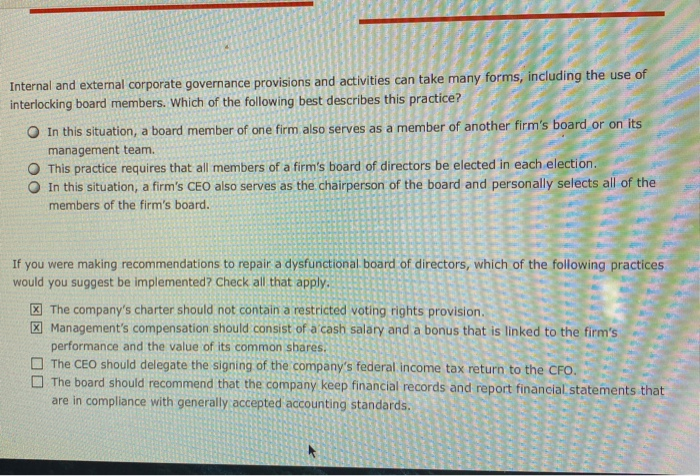

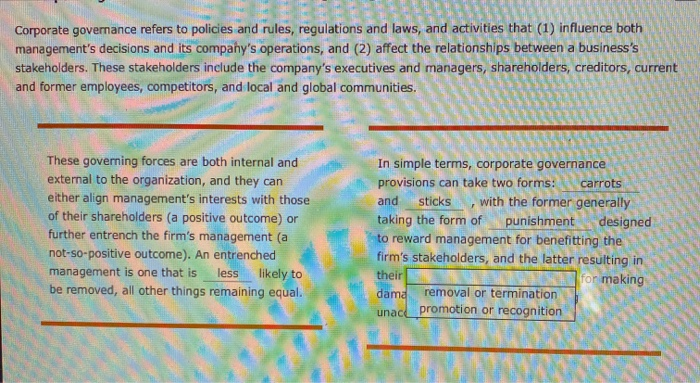

Internal and external corporate governance provisions and activities can take many forms, including the use of interlocking board members. Which of the following best describes this practice? In this situation, a board member of one firm also serves as a member of another firm's board or on its management team. This practice requires that all members of a firm's board of directors be elected in each election. In this situation, a firm's CEO also serves as the chairperson of the board and personally selects all of the members of the firm's board. If you were making recommendations to repair a dysfunctional board of directors, which of the following practices would you suggest be implemented? Check all that apply. X The company's charter should not contain a restricted voting rights provision X Management's compensation should consist of a cash salary and a bonus that is linked to the firm's performance and the value of its common shares. The CEO should delegate the signing of the company's federal income tax return to the CFO. The board should recommend that the company keep financial records and report financial statements that are in compliance with generally accepted accounting standards. LS Corporate governance refers to policies and rules, regulations and laws, and activities that (1) influence both management's decisions and its company's operations, and (2) affect the relationships between a business's stakeholders. These stakeholders include the company's executives and managers, shareholders, creditors, current and former employees, competitors, and local and global communities. These governing forces are both internal and external to the organization, and they can either align management's interests with those of their shareholders (a positive outcome) or further entrench the firm's management (a not-so-positive outcome). An entrenched management is one that is less likely to be removed, all other things remaining equal. In simple terms, corporate governance provisions can take two forms: carrots and sticks , with the former generally taking the form of punishment designed to reward management for benefitting the firm's stakeholders, and the latter resulting in their for making dama removal or termination unac promotion or recognition