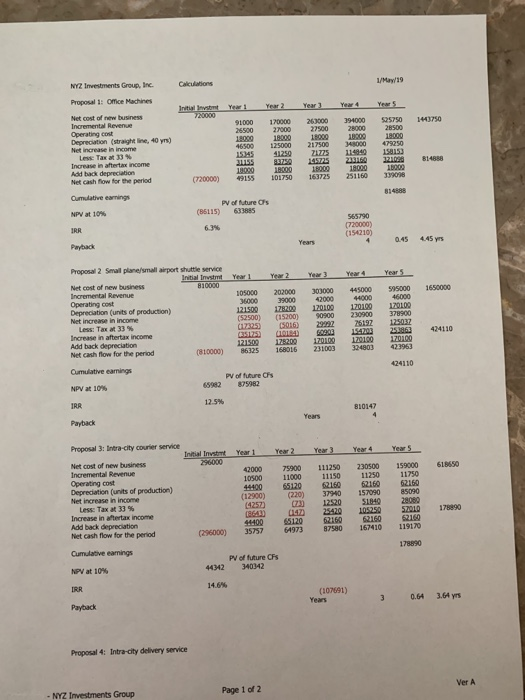

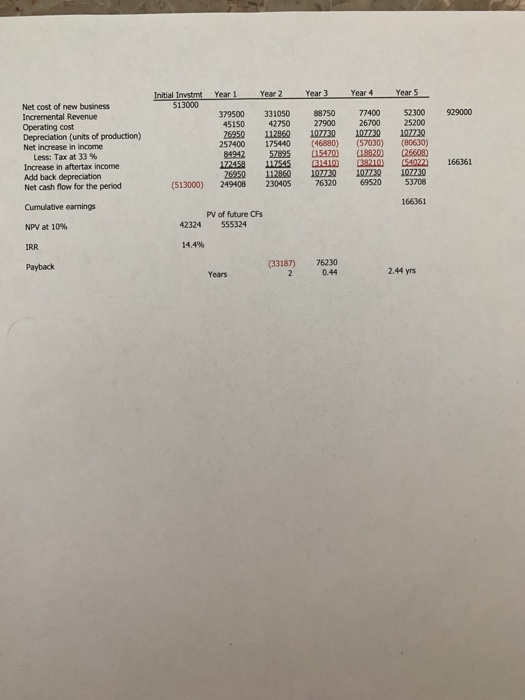

Internal rate of return (IRR) Net present value (NPV) She was famillar with the techniques (she really wished she had given more attention to the capital budgeting techniques and rationale covered in her finance courses in her graduate degree program, but was reasonably confident that she could explain them clearly). She was more concerned that none of these would appeal to Ray, who had always been focused on accumulated earnings (increase in aftertax income). She had tried to convince Ray that the net present value method was the best approach, but Ray did not understand it and called it "mumbo-jumbo" and "hocus-pocus" finance. She nevertheless prepared her analysis and felt assured that she could convince the executive management group which project would be in the firm's best interest and create the most value, and that Ray would listen to others if her presentation was clear and concise. The calculations are presented in an attachment (spreadsheet) for your review and use. 1. Ray Johns admittedly focused on the level of earnings, and particularly the increase in aftertax ncome of each project (proposal). Which proposal do you think Ray wil be focused on, and provide reasons for your answer The first method Rebecca is to present is the payback technique. See the computations in the attachment (spreadsheet), and note the how PB is approximated using the proportion of the year to the nearest decimal place (i.e., 3.4 years). a. Which proposal should they select, given the requirements for the payback method? b. 2. What are the primary disadvantages of this method, and why might it be appealing to an untrained investor? 3. The next method Rebecca presented is the net present value (NPV) technique. Review the NPV calculated in the spreadsheet for each proposal and rank the proposals. Which proposal should be selected, based on the ranking? 4. The next method in her presentation is the internal rate of return (IRR). Rank the projects on the basis of their IRR's in the attached spreadsheet. a. Which proposal should they select, based on the criteria of IRR? b. What are the primary disadvantages of using the IRR method? C. If there were an unlimited capital budget, which projects should XYZ invest in, based on the IRR criteria? d. If any are to be excluded, why? 5. Do the IRR and NPV methods reject the same proposals? Discuss briefly. Given the limitations and recommendations from academicians, which proposal should you choose, and why? 6. Page NYZ Investments Group, Inc.Cakculations Proposal : Ofice Machines Net cost of new business Incremental Revenue Operating cost Depreciation (straight line, 40 yrs) 91000 170000 263000 394000 $25750 1443750 26500 27000 27500 28000 28500 18009 1000 1000 1800 18000 NS00 125000 217500 00 479250 1525 1250 1775 114 158153 31155 87 45725 2310 321028 814888 100 18000 18000 100 1000 9155 101750 163725 251160 39098 Less: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period (720000) Cumulative earming NPV at 10% IRR PV of fluture O's (85115) 633885 63% (720000) (154210) 4 0.45 445 y Proposal 2 Small plane/small airpert shuttle service 3 Year 4 Year 2 Year Year1 Yar Net cost of new business Incremental Revenue Operating cost 810000 105000 202000 303000 45000 595000 1650000 36000 39000 42000 121500 17820 12000 170100 120100 (52500) (15200) 90900 230900 378900 (17325) (06) 2929 2619 125032 35125) 3154203 2586 424110 121500 18200 120100 10100 17000 Net increase in income las: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period 810000) 86325 168016 231003 324803 23963 Cumulative earnings NPV at 10% IRR 424110 PV of future CFs 65982 875982 125% 810147 Proposal 3: Intra-city courier service Invstmt Year1 Year2 Year 3 Yer4 Year 5 296000 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in 42000 75900 111 230500 19000 618650 10500 11000 11150 11250 11750 400 65120 62160 60 62160 (12900) (220) 37940 15709085090 Z3) 12520 51840 28080 Less: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period (8EA) 047 25420 105250 52010 178890 44400 120 62100 160 sus (296000) 35757 64973 87580 167410 119170 Cumulative earnings PV of future CFs wvat 10% 44342 340342 14.6% (107691) 3 0.64 3.64 yrs Proposal 4: Intra-city delivery service - NYZ Investments Group Page 1 of 2 Initial Invstmt Year 1 Year2 Year 3 Year 4 Year 5 513000 Net cost of new business Incremental Revenue Operating cost Depreciation (units of production) Net increase in income 379500 331050 88750 77400 52300 929000 45150 42750 27900 26700 25200 6950 112860 107730 10773 197720 257400 175440 (46880) (57030) (80630) 84942 57895 (5470) (1820 (26608) Less: Tax at 33 % Increase in aftertax income Add back depreciation Net cash flow for the period 3210 5402 166361 172458 11545 26950 112860 1077 1077 107730 (513000) 249408 23040S 76320 69520 53708 Cumulative earnings PV of future CFs 42324 555324 NPV at 10% 14,4% (33187) 76230 0.44 2.44 yrs Years