Question

International Tennis (IT) is a vertically integrated full-service tennis corporation. It produces tennis equipment, including nets, lights, balls, and racquets under the IT brand, selling

International Tennis (IT) is a vertically integrated full-service tennis corporation. It produces tennis equipment, including nets, lights, balls, and racquets under the IT brand, selling them in the wholesale market. It also promotes and manages tennis tournaments in the U.S. and Europe. It has three wholly-owned entities – the headquarters based in New York, the production facility located in Guangzhou, China and one tournament sales organization located in London. 2021 has been a challenging year. Performance measurement for all entities has always been done using the Balanced Scorecard (BSC) approach, with all entities having the same measures. Guangzhou and London management are both questioning the validity of the BSC in the current environment. The President of IT, Chris Everest, is on a Zoom call with Le Federar from London and Tom Murray from Guangzhou, regarding the measurements for 2021.Chris: We need to review the second quarter scorecards. I see all operations are still below budget, and we reduced the budgets by a sizable amount due to the pandemic. What’s going on? Are the measurements below target due to the pandemic or do we have operational issues? I am worried about the second half of the year. What is the message to our shareholders? Our stock has dropped in price and the stock market has done well. What measurements need to be on the scorecard to access how we are doing in this Covid environment? What measures can we use in the last two quarters to incentivize our employees to work to improve profits during this time?

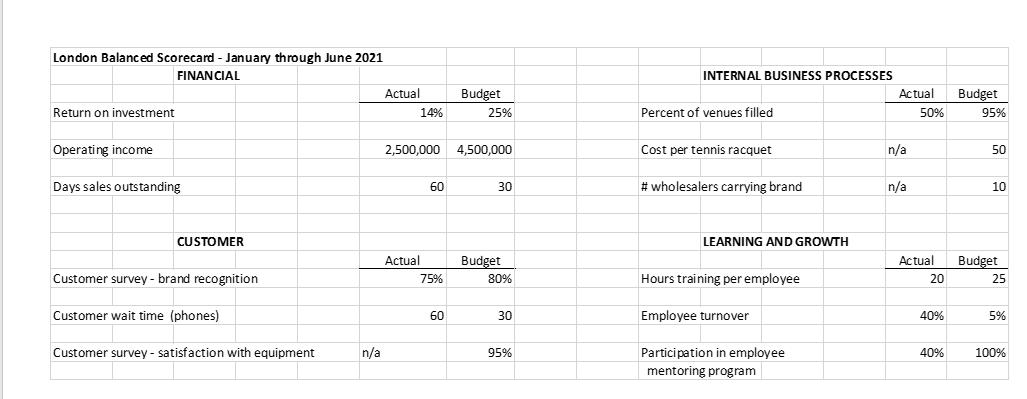

Le: First of all, I never liked all of us having the same measurements. My organization is a sales force – we are a revenue center. Why do we have these high-level metrics like return on investment, when our job is to promote tournaments? All the measurements don’t even apply to us! And, tennis tournaments were only allowed to have reduced capacity this year, which we did not anticipate. My cost of sales is all fixed costs; we have the rental of the stadiums, the payments to the athletes and my selling expenses represent both fixed and variable costs. How is that shown on this scorecard? Our sales force is working just as hard and the demand is there, but we are not allowed to sell more tickets. Perhaps we could reduce some advertising. We need more specific measures for our organization that reflects what we do and the fact that the Delta variant is rampant in Europe. My employees look at this scorecard and have no idea what they should be doing currently, as our normal operations are greatly diminished. This new Delta variant is really affecting my operations. Chris: We are all in the same boat, so to speak. We all answer to the same shareholders, those of IT. That’s why we have the same measures; we’ve discussed this so many times Le. But I agree that we need a change. Let’s come up with new measurements that are more specific to your business but also conducive to corporate profits. Tom: I agree with Le. Our issues are production related; we are a cost center. ROI is a good measurement, but not specific enough for us. Our issue is the availability of supplies and workforce; the demand is there for us, but I can’t hire enough workers. I currently have 50 open positions! Also, the supply chain just cannot deliver enough goods on time. I am paying my workers to literally wait for the aluminum to arrive so they can work on the racquets. These issues show

indirectly in ROI, but not specifically in any measures. We need a specific scorecard for our business only reflecting our geographic challenges and strengths and our specific mission. And somehow we need to reflect the challenges due to Covid. Chris: Well, perhaps it’s a good time to rethink the measurements on the balanced scorecard. I heard the USF Cost 2 class is an expert in Balanced Scorecard. Let’s hire them as consultants.

REQUIRED:

1) Examine the current Balanced Scorecard. What is good about it? What needs improvement? Write a one paragraph memo to Chris with your thoughts.

2) Produce a revised balanced scorecard for the entire entity (IT Consolidated) and one other entity; you can choose China or London. Each quadrant should have 3 measurements. Explain why you chose each measurement. You will not necessarily have the numbers for each key performance indicator; that information would need to come from the company. Make sure the China/London scorecard reflects their challenges.

WORKBOOK SET UP:

3) Set up an excel workbook with 3 tabs(1) Comments to Chris regarding existing Balanced Scorecard (requirement 1)(2) Revised scorecard – New York (total entity). Include a short reason for each measure below the scorecard.(3) Same as (2) for your choice of China or London. Please be detailed about how your choice of measurement will help their employees understand the unique goals of that entity.

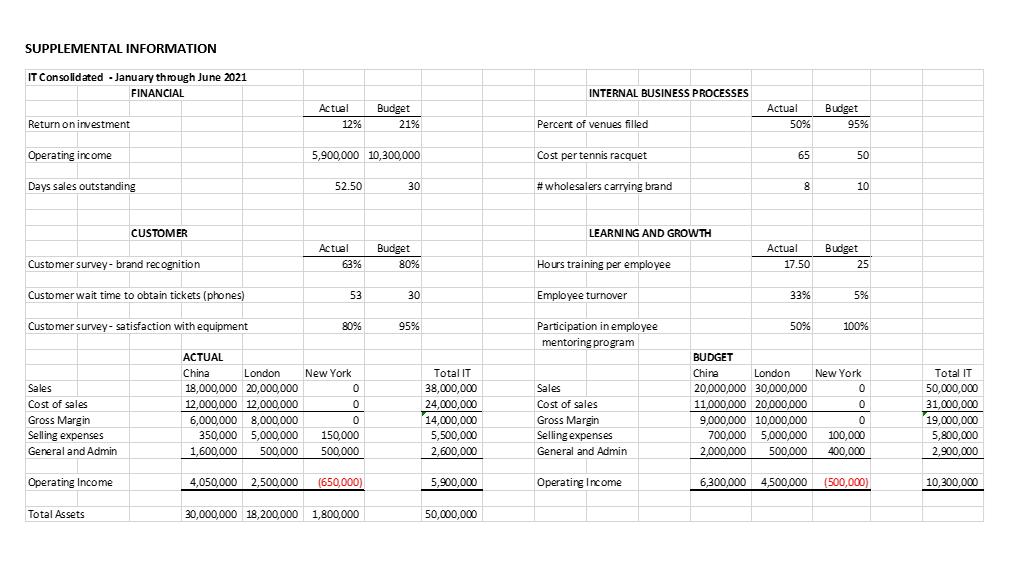

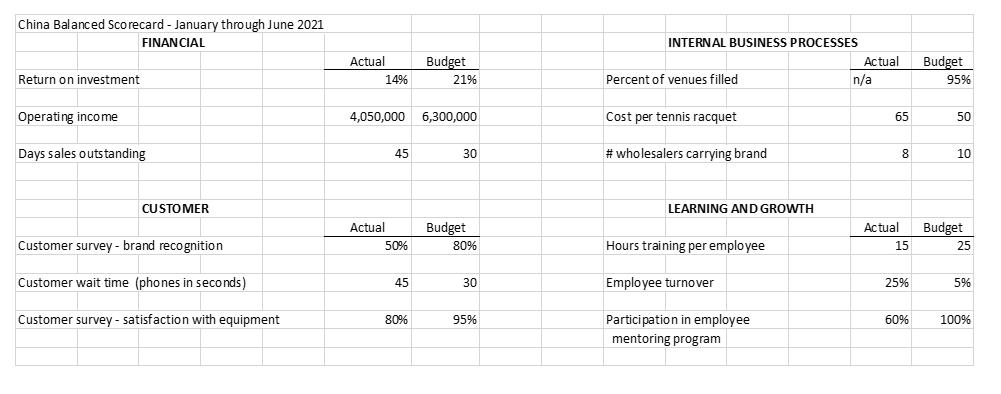

SUPPLEMENTAL INFORMATION IT Consolidated January through June 2021 FINANCIAL Return on investment Operating income Days sales outstanding Customer survey-brand recognition Customer wait time to obtain tickets (phones) Customer survey- satisfaction with equipment Sales Cost of sales Gross Margin Selling expenses General and Admin Operating Income CUSTOMER Total Assets Actual 12% 52.50 5,900,000 10,300,000 Actual 63% 53 80% ACTUAL China London 18,000,000 20,000,000 12,000,000 12,000,000 6,000,000 8,000,000 350,000 5,000,000 150,000 1,600,000 500,000 500,000 4,050,000 2,500,000 (650,000) New York 0 0 0 Budget 30,000,000 18,200,000 1,800,000 21% 30 Budget 80% 30 95% Total IT 38,000,000 24,000,000 14,000,000 5,500,000 2,600,000 5,900,000 50,000,000 INTERNAL BUSINESS PROCESSES Percent of venues filled Cost per tennis racquet #wholesalers carrying brand LEARNING AND GROWTH Hours training per employee Employee turnover Participation in employee mentoring program Sales Cost of sales Gross Margin Selling expenses General and Admin Operating Income Actual 50% Actual 65 8 17.50 33% 50% BUDGET China London 20,000,000 30,000,000 11,000,000 20,000,000 9,000,000 10,000,000 Budget 95% 50 10 Budget 25 5% 100% New York 0 0 0 700,000 5,000,000 100,000 2,000,000 500,000 400.000 6,300,000 4,500,000 (500,000) Total IT 50,000,000 31,000,000 19,000,000 5,800,000 2,900,000 10,300,000

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

To Chris Everest President of International Tennis Subject Review of Current Balanced Scorecard Dear Chris After examining the current Balanced Scorec...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started