Answered step by step

Verified Expert Solution

Question

1 Approved Answer

International Finance help 1. (Based on FT 17.1 - External Wealth Changes) Answer the following questions on the changes in External Wealth (use the equations

International Finance help

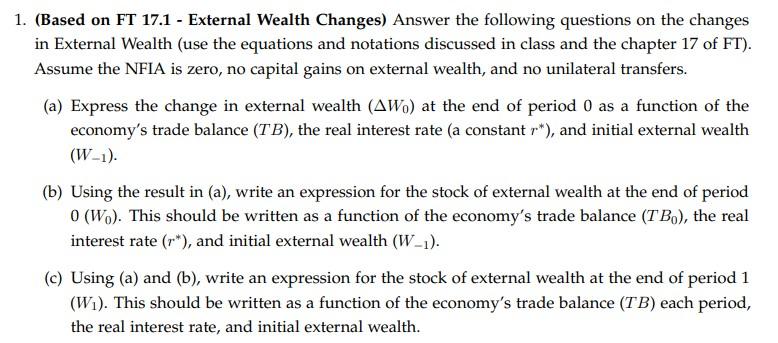

1. (Based on FT 17.1 - External Wealth Changes) Answer the following questions on the changes in External Wealth (use the equations and notations discussed in class and the chapter 17 of FT). Assume the NFIA is zero, no capital gains on external wealth, and no unilateral transfers. (a) Express the change in external wealth (W0) at the end of period 0 as a function of the economy's trade balance (TB), the real interest rate (a constant r ), and initial external wealth (W1) (b) Using the result in (a), write an expression for the stock of external wealth at the end of period 0(W0). This should be written as a function of the economy's trade balance (TB0), the real interest rate (r), and initial external wealth (W1). (c) Using (a) and (b), write an expression for the stock of external wealth at the end of period 1 (W1). This should be written as a function of the economy's trade balance (TB) each period, the real interest rate, and initial external wealth. 1. (Based on FT 17.1 - External Wealth Changes) Answer the following questions on the changes in External Wealth (use the equations and notations discussed in class and the chapter 17 of FT). Assume the NFIA is zero, no capital gains on external wealth, and no unilateral transfers. (a) Express the change in external wealth (W0) at the end of period 0 as a function of the economy's trade balance (TB), the real interest rate (a constant r ), and initial external wealth (W1) (b) Using the result in (a), write an expression for the stock of external wealth at the end of period 0(W0). This should be written as a function of the economy's trade balance (TB0), the real interest rate (r), and initial external wealth (W1). (c) Using (a) and (b), write an expression for the stock of external wealth at the end of period 1 (W1). This should be written as a function of the economy's trade balance (TB) each period, the real interest rate, and initial external wealthStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started