Answered step by step

Verified Expert Solution

Question

1 Approved Answer

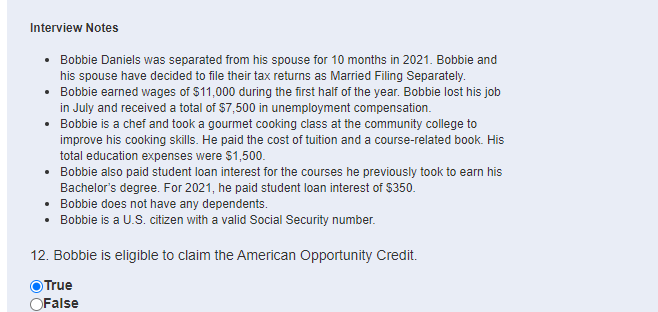

Interview Notes Bobbie Daniels was separated from his spouse for 10 months in 2021. Bobbie and his spouse have decided to file their tax

Interview Notes Bobbie Daniels was separated from his spouse for 10 months in 2021. Bobbie and his spouse have decided to file their tax returns as Married Filing Separately. Bobbie earned wages of $11,000 during the first half of the year. Bobbie lost his job in July and received a total of $7,500 in unemployment compensation. Bobbie is a chef and took a gourmet cooking class at the community college to improve his cooking skills. He paid the cost of tuition and a course-related book. His total education expenses were $1,500. Bobbie also paid student loan interest for the courses he previously took to earn his Bachelor's degree. For 2021, he paid student loan interest of $350. Bobbie does not have any dependents. Bobbie is a U.S. citizen with a valid Social Security number. 12. Bobbie is eligible to claim the American Opportunity Credit. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started