Answered step by step

Verified Expert Solution

Question

1 Approved Answer

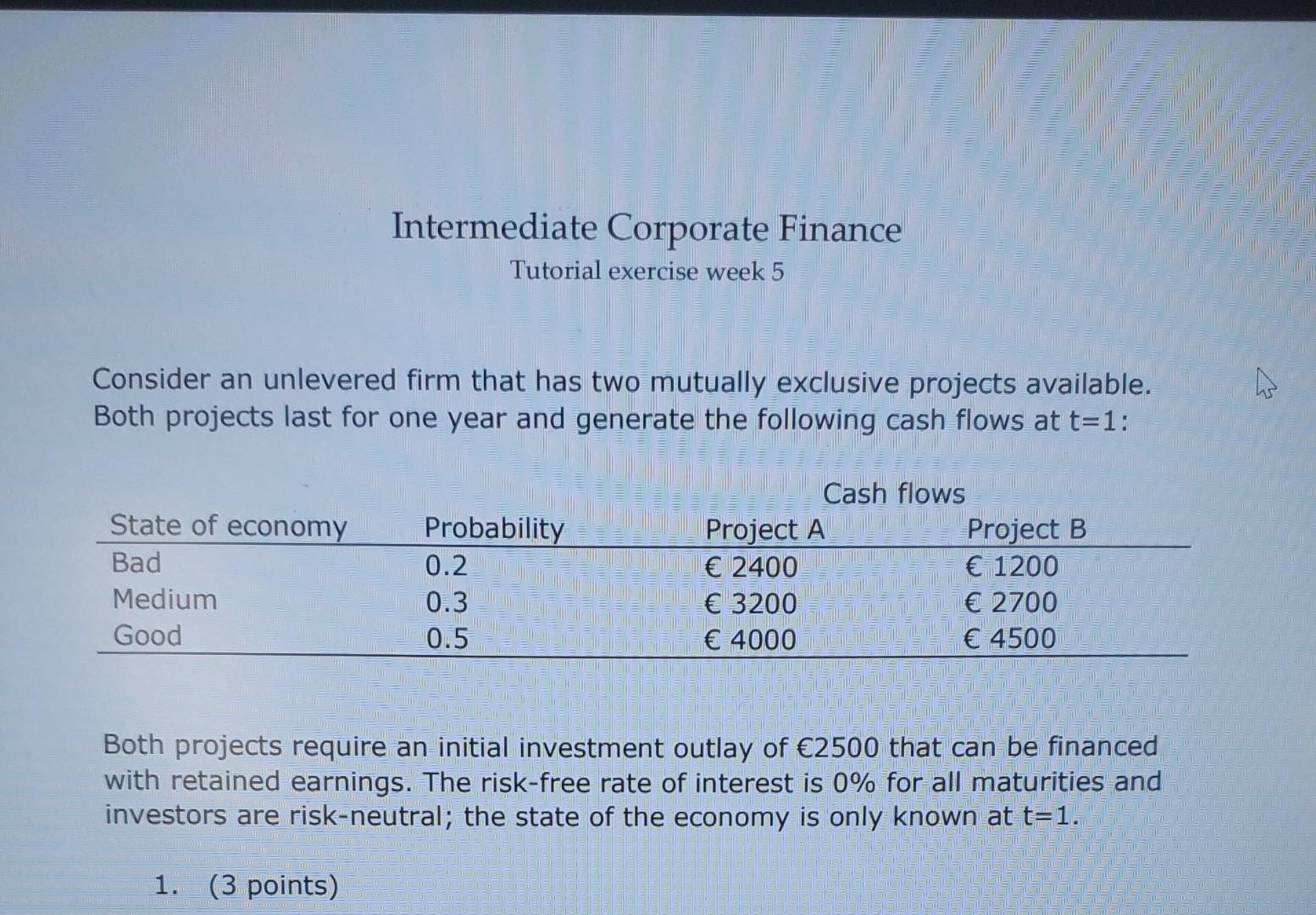

Intermediate Corporate Finance Tutorial exercise week 5 Consider an unlevered firm that has two mutually exclusive projects available. Both projects last for one year and

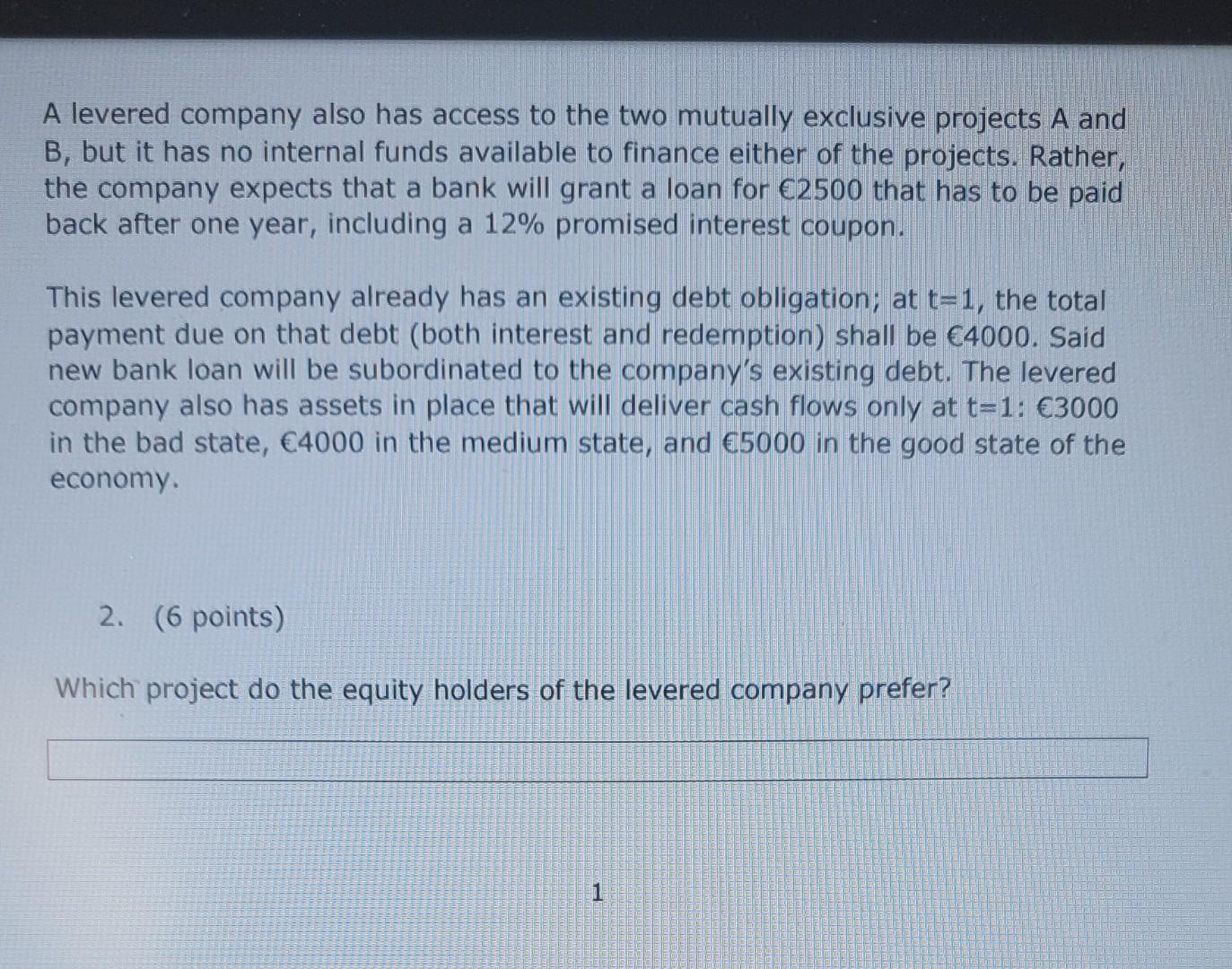

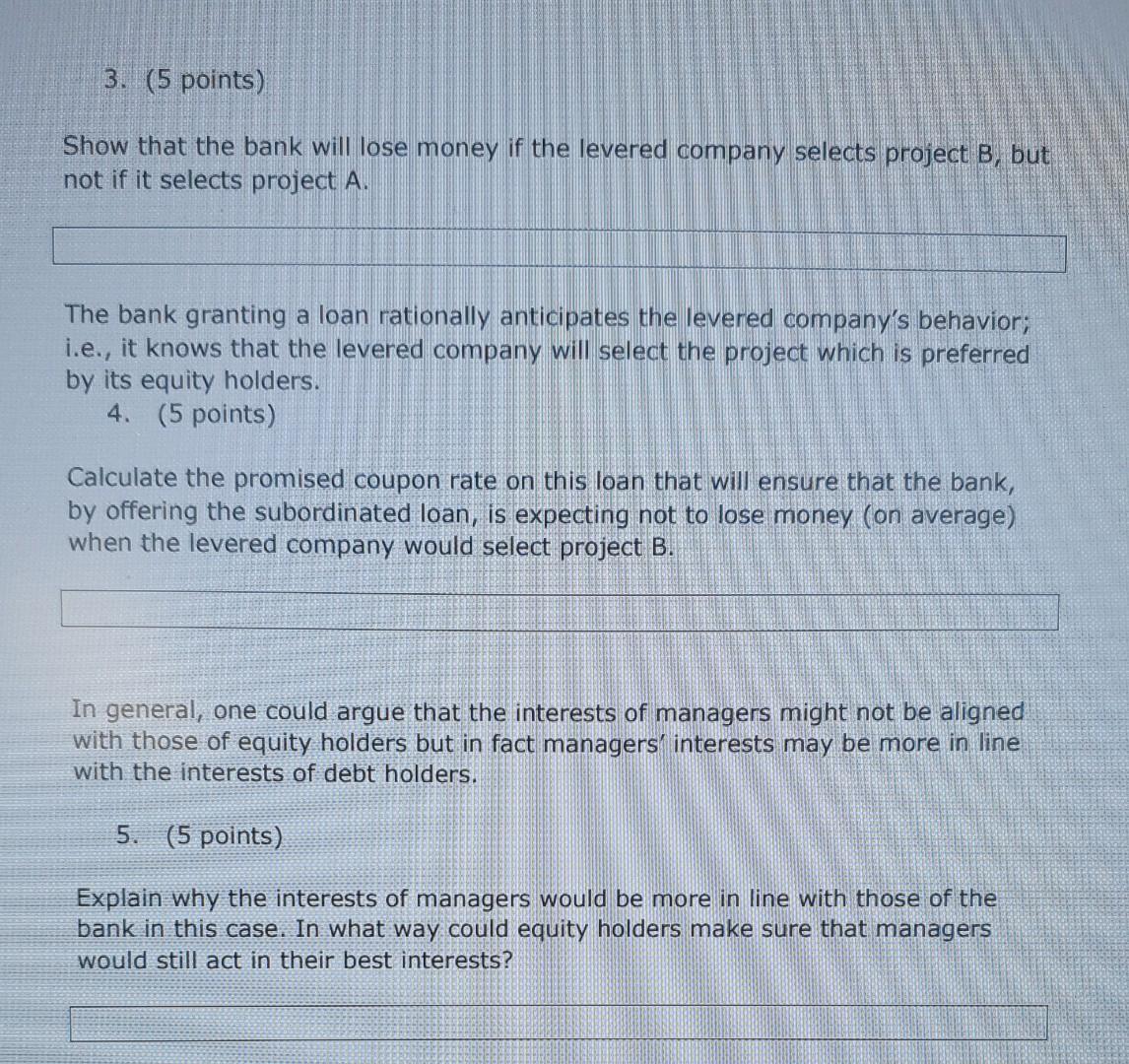

Intermediate Corporate Finance Tutorial exercise week 5 Consider an unlevered firm that has two mutually exclusive projects available. Both projects last for one year and generate the following cash flows at t=1: Cash flows State of economy Probability Project A 2400 Project B 1200 Bad 0.2 Medium 0.3 3200 2700 Good 0.5 4000 4500 Both projects require an initial investment outlay of 2500 that can be financed with retained earnings. The risk-free rate of interest is 0% for all maturities and investors are risk-neutral; the state of the economy is only known at t=1. 1. (3 points) k A levered company also has access to the two mutually exclusive projects A and B, but it has no internal funds available to finance either of the projects. Rather, the company expects that a bank will grant a loan for 2500 that has to be paid back after one year, including a 12% promised interest coupon. This levered company already has an existing debt obligation; at t=1, the total payment due on that debt (both interest and redemption) shall be 4000. Said new bank loan will be subordinated to the company's existing debt. The levered company also has assets in place that will deliver cash flows only at t=1: 3000 in the bad state, 4000 in the medium state, and 5000 in the good state of the economy. 2. (6 points) Which project do the equity holders of the levered company prefer? 1 3. (5 points) Show that the bank will lose money if the levered company selects project B, but not if it selects project A. The bank granting a loan rationally anticipates the levered company's behavior; i.e., it knows that the levered company will select the project which is preferred by its equity holders. 4. (5 points) Calculate the promised coupon rate on this loan that will ensure that the bank, by offering the subordinated loan, is expecting not to lose money (on average) when the levered company would select project B. In general, one could argue that the interests of managers might not be aligned with those of equity holders but in fact managers interests may be more in line with the interests of debt holders. 5. (5 points) Explain why the interests of managers would be more in line with those of the bank in this case. In what way could equity holders make sure that managers would still act in their best interests? Intermediate Corporate Finance Tutorial exercise week 5 Consider an unlevered firm that has two mutually exclusive projects available. Both projects last for one year and generate the following cash flows at t=1: Cash flows State of economy Probability Project A 2400 Project B 1200 Bad 0.2 Medium 0.3 3200 2700 Good 0.5 4000 4500 Both projects require an initial investment outlay of 2500 that can be financed with retained earnings. The risk-free rate of interest is 0% for all maturities and investors are risk-neutral; the state of the economy is only known at t=1. 1. (3 points) k A levered company also has access to the two mutually exclusive projects A and B, but it has no internal funds available to finance either of the projects. Rather, the company expects that a bank will grant a loan for 2500 that has to be paid back after one year, including a 12% promised interest coupon. This levered company already has an existing debt obligation; at t=1, the total payment due on that debt (both interest and redemption) shall be 4000. Said new bank loan will be subordinated to the company's existing debt. The levered company also has assets in place that will deliver cash flows only at t=1: 3000 in the bad state, 4000 in the medium state, and 5000 in the good state of the economy. 2. (6 points) Which project do the equity holders of the levered company prefer? 1 3. (5 points) Show that the bank will lose money if the levered company selects project B, but not if it selects project A. The bank granting a loan rationally anticipates the levered company's behavior; i.e., it knows that the levered company will select the project which is preferred by its equity holders. 4. (5 points) Calculate the promised coupon rate on this loan that will ensure that the bank, by offering the subordinated loan, is expecting not to lose money (on average) when the levered company would select project B. In general, one could argue that the interests of managers might not be aligned with those of equity holders but in fact managers interests may be more in line with the interests of debt holders. 5. (5 points) Explain why the interests of managers would be more in line with those of the bank in this case. In what way could equity holders make sure that managers would still act in their best interests

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started