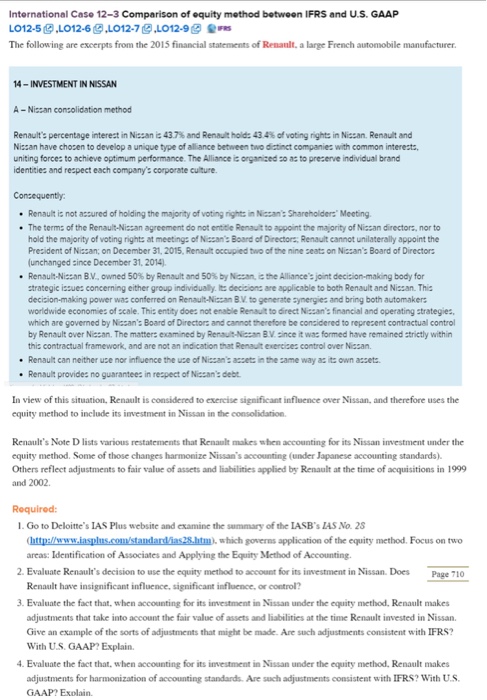

International Case 12-3 Comparison of equity method between IFRS and U.S. GAAP LO12-5@LO12-6@LO12-7 @LO12-9@eRS The following are excerpts from the 2015 financial statements of Renault, a large French automobile manufacturer. 14-INVESTMENT IN NISSAN A - Niccan concolidation method Renault's percentage interest in Nissan 43.7% and Renault holds 43 4% of voting nghtin Nissan Renault and Nizcan have chozen to develop a unique type of aliance between two dictinct companies with common interezts, uniting forces to achieve optimum performance The Alliance organaedao ac to preserve individual brand identities and respect each company': corporate culture Concequently Renault ic not accured of holding the majority of voting rights in Niccan: Shareholder: Meeting The termz of the Renault-Niczan agreement do not entitie Renault to appoint the majority of Niccan directors, nor to hold the majority of voting rights at meetings of Niccan Board of Directora, Renault cannot unilaterally appoint the Prezident of Nicsan; on December 31, 2015, Renault occupied two of the nine zeats on Nicsans Board of Directors unchanged zince December 31, 2014) Renault-Nissan BV, owned 50% by Renault and 50% by Netan,the Alliance's jort decision-making body for ctrategic izzue: concerning either group individually. Its decisions are applicable to both Renault and Niszan. Thic decizion-making power wac conferred on Renault-Niccan B.V to generate cynergies and bring both automaker worldwide economies of scale. Thiz entity does not enable Renault to direct Niczans financial and operating strategie: which are governed by Niccan': Board of Directors and cannot therefore be considered to reprezent contractual control by Rensult over Niccan. The matters examined by Renault-Niccan B.V cince it wa formed have remained ctrietly within thi: contractual framework, and are not an nication that Renault exereses control over san. Renault can neither use nor influence the use of Nissan: asset:the same way as its own assets. * . Renault provide: no guarantee: in respect of Niccan: debe In view of this situation, Renault is considered to exercise significant influence over Nissan, and therefore uses the equity method to include its investment in Nissan in the consolidation Renault's Note D lists various restatements that Renault makes when accounting for its Nissan investment under the equity method. Some of those changes harmonize Nissans accounting (under Japanese accounting standards). Others reflect adjustments to fair value of assets and liabilities applied by Renault at the time of acquisitions in 1999 and 2002. Required: I. Go to Deloitte's IAS Plus website and examine the summary of the IASB's IAS No. 2s which governs application of the equity method. Focus on two areas: Identification of Associates and Applying the Equity Method of Accounting. 2 Evaluate Renault's decision to use the equity method to account for its investment in Nissan Does Page 710 Renault have insignificant influence, significant influence, or control? 3. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments that take into account the fair value of assets and liabilities at the time Renault invested in Nissan. Give an example of the sorts of adjustments that might be made. Are such adjustments consistent with IFRS? With U.S. GAAP? Explain. 4. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments for harmonization of accounting standards. Are such adjustments consistent with IFRS? With U.S GAAP? Exolain. International Case 12-3 Comparison of equity method between IFRS and U.S. GAAP LO12-5@LO12-6@LO12-7 @LO12-9@eRS The following are excerpts from the 2015 financial statements of Renault, a large French automobile manufacturer. 14-INVESTMENT IN NISSAN A - Niccan concolidation method Renault's percentage interest in Nissan 43.7% and Renault holds 43 4% of voting nghtin Nissan Renault and Nizcan have chozen to develop a unique type of aliance between two dictinct companies with common interezts, uniting forces to achieve optimum performance The Alliance organaedao ac to preserve individual brand identities and respect each company': corporate culture Concequently Renault ic not accured of holding the majority of voting rights in Niccan: Shareholder: Meeting The termz of the Renault-Niczan agreement do not entitie Renault to appoint the majority of Niccan directors, nor to hold the majority of voting rights at meetings of Niccan Board of Directora, Renault cannot unilaterally appoint the Prezident of Nicsan; on December 31, 2015, Renault occupied two of the nine zeats on Nicsans Board of Directors unchanged zince December 31, 2014) Renault-Nissan BV, owned 50% by Renault and 50% by Netan,the Alliance's jort decision-making body for ctrategic izzue: concerning either group individually. Its decisions are applicable to both Renault and Niszan. Thic decizion-making power wac conferred on Renault-Niccan B.V to generate cynergies and bring both automaker worldwide economies of scale. Thiz entity does not enable Renault to direct Niczans financial and operating strategie: which are governed by Niccan': Board of Directors and cannot therefore be considered to reprezent contractual control by Rensult over Niccan. The matters examined by Renault-Niccan B.V cince it wa formed have remained ctrietly within thi: contractual framework, and are not an nication that Renault exereses control over san. Renault can neither use nor influence the use of Nissan: asset:the same way as its own assets. * . Renault provide: no guarantee: in respect of Niccan: debe In view of this situation, Renault is considered to exercise significant influence over Nissan, and therefore uses the equity method to include its investment in Nissan in the consolidation Renault's Note D lists various restatements that Renault makes when accounting for its Nissan investment under the equity method. Some of those changes harmonize Nissans accounting (under Japanese accounting standards). Others reflect adjustments to fair value of assets and liabilities applied by Renault at the time of acquisitions in 1999 and 2002. Required: I. Go to Deloitte's IAS Plus website and examine the summary of the IASB's IAS No. 2s which governs application of the equity method. Focus on two areas: Identification of Associates and Applying the Equity Method of Accounting. 2 Evaluate Renault's decision to use the equity method to account for its investment in Nissan Does Page 710 Renault have insignificant influence, significant influence, or control? 3. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments that take into account the fair value of assets and liabilities at the time Renault invested in Nissan. Give an example of the sorts of adjustments that might be made. Are such adjustments consistent with IFRS? With U.S. GAAP? Explain. 4. Evaluate the fact that, when accounting for its investment in Nissan under the equity method, Renault makes adjustments for harmonization of accounting standards. Are such adjustments consistent with IFRS? With U.S GAAP? Exolain