Intermediate Financial Reporting II

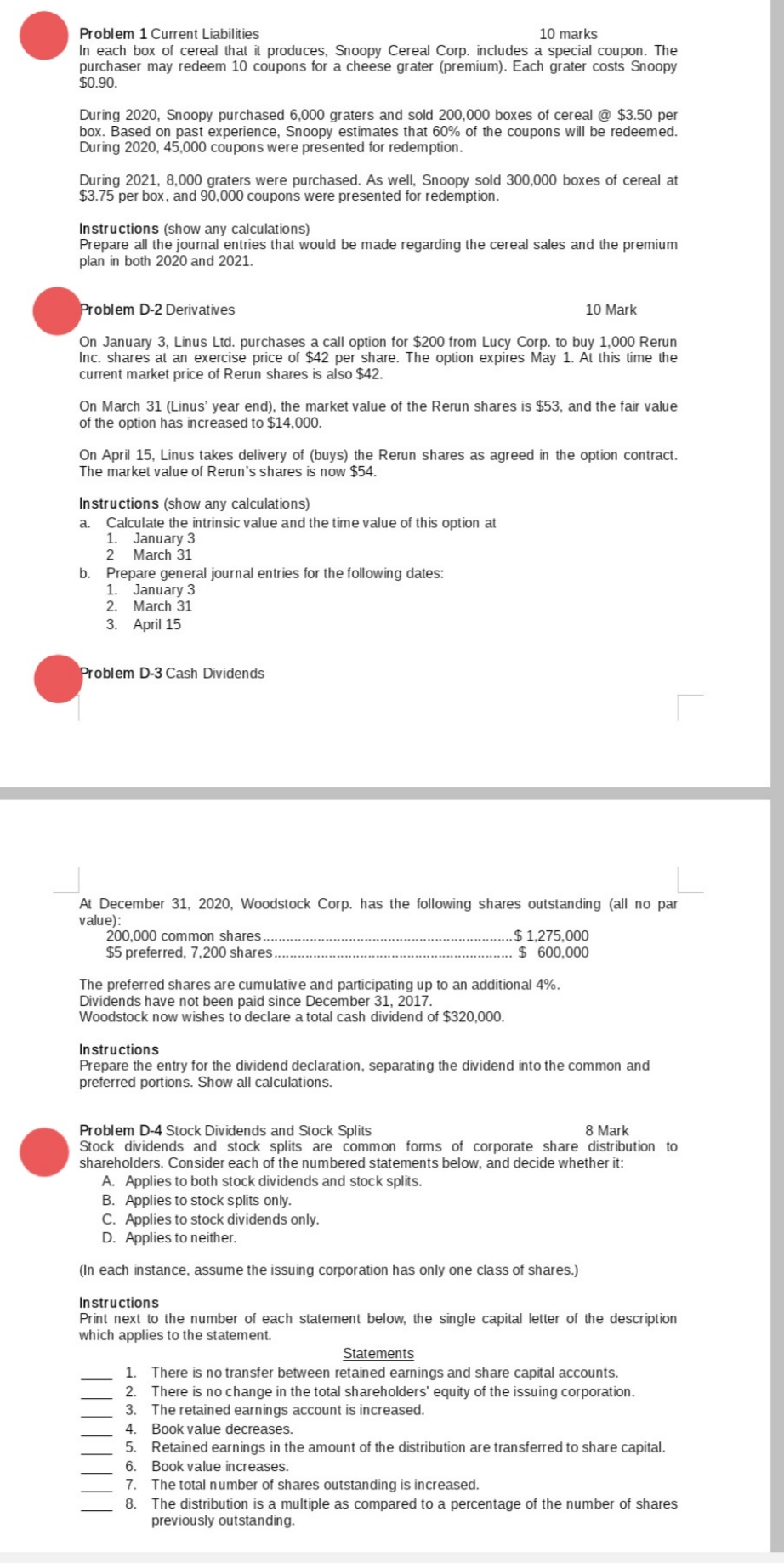

Problem 1 Current Liabilities 10 marks In each box of cereal that it produces, Snoopy Cereal Corp. includes a special coupon. The purchaser may redeem 10 coupons for a cheese grater (premium). Each grater costs Snoopy $0.90. During 2020, Snoopy purchased 6,000 graters and sold 200,000 boxes of cereal @ $3.50 per box. Based on past experience, Snoopy estimates that 60% of the coupons will be redeemed. During 2020, 45,000 coupons were presented for redemption. During 2021, 8,000 graters were purchased. As well, Snoopy sold 300,000 boxes of cereal at $3.75 per box, and 90,000 coupons were presented for redemption. Instructions (show any calculations) Prepare all the journal entries that would be made regarding the cereal sales and the premium plan in both 2020 and 2021. Problem D-2 Derivatives 10 Mark On January 3, Linus Lid. purchases a call option for $200 from Lucy Corp. to buy 1,000 Rerun Inc. shares at an exercise price of $42 per share. The option expires May 1. At this time the current market price of Rerun shares is also $42. On March 31 (Linus' year end), the market value of the Rerun shares is $53, and the fair value of the option has increased to $14,000. On April 15, Linus takes delivery of (buys) the Rerun shares as agreed in the option contract. The market value of Rerun's shares is now $54. Instructions (show any calculations) a. Calculate the intrinsic value and the time value of this option at 1. January 3 2 March 31 b. Prepare general journal entries for the following dates: 1. January 3 2. March 31 3. April 15 Problem D-3 Cash Dividends At December 31, 2020, Woodstock Corp. has the following shares outstanding (all no par value): 200,000 common shares. ...... $ 1,275,000 $5 preferred, 7,200 shares... .. $ 600,000 The preferred shares are cumulative and participating up to an additional 4%. Dividends have not been paid since December 31, 2017. Woodstock now wishes to declare a total cash dividend of $320,000. Instructions Prepare the entry for the dividend declaration, separating the dividend into the common and preferred portions. Show all calculations. Problem D-4 Stock Dividends and Stock Splits 8 Mark Stock dividends and stock splits are common forms of corporate share distribution to shareholders. Consider each of the numbered statements below, and decide whether it: A. Applies to both stock dividends and stock splits. B. Applies to stock splits only. C. Applies to stock dividends only. D. Applies to neither. (In each instance, assume the issuing corporation has only one class of shares.) Instructions Print next to the number of each statement below, the single capital letter of the description which applies to the statement. Statements 1. There is no transfer between retained earnings and share capital accounts. There is no change in the total shareholders' equity of the issuing corporation. The retained earnings account is increased. Book value decreases. Retained earnings in the amount of the distribution are transferred to share capital. 6. Book value increases. 7. The total number of shares outstanding is increased. 8. The distribution is a multiple as compared to a percentage of the number of shares previously outstanding