intermediate Financial Reporting

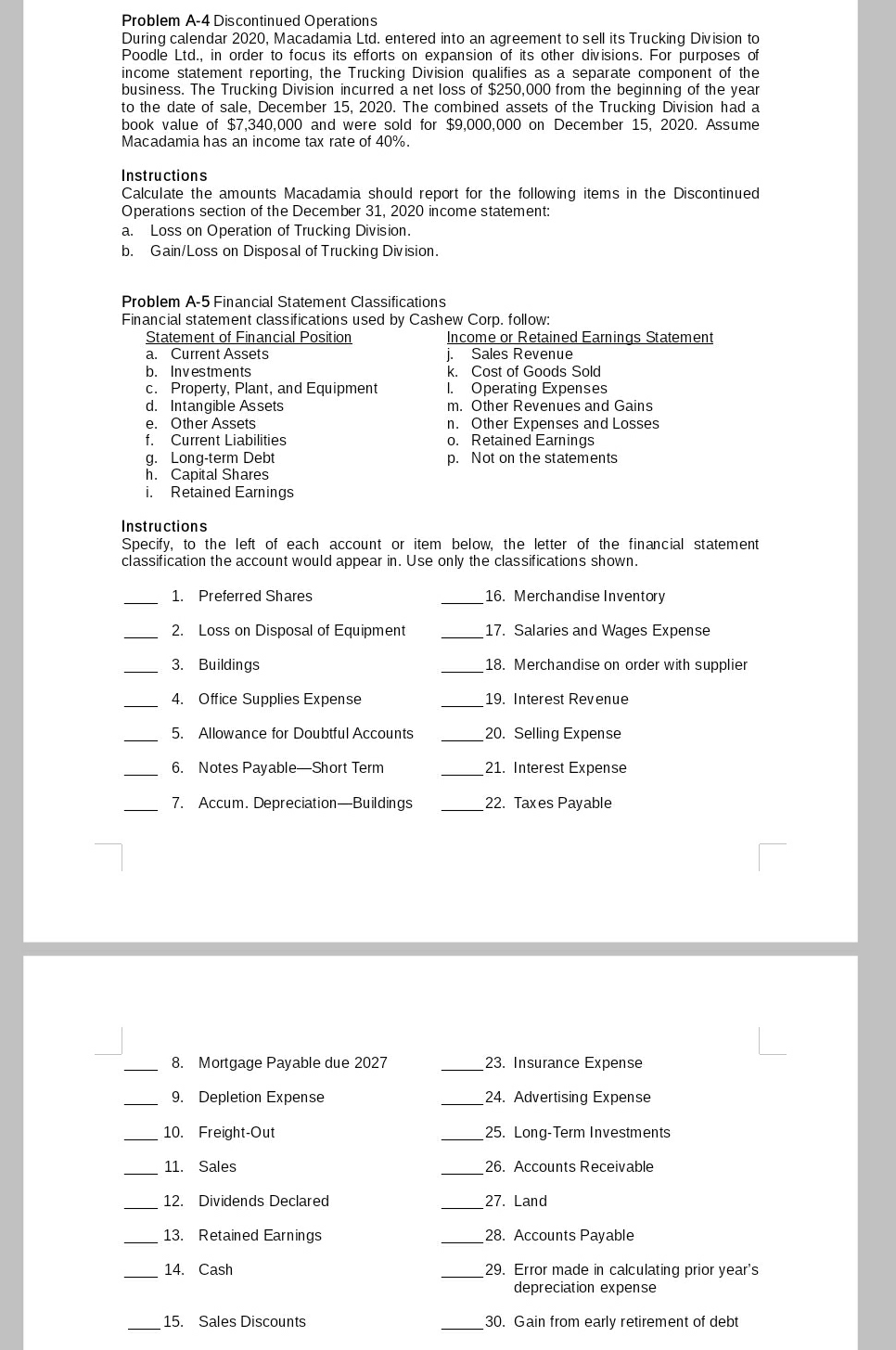

Problem A-4 Discontinued Operations During calendar 2020, Macadamia Ltd. entered into an agreement to sell its Trucking Division to Poodle Ltd., in order to focus its efforts on expansion of its other divisions. For purposes of income statement reporting, the Trucking Division qualifies as a separate component of the business. The Trucking Division incurred a net loss of $250,000 from the beginning of the year to the date of sale, December 15, 2020. The combined assets of the Trucking Division had a book value of $7,340,000 and were sold for $9,000,000 on December 15, 2020. Assume Macadamia has an income tax rate of 40%. Instructions Calculate the amounts Macadamia should report for the following items in the Discontinued Operations section of the December 31, 2020 income statement: a. Loss on Operation of Trucking Division. b. GainlLoss on Disposal of Trucking Division. Problem A-5 Financial Statement Classifications Financial statement classifications used by Cashew Corp. follow: Statement of Financial Position Income or Retained Earnings Statement a. CurrentAssets j. Sales Revenue b. Investments k. Cost of Goods Sold c. Property, Plant, and Equipment |. Operating Expenses d. IntangibleAssets m. Other Revenues and Gains e. OtherAssets n. Other Expenses and Losses f. Current Liabilities o. Retained Earnings 9. Long-term Debt p. Not on the statements h. Capital Shares I. Retained Earnings Instructions Specify, to the left of each account or item below, the letter of the financial statement classification the account would appear in. Use only the classifications shown. _ 1. Preferred Shares _15. Merchandise Inventory _ 2. Loss on Disposal of Equipment _17. Salaries and Wages Expense _ 3. Buildings _18. Merchandise on order with supplier _ 4. Office Supplies Expense _19. Interest Revenue _ 5. Allowance for DoubtfulAccounts _20. Selling Expense _ 6. Notes PayableShort Term _21. Interest Expense _ 7. Accum. DepreciationBuildings _22. Taxes Payable _ 8. Mortgage Payable due 2027 _23. Insurance Expense _ 9. Depletion Expense _24. Advertising Expense _ 10. Freight-Out _25. Long-Term Investments _ 11. Sales _25. Accounts Receivable _ 12. Dividends Declared _27. Land _ 13. Retained Earnings _28. Accounts Payable _ 14. Cash _29. Error made in calculating prior year's depreciation expense 15. Sales Discounts 30. Gain from early retirement of debt