Answered step by step

Verified Expert Solution

Question

1 Approved Answer

International Accounting Standard (IAS) 5 relates to Information to be Disclosed in the Financial Statements. Being a member of the International Accounting Standard Committee, India

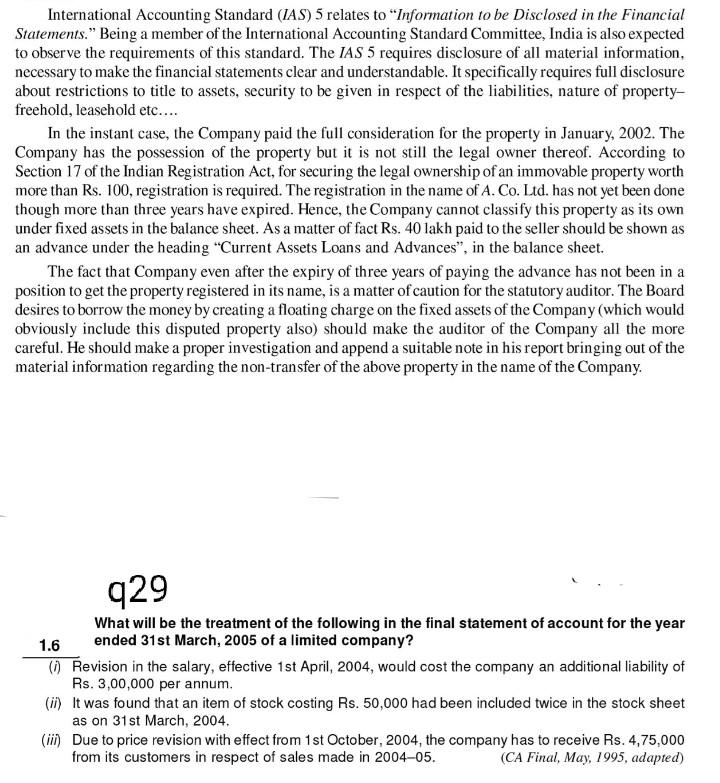

International Accounting Standard (IAS) 5 relates to "Information to be Disclosed in the Financial Statements." Being a member of the International Accounting Standard Committee, India is also expected to observe the requirements of this standard. The IAS 5 requires disclosure of all material information, necessary to make the financial statements clear and understandable. It specifically requires full disclosure about restrictions to title to assets, security to be given in respect of the liabilities, nature of property- freehold, leasehold etc.... In the instant case, the Company paid the full consideration for the property in January, 2002. The Company has the possession of the property but it is not still the legal owner thereof. According to Section 17 of the Indian Registration Act, for securing the legal ownership of an immovable property worth more than Rs. 100, registration is required. The registration in the name of A. Co. Ltd. has not yet been done though more than three years have expired. Hence, the Company cannot classify this property as its own under fixed assets in the balance sheet. As a matter of fact Rs. 40 lakh paid to the seller should be shown as an advance under the heading "Current Assets Loans and Advances", in the balance sheet. The fact that Company even after the expiry of three years of paying the advance has not been in a position to get the property registered in its name, is a matter of caution for the statutory auditor. The Board desires to borrow the money by creating a floating charge on the fixed assets of the Company (which would obviously include this disputed property also) should make the auditor of the Company all the more careful. He should make a proper investigation and append a suitable note in his report bringing out of the material information regarding the non-transfer of the above property in the name of the Company. 929 What will be the treatment of the following in the final statement of account for the year 1.6 ended 31st March, 2005 of a limited company? () Revision in the salary, effective 1st April, 2004, would cost the company an additional liability of Rs. 3,00,000 per annum. (ii) It was found that an item of stock costing Rs. 50,000 had been included twice in the stock sheet as on 31st March, 2004. (iii) Due to price revision with effect from 1st October, 2004, the company has to receive Rs. 4,75,000 from its customers in respect of sales made in 200405. (CA Final, May, 1995, adapted)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started