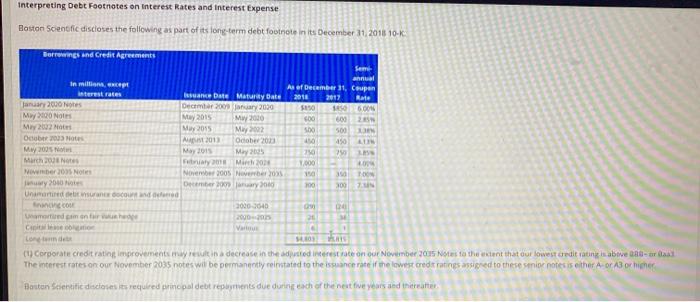

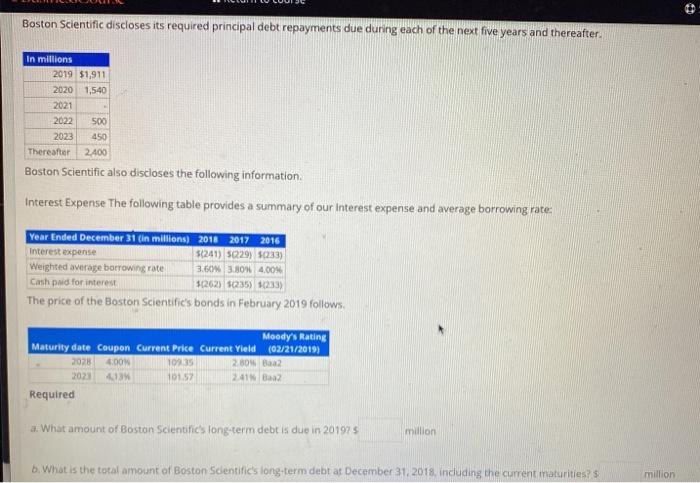

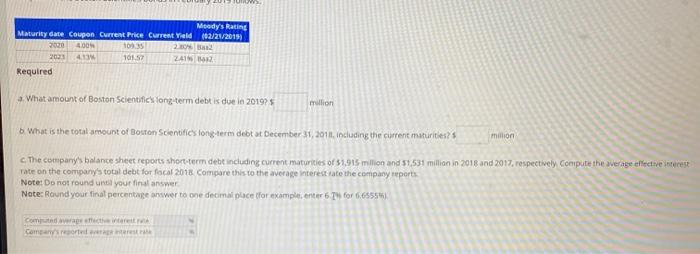

Interpreting Debt Footnotes on interest Rates and interest Expense Boston Scientific discloses the following as part of its long-term debt footnote in its December 11 2016 10- Borrowings and Credit Agreements in millions et interest rates January 2000 Notes My NO May 2002 Odoo May 2005 March wwmber Nolies 2010 United Countdown accou momento C Sem annual As of December 11, Coupon sance Date My Date 2018 2017 December 2009 2030 6.000 May 2015 May 2010 500 600 May 2015 May 2002 500 A 2013 Odober 2013 450 450 May 2005 190 20 Mi 1.000 NOV 2005 November 190 TON December 2000 100 300 UN 2000-3040 2 VE (1) Corporate credit rating improvements may result in a decrease in the adjusted interest rate on our November 2005 Notes to the extent that our lowest credit rating is above straat The interest rates on our November 2035 notes will be permanently reinstated to the issuance rate if the lowest credit ratings assigned to these senior notes is either A or 3 or higher Barton Scientific decises is required princadet repayments due during each of the next five years and thereafter Boston Scientific discloses its required principal debt repayments due during each of the next five years and thereafter. In millions 2019 $1,911 2020 1,540 2021 2022 500 2023 450 Thereafter 2.400 Boston Scientific also discloses the following information. Interest Expense The following table provides a summary of our interest expense and average borrowing rate: Year Ended December 31 (in millions) 2018 2017 2016 Interest expense 56241) 50229) 5033) Weighted average borrowing rate 3.60 3.80 4.00% Cash paid for interest 26251235) 233) The price of the Boston Scientific's bonds in February 2019 follows Moody's Rating Maturity date Coupon Current Price Current Yield (02/21/2019) 2078 4.00 109.35 2009 Baaz 202343 10152 2411 Baaz Required a. What amount of Boston Scientific's long-term debt is due in 201975 million b. What is the total amount of Boston Scientific long-term debt at December 31, 2018, induding the current maturities? million w Moody's Rating Maturity date Coupon Current Price Current Yield (92/21/2017 2020 4.00 103.35 2012 2023 411 101.5 ZAIN Required 3. What amount of Boston Scientific long-term debt is duelo 20197 million b. What is the total amount of Boston Scientifies long-term debt at December 31, 2011. Including the current maturities? million c. The company's balance sheet reports short-term debt including current maturities of 1,915 million and 51,531 million in 2018 and 2017, respectively Compute the average effective interest rate on the company's total debt for facal 2016 Compare this to the average interest rate the company reports Note: Do not round until you find answer Nate: Round your tinat percentage answer to one docmai place for example, enter 6 Tu for 6,68554) Company recorders Interpreting Debt Footnotes on interest Rates and interest Expense Boston Scientific discloses the following as part of its long-term debt footnote in its December 11 2016 10- Borrowings and Credit Agreements in millions et interest rates January 2000 Notes My NO May 2002 Odoo May 2005 March wwmber Nolies 2010 United Countdown accou momento C Sem annual As of December 11, Coupon sance Date My Date 2018 2017 December 2009 2030 6.000 May 2015 May 2010 500 600 May 2015 May 2002 500 A 2013 Odober 2013 450 450 May 2005 190 20 Mi 1.000 NOV 2005 November 190 TON December 2000 100 300 UN 2000-3040 2 VE (1) Corporate credit rating improvements may result in a decrease in the adjusted interest rate on our November 2005 Notes to the extent that our lowest credit rating is above straat The interest rates on our November 2035 notes will be permanently reinstated to the issuance rate if the lowest credit ratings assigned to these senior notes is either A or 3 or higher Barton Scientific decises is required princadet repayments due during each of the next five years and thereafter Boston Scientific discloses its required principal debt repayments due during each of the next five years and thereafter. In millions 2019 $1,911 2020 1,540 2021 2022 500 2023 450 Thereafter 2.400 Boston Scientific also discloses the following information. Interest Expense The following table provides a summary of our interest expense and average borrowing rate: Year Ended December 31 (in millions) 2018 2017 2016 Interest expense 56241) 50229) 5033) Weighted average borrowing rate 3.60 3.80 4.00% Cash paid for interest 26251235) 233) The price of the Boston Scientific's bonds in February 2019 follows Moody's Rating Maturity date Coupon Current Price Current Yield (02/21/2019) 2078 4.00 109.35 2009 Baaz 202343 10152 2411 Baaz Required a. What amount of Boston Scientific's long-term debt is due in 201975 million b. What is the total amount of Boston Scientific long-term debt at December 31, 2018, induding the current maturities? million w Moody's Rating Maturity date Coupon Current Price Current Yield (92/21/2017 2020 4.00 103.35 2012 2023 411 101.5 ZAIN Required 3. What amount of Boston Scientific long-term debt is duelo 20197 million b. What is the total amount of Boston Scientifies long-term debt at December 31, 2011. Including the current maturities? million c. The company's balance sheet reports short-term debt including current maturities of 1,915 million and 51,531 million in 2018 and 2017, respectively Compute the average effective interest rate on the company's total debt for facal 2016 Compare this to the average interest rate the company reports Note: Do not round until you find answer Nate: Round your tinat percentage answer to one docmai place for example, enter 6 Tu for 6,68554) Company recorders