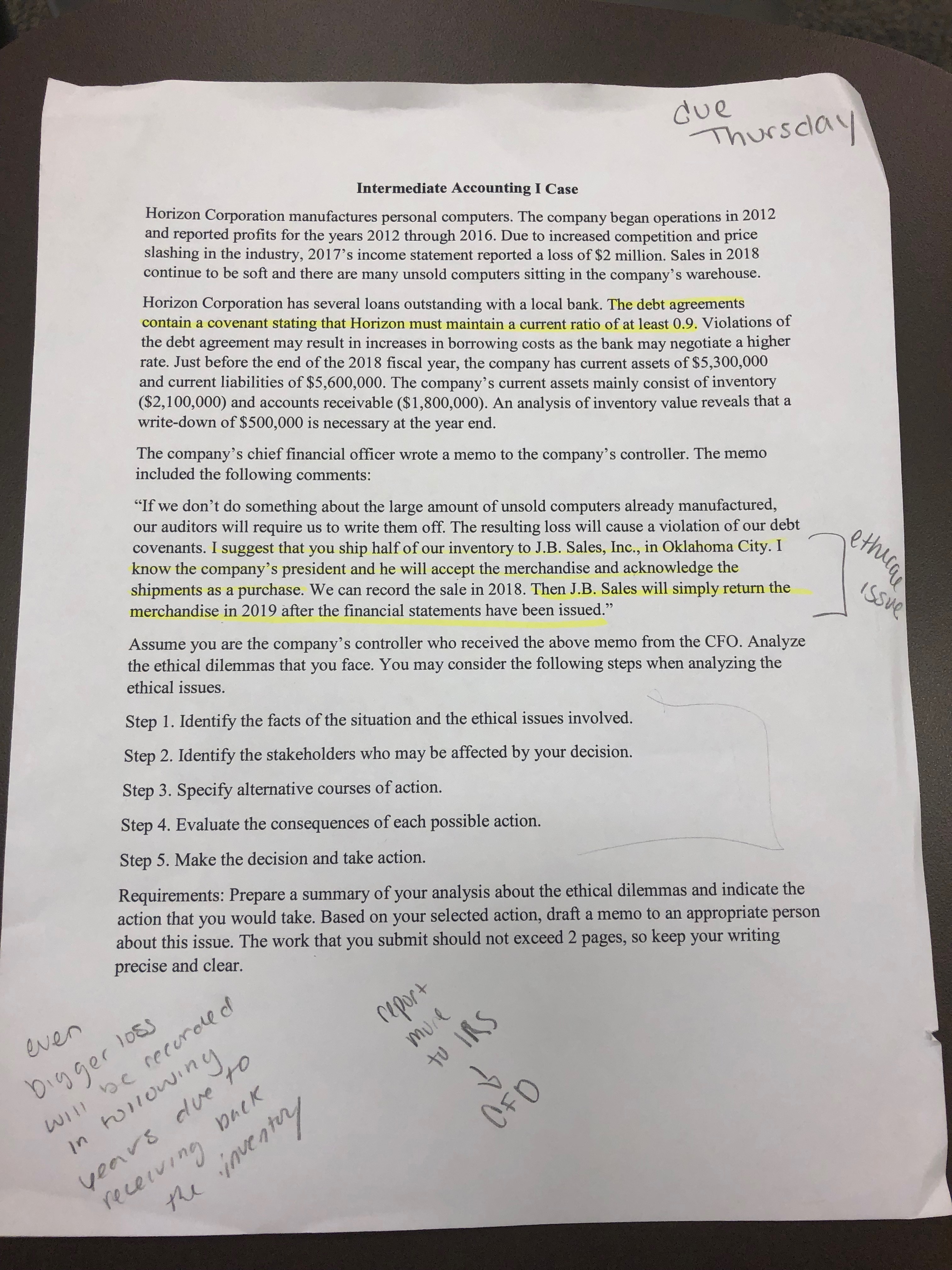

Intermediate Accounting I Case due Thursday Horizon Corporation manufactures personal computers. The company began operations in 2012 and reported profits for the years 2012 through 2016. Due to increased competition and price slashing in the industry, 2017's income statement reported a loss of $2 million. Sales in 2018 continue to be soft and there are many unsold computers sitting in the company's warehouse. Horizon Corporation has several loans outstanding with a local bank. The debt agreements contain a covenant stating that Horizon must maintain a current ratio of at least 0.9. Violations of the debt agreement may result in increases in borrowing costs as the bank may negotiate a higher rate. Just before the end of the 2018 fiscal year, the company has current assets of $5,300,000 and current liabilities of $5,600,000. The company's current assets mainly consist of inventory ($2,100,000) and accounts receivable ($1,800,000). An analysis of inventory value reveals that a write-down of $500,000 is necessary at the year end. The company's chief financial officer wrote a memo to the company's controller. The memo included the following comments: "If we don't do something about the large amount of unsold computers already manufactured, our auditors will require us to write them off. The resulting loss will cause a violation of our debt covenants. I suggest that you ship half of our inventory to J.B. Sales, Inc., in Oklahoma City. I know the company's president and he will accept the merchandise and acknowledge the shipments as a purchase. We can record the sale in 2018. Then J.B. Sales will simply return the merchandise in 2019 after the financial statements have been issued." Assume you are the company's controller who received the above memo from the CFO. Analyze the ethical dilemmas that you face. You may consider the following steps when analyzing the ethical issues. Step 1. Identify the facts of the situation and the ethical issues involved. Step 2. Identify the stakeholders who may be affected by your decision. Step 3. Specify alternative courses of action. Step 4. Evaluate the consequences of each possible action. Step 5. Make the decision and take action. Requirements: Prepare a summary of your analysis about the ethical dilemmas and indicate the action that you would take. Based on your selected action, draft a memo to an appropriate person about this issue. The work that you submit should not exceed 2 pages, so keep your writing precise and clear. ethical Issue even bigger loss will be recorded In following years due to receiving back the inventory report to IRS mure CFD

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started