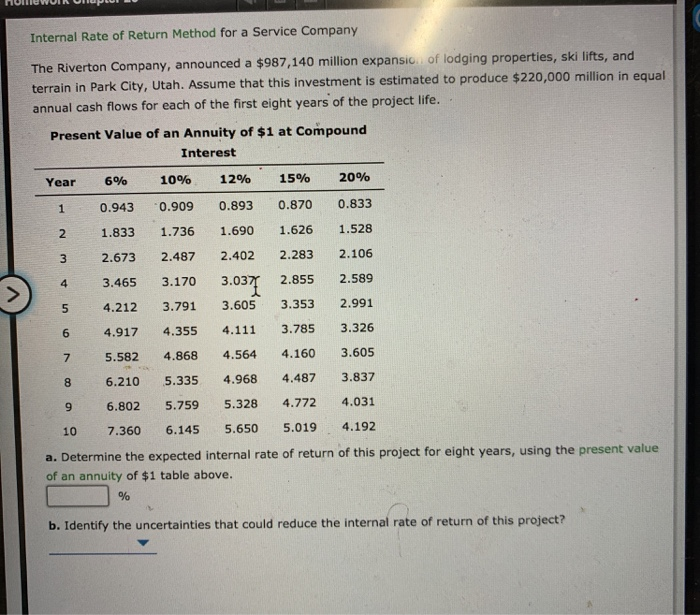

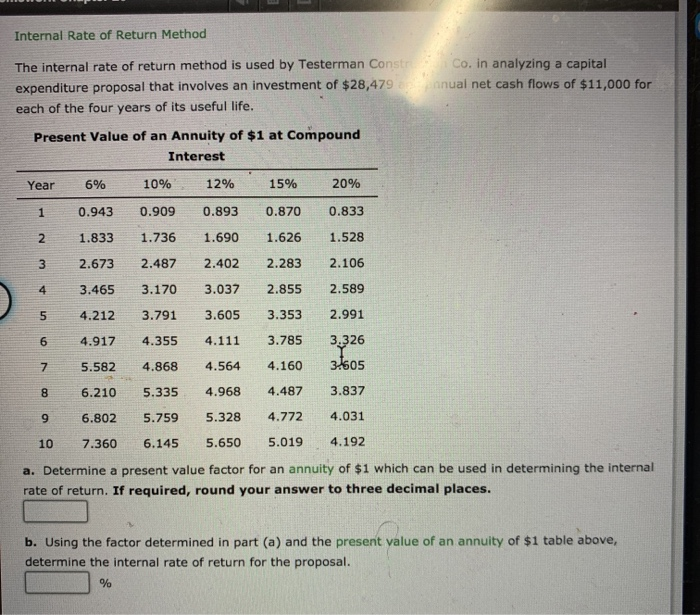

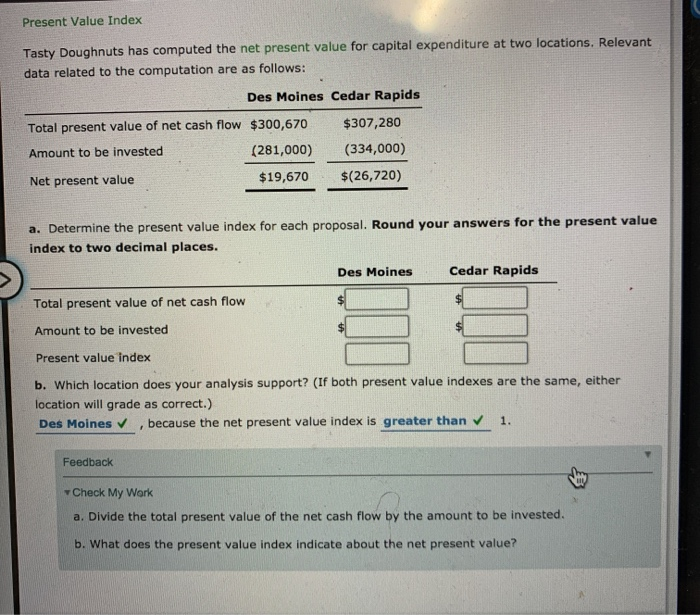

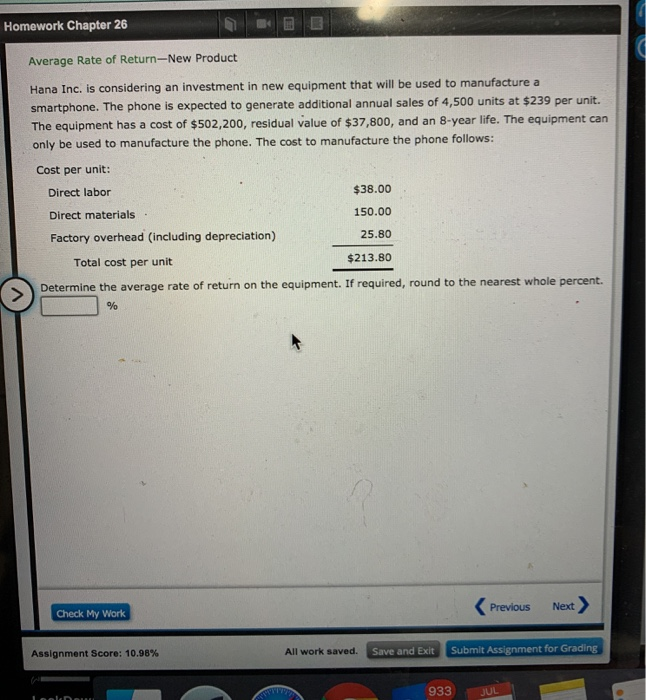

Internal Rate of Return Method for a Service Company The Riverton Company, announced a $987,140 million expansio of lodging properties, ski lifts, and terrain in Park City, Utah. Assume that this investment is estimated to produce $220,000 million in equal annual cash flows for each of the first eight years of the project life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine the expected internal rate of return of this project for eight years, using the present value of an annuity of $1 table above. % b. Identify the uncertainties that could reduce the internal rate of return of this project? Internal Rate of Return Method The internal rate of return method is used by Testerman Constru Co. in analyzing a capital expenditure proposal that involves an investment of $28,479 janual net cash flows of $11,000 for each of the four years of its useful life. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.505 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. Determine a present value factor for an annuity of $1 which can be used in determining the internal rate of return. If required, round your answer to three decimal places. b. Using the factor determined in part (a) and the present value of an annuity of $1 table above, determine the internal rate of return for the proposal. % Present Value Index Tasty Doughnuts has computed the net present value for capital expenditure at two locations. Relevant data related to the computation are as follows: Des Moines Cedar Rapids Total present value of net cash flow $300,670 Amount to be invested (281,000) $307,280 (334,000) $(26,720) Net present value $19,670 a. Determine the present value index for each proposal. Round your answers for the present value index to two decimal places. Des Moines Cedar Rapids $ Total present value of net cash flow Amount to be invested $ Present value index b. Which location does your analysis support? (If both present value indexes are the same, either location will grade as correct.) Des Moines because the net present value index is greater than 1. Feedback Check My Work a. Divide the total present value of the net cash flow by the amount to be invested. b. What does the present value index indicate about the net present value? Homework Chapter 26 Average Rate of Return-New Product Hana Inc. is considering an investment in new equipment that will be used to manufacture a smartphone. The phone is expected to generate additional annual sales of 4,500 units at $239 per unit. The equipment has a cost of $502,200, residual value of $37,800, and an 8-year life. The equipment can only be used to manufacture the phone. The cost to manufacture the phone follows: Cost per unit: Direct labor $38.00 Direct materials 150.00 25.80 Factory overhead (including depreciation) Total cost per unit $213.80 Determine the average rate of return on the equipment. If required, round to the nearest whole percent. % Check My Work Assignment Score: 10.98% All work saved. Save and Exit Submit Assignment for Grading 933 JUL