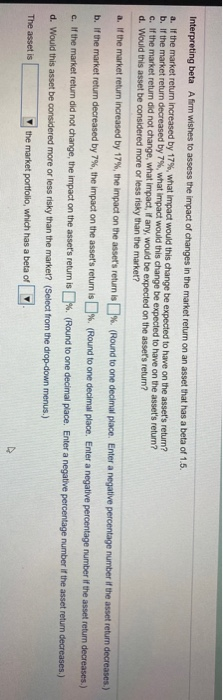

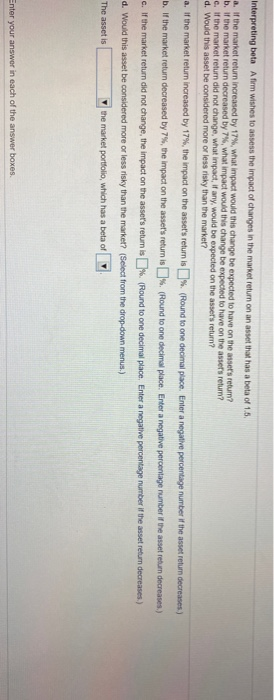

Interpreting beta Afirm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.5. a. If the market return increased by 17%, what impact would this change be expected to have on the asset's return? b. If the market return decreased by 7%, what impact would this change be expected to have on the asset's return? c. If the market return did not change, what impact, if any, would be expected on the asser's return? d. Would this asset be considered more or less risky than the market? a. If the market return increased by 17%, the impact on the asset's return is %. (Round to one decimal place. Enter a negative percentage number if the asset return decreases.) b. If the market return decreased by 7%, the impact on the asset's return is %. (Round to one decimal place. Enter a negative percentage number if the asset return decreases.) c. If the market return did not change, the impact on the asset's return is %. (Round to one decimal place. Enter a negative percentage number if the asset retum decreases.) d. Would this asset be considered more or less risky than the market? (Select from the drop-down menus.) The asset is the market portfolio, which has a beta of Interpreting beta Afirm wishes to assess the impact of changes in the market return on an asset that has a beta of 1.5 a. If the market return increased by 17%, what impact would this change be expected to have on the asser's return? b. If the market return decreased by 7%, what impact would this change be expected to have on the assets return? e. If the market return did not change, what impact, if any, would be expected on the asser's return? d. Would this asset be considered more or less risky than the market? a. If the market return increased by 17%, the impact on the asset's return is % (Round to one decimal place. Enter a negative percentage number if the asset retum decreases) b. If the market return decreased by 7%, the impact on the asset's retumis % (Round to one decimal place. Enter a negative percentage number if the asset retum decreases.) c. If the market return did not change, the impact on the asset's return is %. (Round to one decimal place. Enter a negative percentage number if the asset return decreases) d. Would this asset be considered more or less risky than the market? (Select from the drop-down menus.) The asset is the market portfolio, which has a beta of v Enter your answer in each of the answer boxes