Question: Intermediate Financial Accounting 1 Chapters 4 , 5 Intermediate Financial Accounting 1 Chapters 4 , 5 Intermediate Financial Accounting 1 Chapters 4 , 5 &

Intermediate Financial Accounting

Chapters Intermediate Financial Accounting

Chapters

Intermediate Financial Accounting

Chapters &

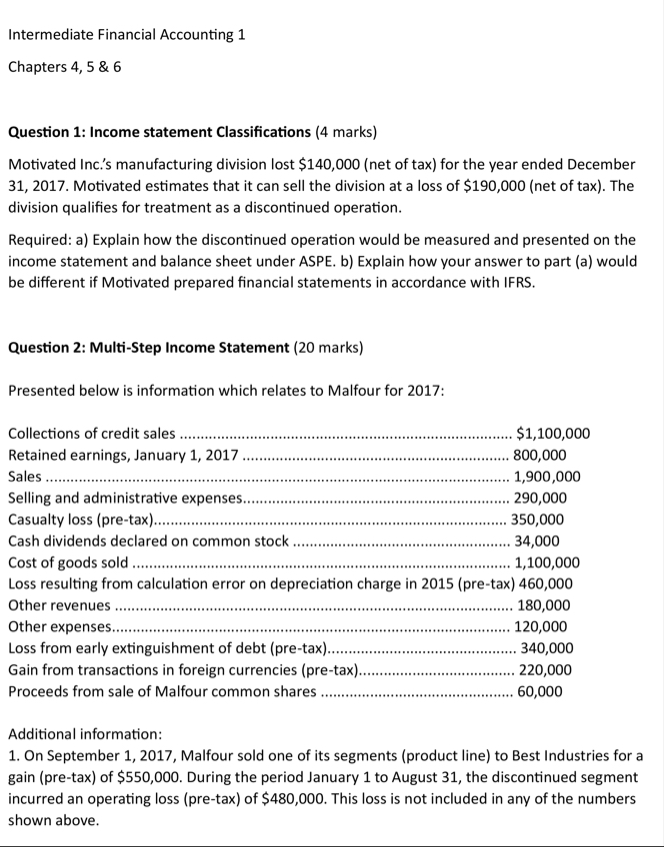

Question : Income statement Classifications marks

Motivated Inc.s manufacturing division lost $net of tax for the year ended December Motivated estimates that it can sell the division at a loss of $net of tax The division qualifies for treatment as a discontinued operation.

Required: a Explain how the discontinued operation would be measured and presented on the income statement and balance sheet under ASPE. b Explain how your answer to part a would be different if Motivated prepared financial statements in accordance with IFRS.

Question : MultiStep Income Statement marks

Presented below is information which relates to Malfour for :

tableCollections of credit sales,$Retained earnings, January SalesSelling and administrative expenses.,Casualty loss pretaxCash dividends declared on common stock,Cost of goods sold,Loss resulting from calculation error on depreciation,Other revenues,Other expenses..,Loss from early extinguishment of debt pretaxGain from transactions in foreign currencies pretaxProceeds from sale of Malfour common shares

Additional information:

On September Malfour sold one of its segments product line to Best Industries for a gain pretax of $ During the period January to August the discontinued segment incurred an operating loss pretax of $ This loss is not included in any of the numbers shown above.

Included in "Selling and Administrative Expenses" is "Bad Debts Expense" of $ Malfour bases its bad debts expense upon a percentage of sales. In and the percentage was In the percentage was changed to

Early in Malfour changed depreciation methods for its plant assets from the double decliningbalance to the straightline method. The affected assets were purchased at the beginning of for $ had no residual value, and had useful lives of years.

Depreciation expense of $ is included in the "Selling and Administrative Expenses" of $

a In good form, prepare a multiplestep income statement for Assume a income tax rate and that common shares were outstanding during the year.

b Prepare a statement of Retained earnings

Note: Malfour Limited follows ASPE. Read the question carefully, as some information does not always apply to the question at hand. For example, the change in depreciation is a change in estimate, not a change in accounting policy. It may be helpful to review the solution to E and P in your practice exercises and E in the study guide.

Question : Statement of Financial Position Classification marks

Use the code letters listed below to indicate, for each statement of financial position item listed below, the usual valuation reported on the statement of financial position.

a No par value

b Current cost of replacement

c Amount payable when due, less unamortized discount or plus unamortized premium

d Amount payable when due

e Fair value at statement of financial position date

f Net realizable value

g Lower of cost or net realizable value

h Original cost less accumulated depreciationamortization

i Original cost less accumulated depletion

j Historical cost

k Unexpired or unconsumed cost

Common shares

Longterm bonds payable

Prepaid expenses

Land in use

Natural resources

Land future plant site

Property, plant, and equipment

Patents

Trade accounts receivable

Trading securities

Copyrights

Merchandise inventory

Question : Statement of Financial Position & Cash Flow marks

Amerac Inc. had the following statement of financial position at the end of operations for :

tableAmerac Inc. Statement of Financial PositionDecember

During the following occurred:

Amerac liquidated its FVNI portfolio as a loss of $

A parcel of land was purchased for $

An additional $ worth of common shares was issued.

Dividends totaling $ were declared and paid to shareholders.

Net income for was $ including $ in depreciation expense.

Land was purchased through the issuance of $ in add

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock