Intermediate Financial Reporting

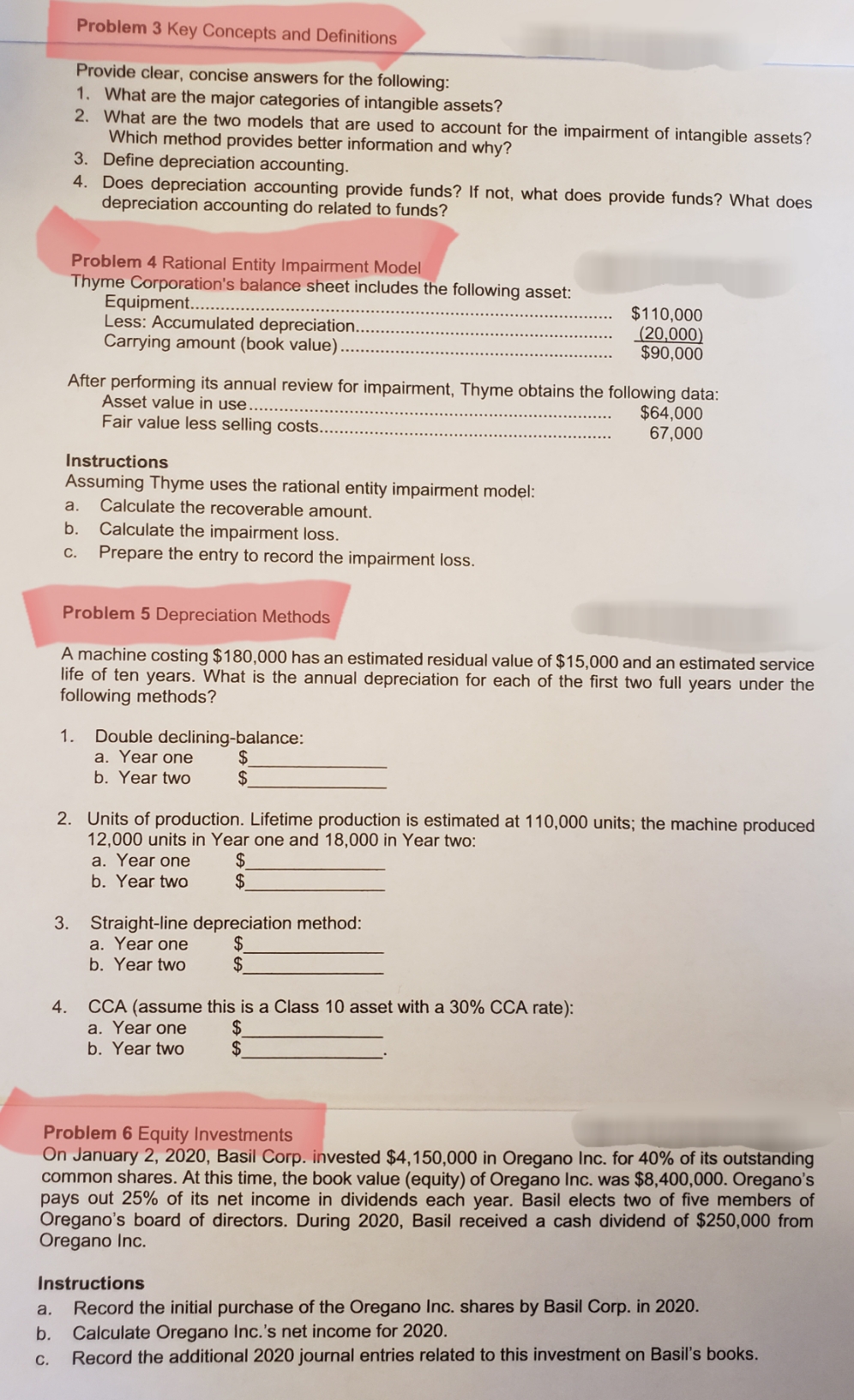

Problem 3 Key Concepts and Definitions Provide clear, concise answers for the following: 1. What are the major categories of intangible assets? 2. What are the two models that are used to account for the impairment of intangible assets? Which method provides better information and why? 3. Define depreciation accounting. 4. Does depreciation accounting provide funds? If not, what does provide funds? What does depreciation accounting do related to funds? Problem 4 Rational Entity Impairment Model Thyme Corporation's balance sheet includes the following asset: Equipment........ $110,000 Less: Accumulated depreciation........ (20,000) Carrying amount (book value) .. $90,000 After performing its annual review for impairment, Thyme obtains the following data: Asset value in use ......... $64,000 Fair value less selling costs....... 67,000 Instructions Assuming Thyme uses the rational entity impairment model: a. Calculate the recoverable amount. b. Calculate the impairment loss. c. Prepare the entry to record the impairment loss. Problem 5 Depreciation Methods A machine costing $180,000 has an estimated residual value of $15,000 and an estimated service life of ten years. What is the annual depreciation for each of the first two full years under the following methods? 1. Double declining-balance: a. Year one b. Year two 2. Units of production. Lifetime production is estimated at 110,000 units; the machine produced 12,000 units in Year one and 18,000 in Year two: a. Year one $_ b. Year two EA 3. Straight-line depreciation method: a. Year one b. Year two 4. CCA (assume this is a Class 10 asset with a 30% CCA rate): a. Year one $_ b. Year two Problem 6 Equity Investments On January 2, 2020, Basil Corp. invested $4, 150,000 in Oregano Inc. for 40% of its outstanding common shares. At this time, the book value (equity) of Oregano Inc. was $8,400,000. Oregano's pays out 25% of its net income in dividends each year. Basil elects two of five members of Oregano's board of directors. During 2020, Basil received a cash dividend of $250,000 from Oregano Inc. Instructions a. Record the initial purchase of the Oregano Inc. shares by Basil Corp. in 2020. b. Calculate Oregano Inc.'s net income for 2020. c. Record the additional 2020 journal entries related to this investment on Basil's books