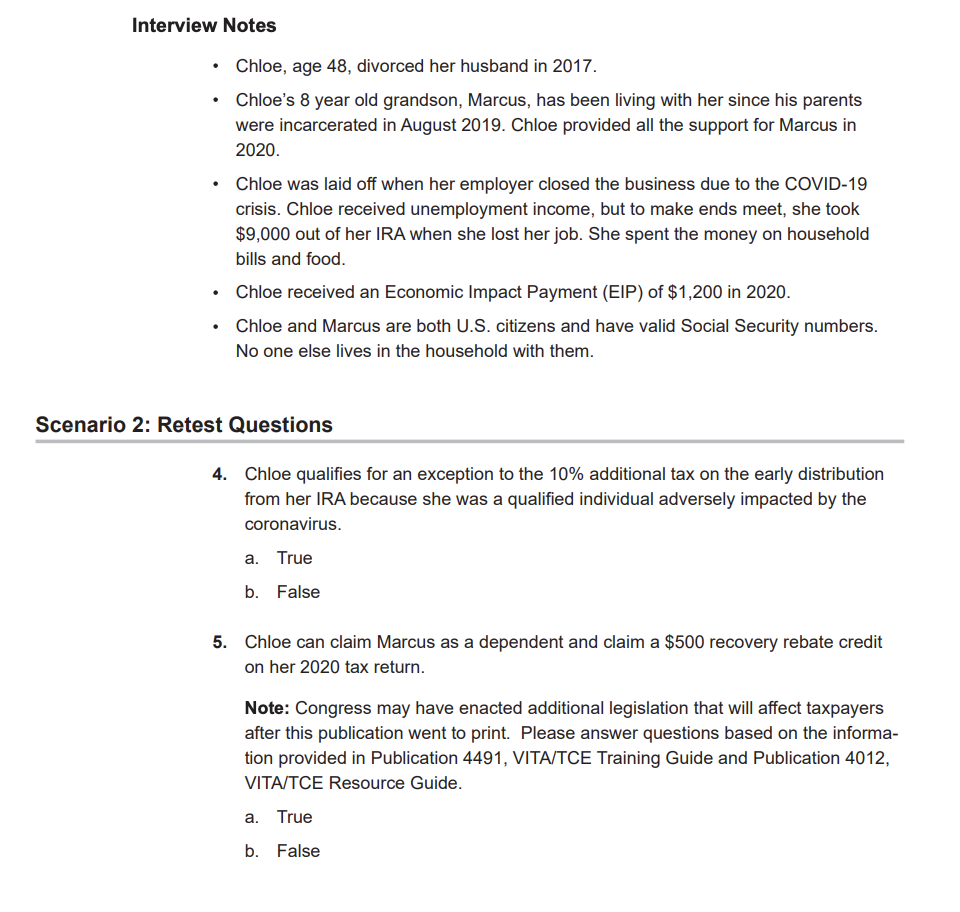

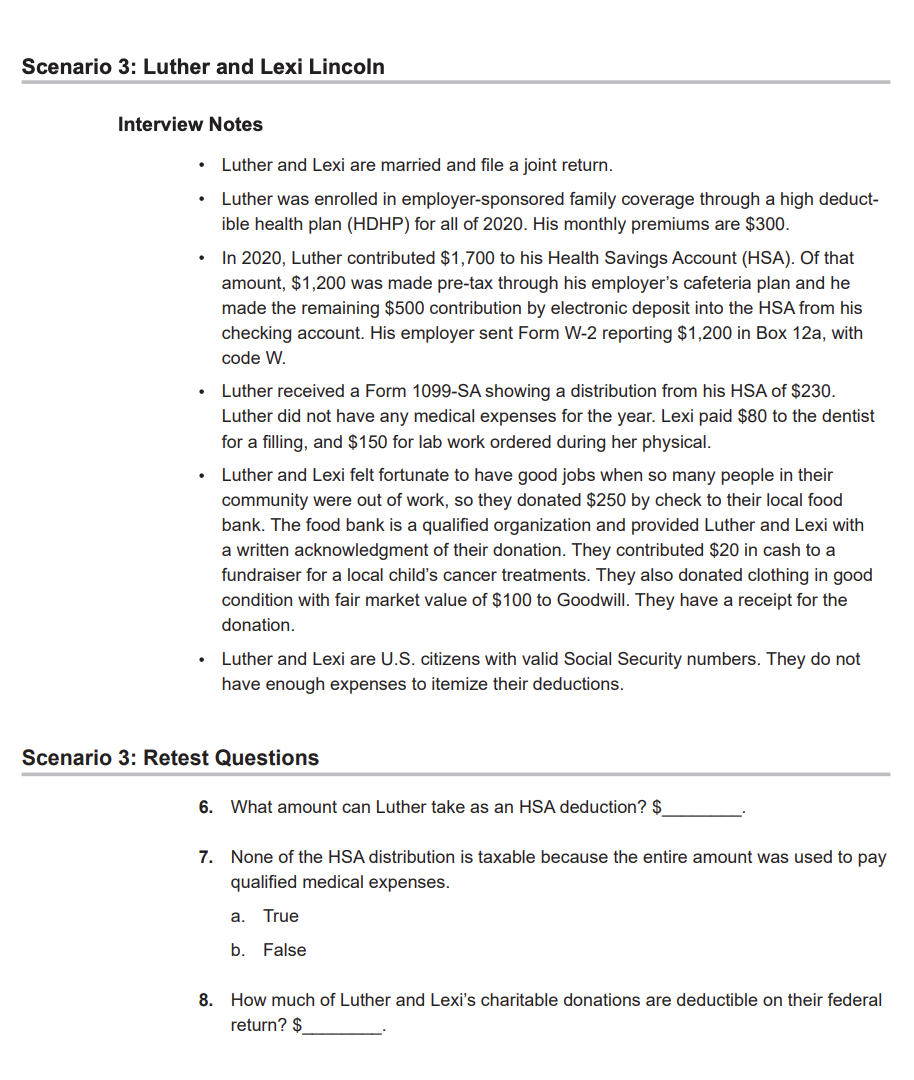

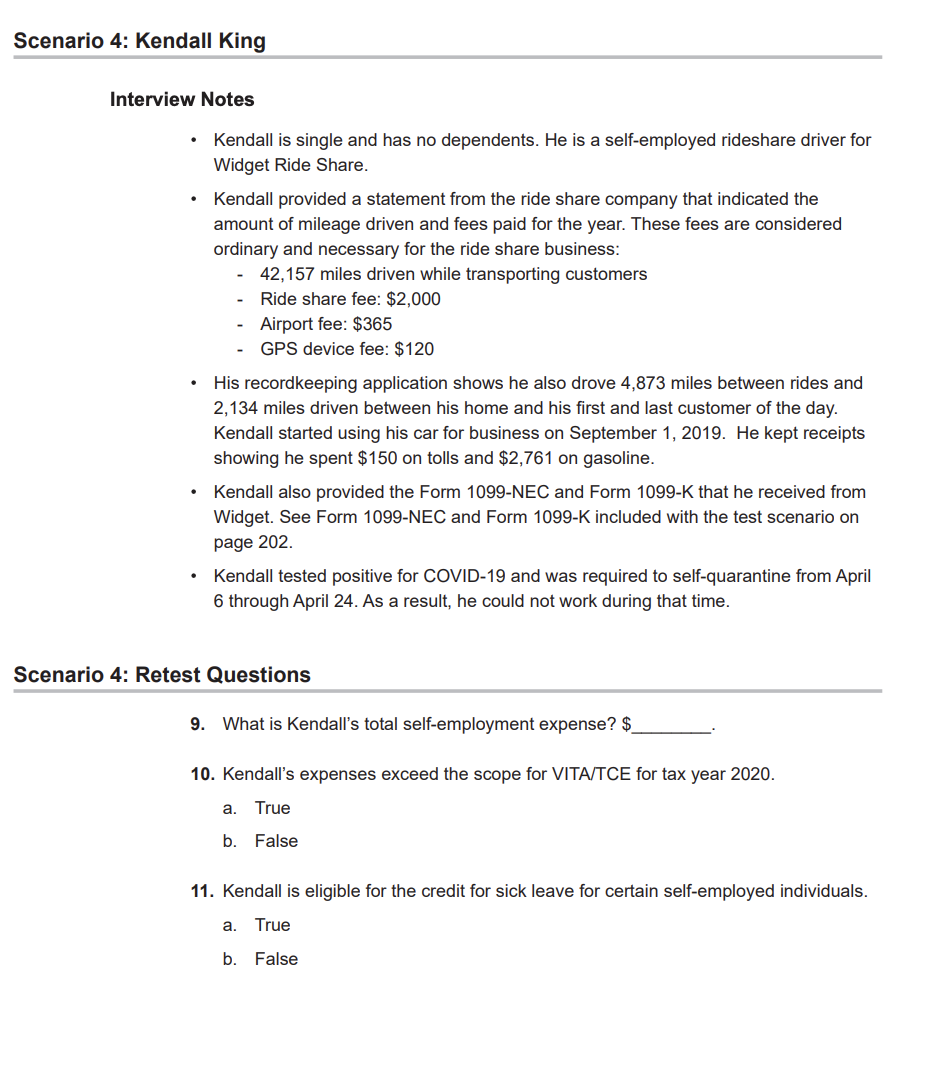

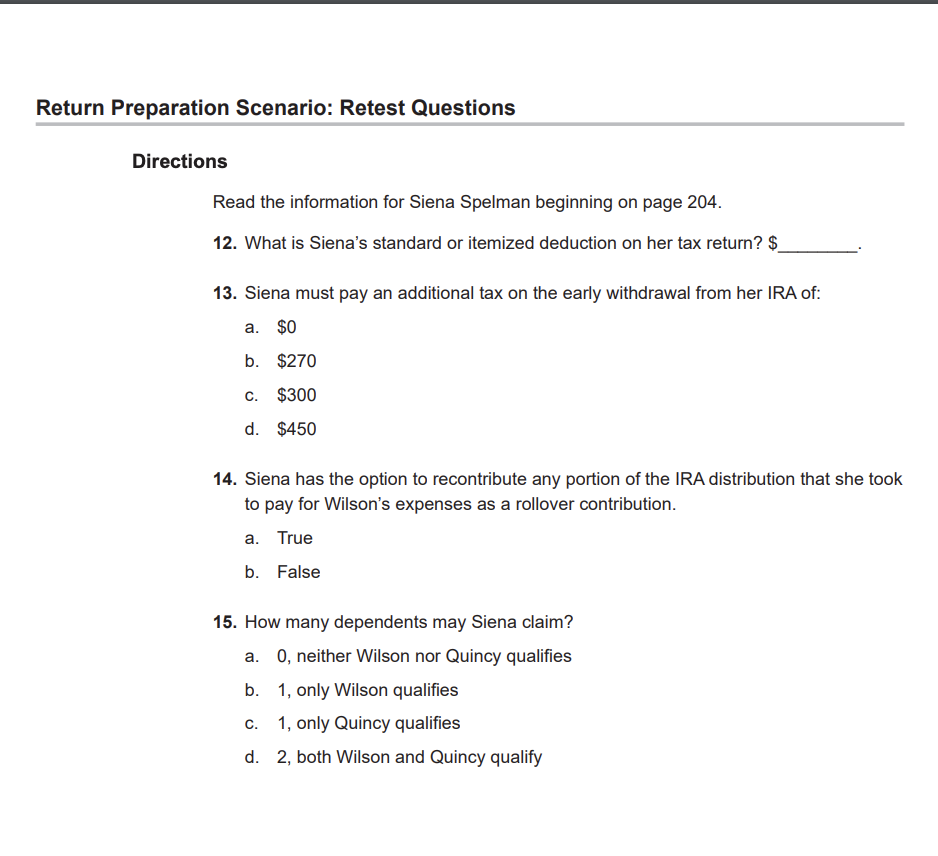

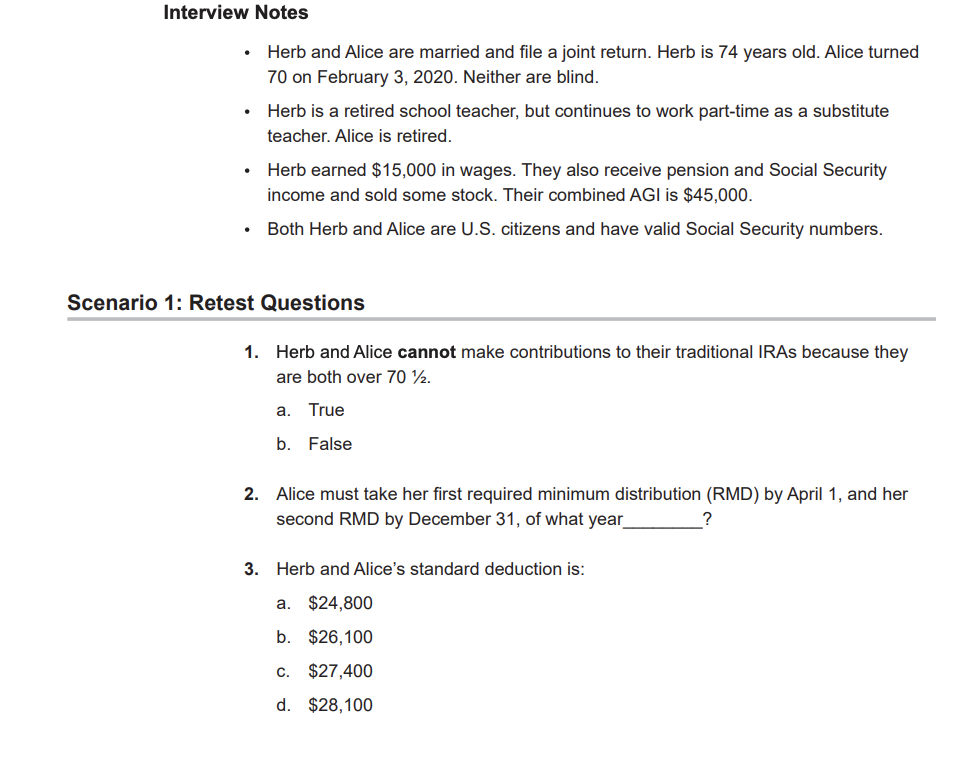

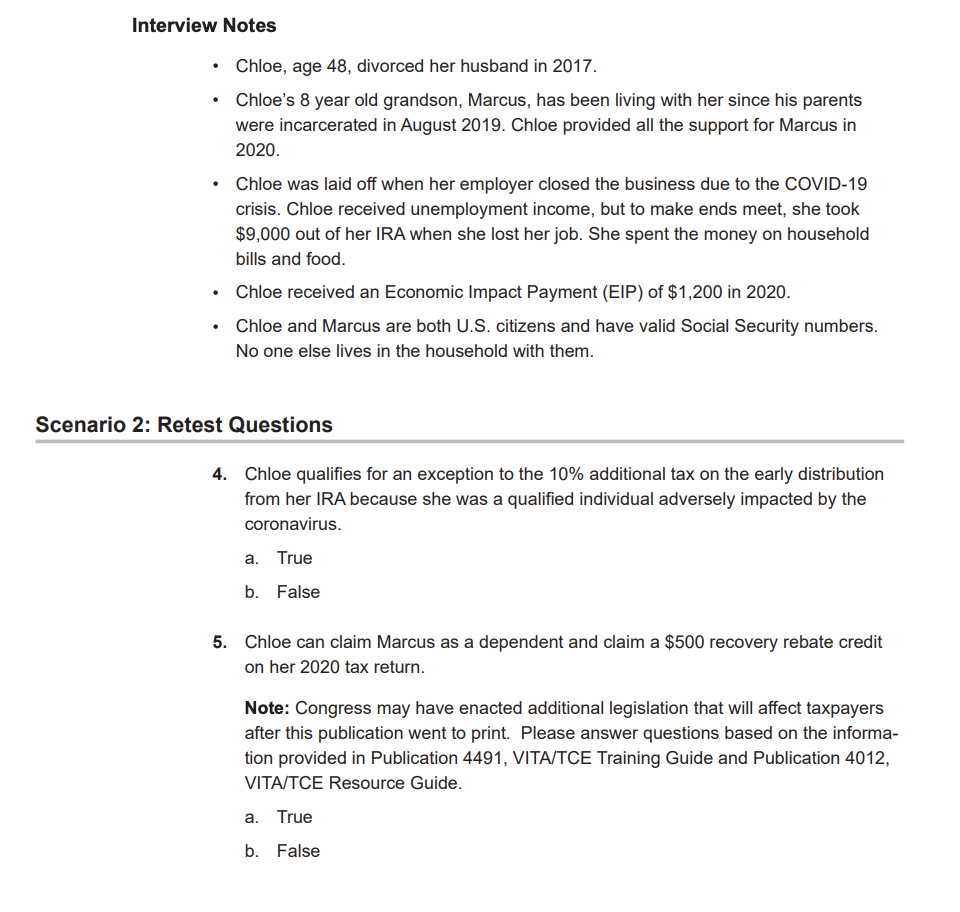

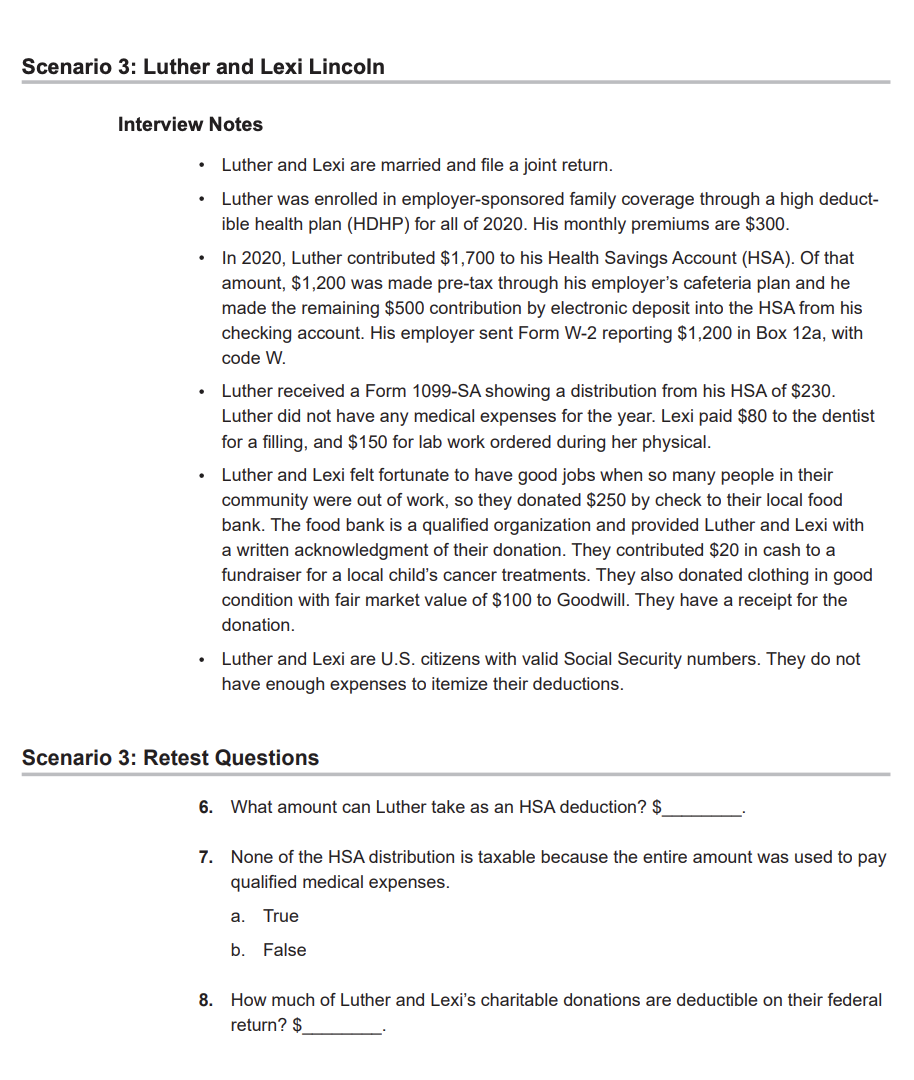

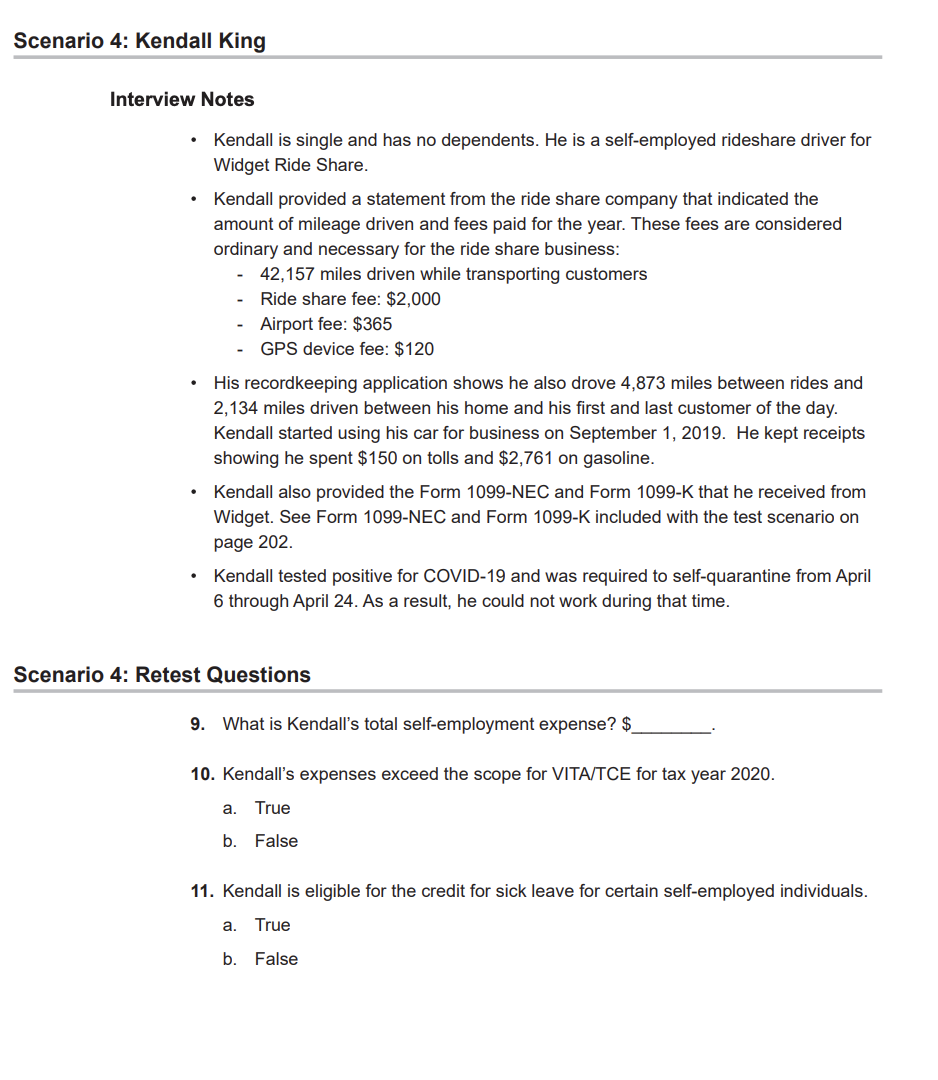

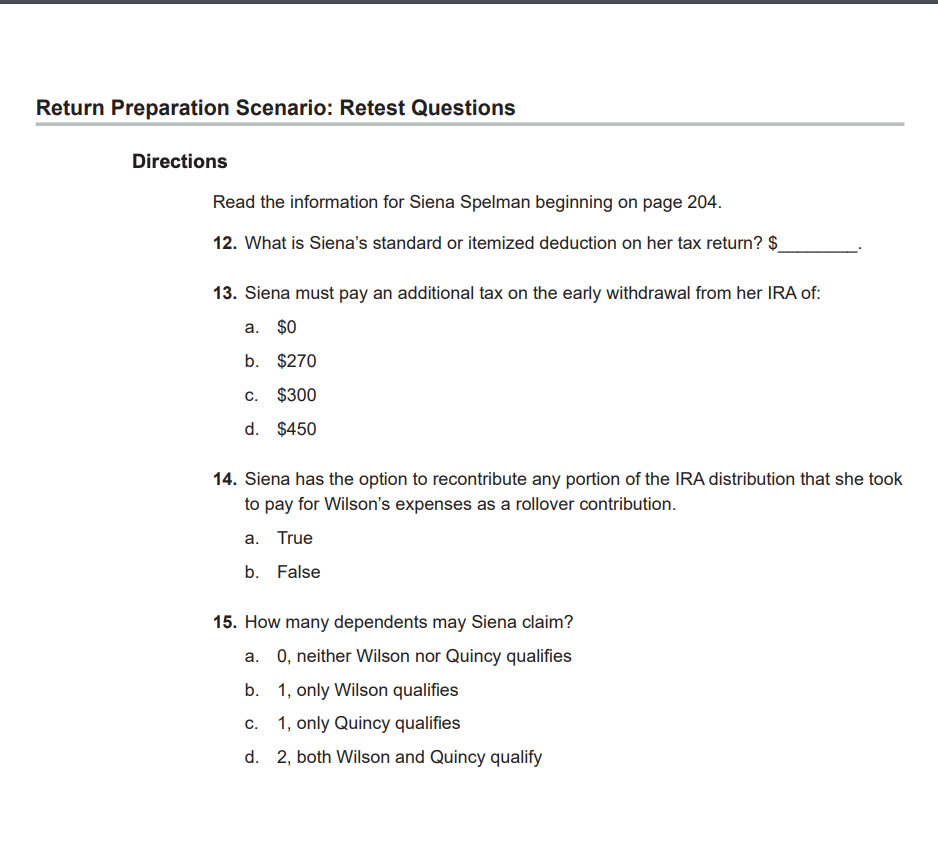

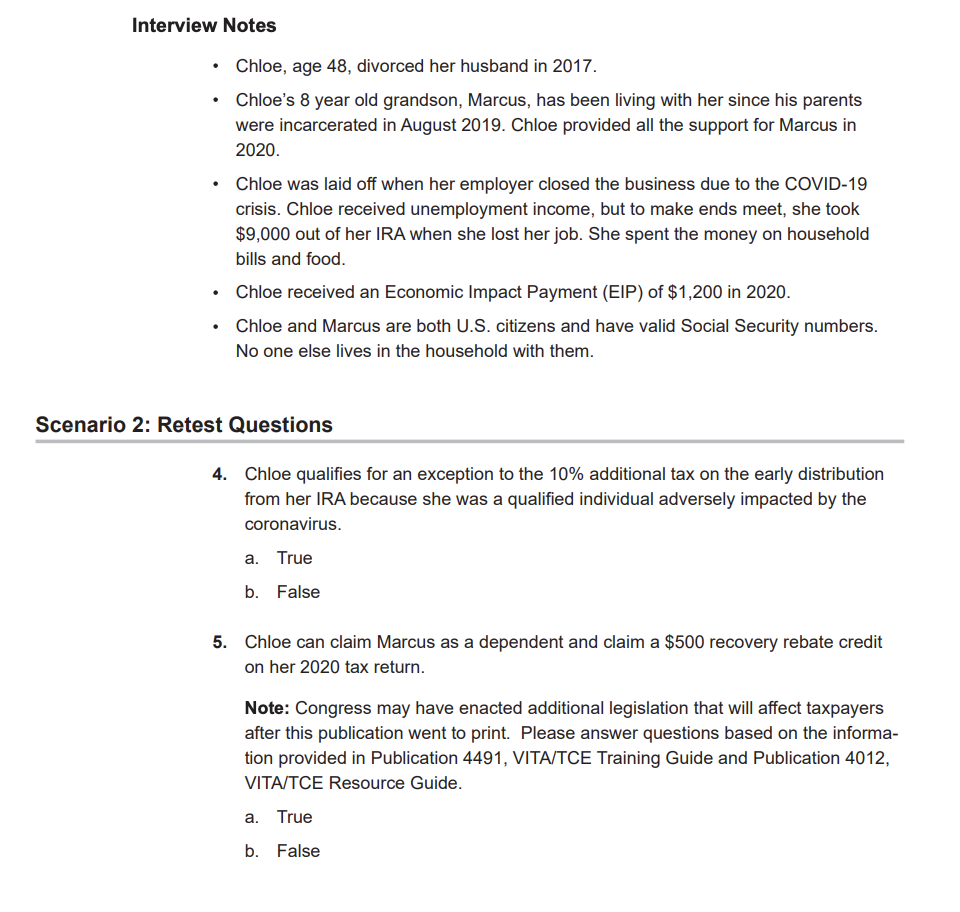

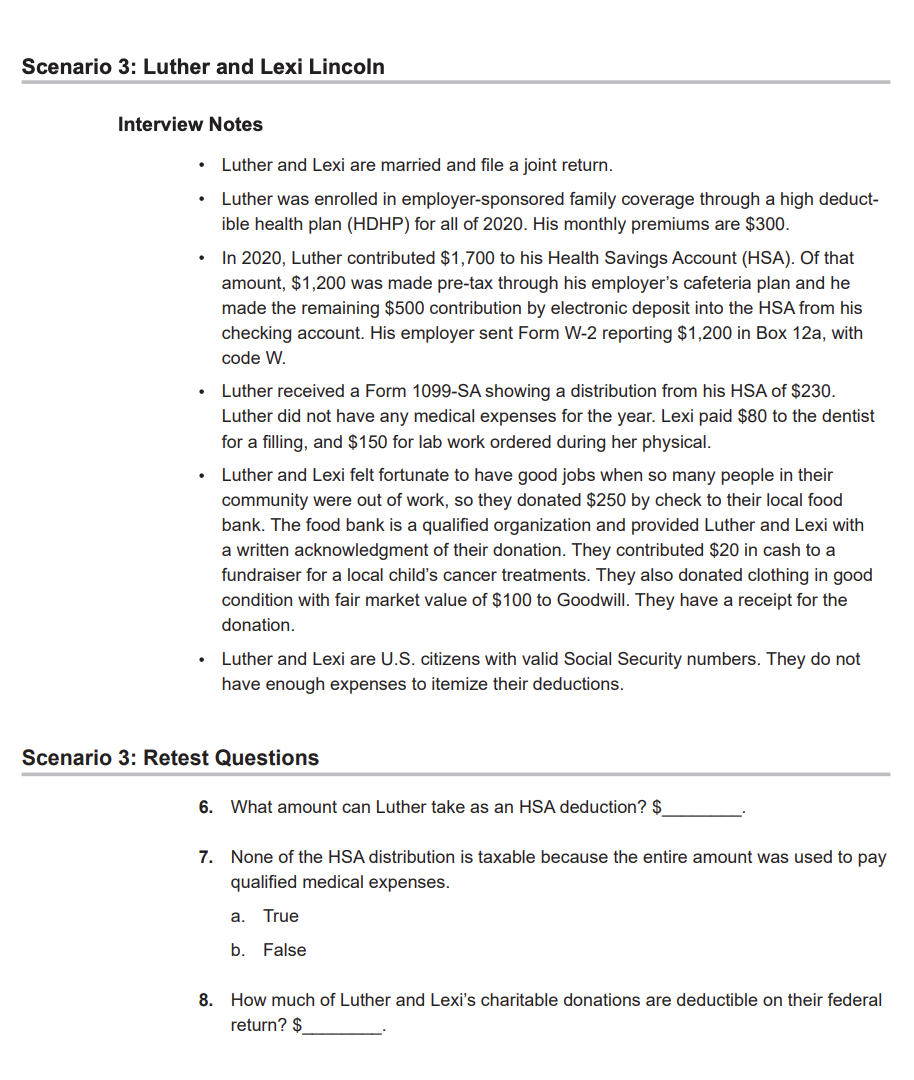

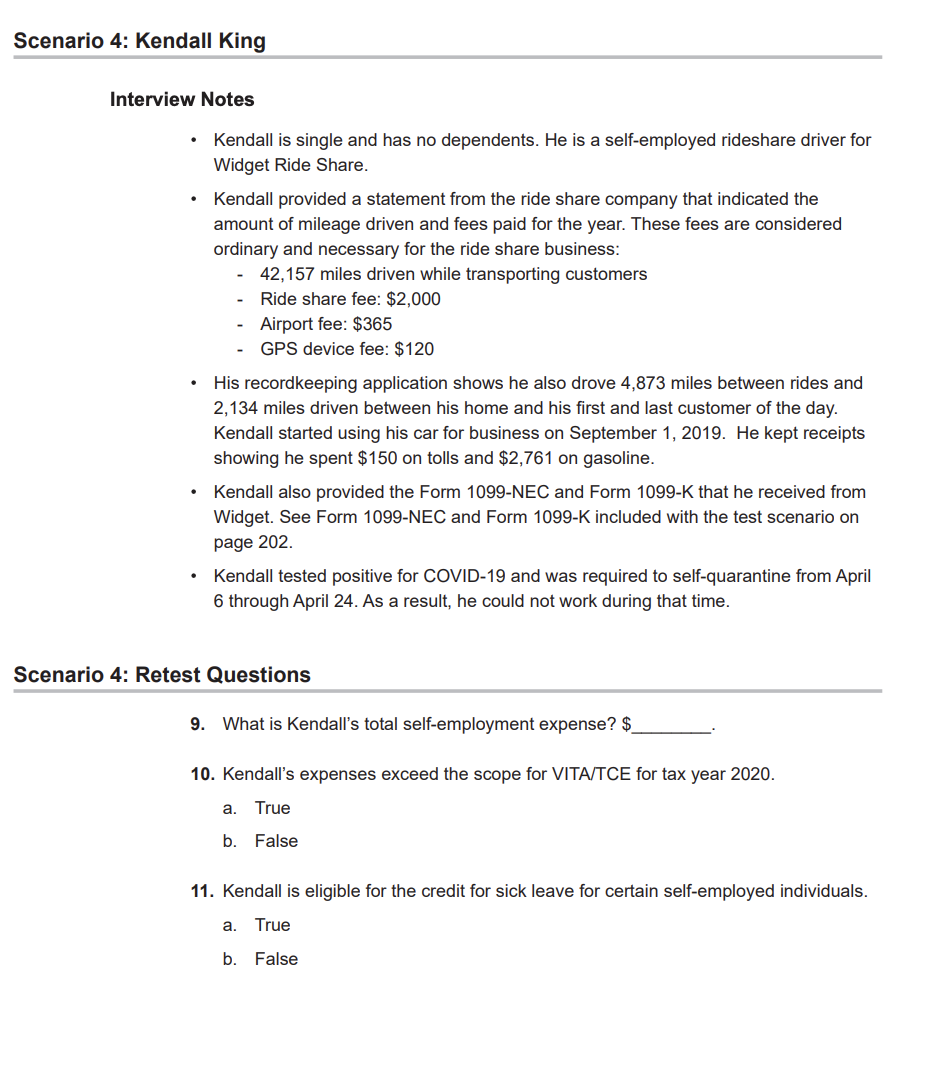

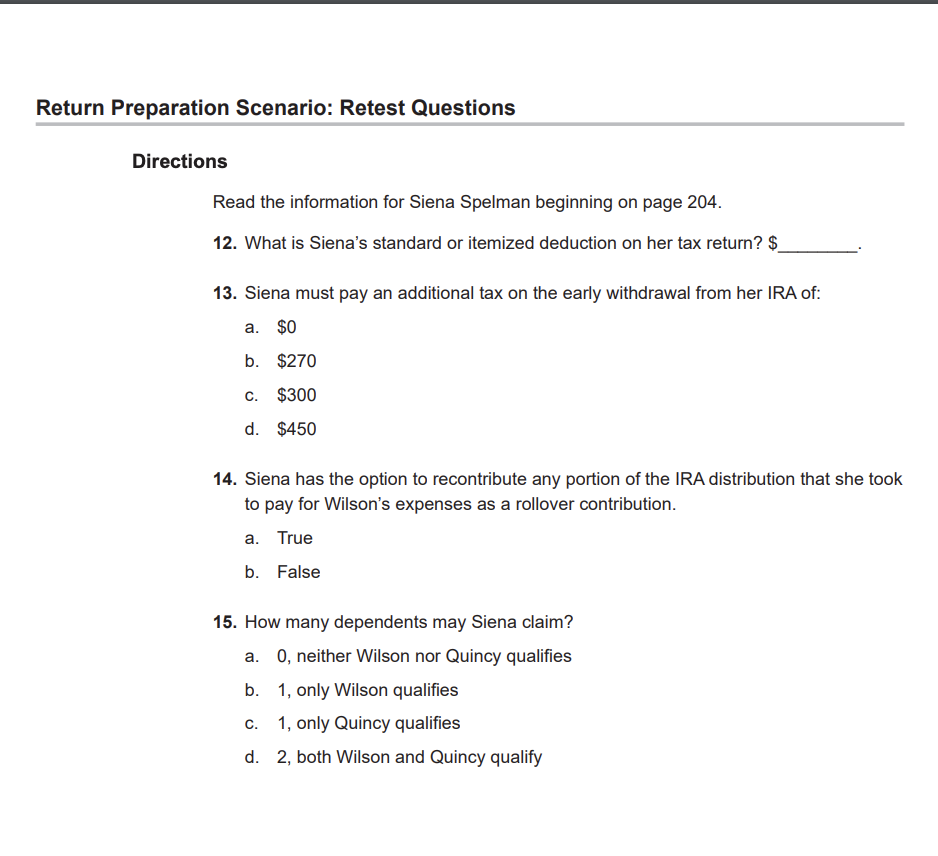

Interview Notes . Herb and Alice are married and file a joint return. Herb is 74 years old. Alice turned 70 on February 3, 2020. Neither are blind. . Herb is a retired school teacher, but continues to work part-time as a substitute teacher. Alice is retired. . Herb earned $15,000 in wages. They also receive pension and Social Security income and sold some stock. Their combined AGI is $45,000. . Both Herb and Alice are U.S. citizens and have valid Social Security numbers. Scenario 1: Retest Questions 1. Herb and Alice cannot make contributions to their traditional IRAs because they are both over 70 1/2. a. True b. False 2. Alice must take her first required minimum distribution (RMD) by April 1, and her second RMD by December 31, of what year_ ? 3. Herb and Alice's standard deduction is: a. $24,800 b. $26, 100 c. $27,400 d. $28, 100Interview Notes . Chloe, age 48, divorced her husband in 2017. . Chloe's 8 year old grandson, Marcus, has been living with her since his parents were incarcerated in August 2019. Chloe provided all the support for Marcus in 2020. Chloe was laid off when her employer closed the business due to the COVID-19 crisis. Chloe received unemployment income, but to make ends meet, she took $9,000 out of her IRA when she lost her job. She spent the money on household bills and food. Chloe received an Economic Impact Payment (EIP) of $1,200 in 2020. . Chloe and Marcus are both U.S. citizens and have valid Social Security numbers. No one else lives in the household with them. Scenario 2: Retest Questions 4. Chloe qualifies for an exception to the 10% additional tax on the early distribution from her IRA because she was a qualified individual adversely impacted by the coronavirus. a. True b. False 5. Chloe can claim Marcus as a dependent and claim a $500 recovery rebate credit on her 2020 tax return. Note: Congress may have enacted additional legislation that will affect taxpayers after this publication went to print. Please answer questions based on the informa- tion provided in Publication 4491, VITA/TCE Training Guide and Publication 4012, VITA/TCE Resource Guide. a. True b. FalseScenario 3: Luther and Lexi Lincoln Interview Notes Luther and Lexi are married and file a joint return. . Luther was enrolled in employer-sponsored family coverage through a high deduct- ible health plan (HDHP) for all of 2020. His monthly premiums are $300. . In 2020, Luther contributed $1,700 to his Health Savings Account (HSA). Of that amount, $1,200 was made pre-tax through his employer's cafeteria plan and he made the remaining $500 contribution by electronic deposit into the HSA from his checking account. His employer sent Form W-2 reporting $1,200 in Box 12a, with code W. . Luther received a Form 1099-SA showing a distribution from his HSA of $230. Luther did not have any medical expenses for the year. Lexi paid $80 to the dentist for a filling, and $150 for lab work ordered during her physical. Luther and Lexi felt fortunate to have good jobs when so many people in their community were out of work, so they donated $250 by check to their local food bank. The food bank is a qualified organization and provided Luther and Lexi with a written acknowledgment of their donation. They contributed $20 in cash to a fundraiser for a local child's cancer treatments. They also donated clothing in good condition with fair market value of $100 to Goodwill. They have a receipt for the donation. Luther and Lexi are U.S. citizens with valid Social Security numbers. They do not have enough expenses to itemize their deductions. Scenario 3: Retest Questions 6. What amount can Luther take as an HSA deduction? $_ 7. None of the HSA distribution is taxable because the entire amount was used to pay qualified medical expenses. a. True b. False 8. How much of Luther and Lexi's charitable donations are deductible on their federal return? $Scenario 4: Kendall King Interview Notes Kendall is single and has no dependents. He is a self-employed rideshare driver for Widget Ride Share Kendall provided a statement from the ride share company that indicated the amount of mileage driven and fees paid for the year. These fees are considered ordinary and necessary for the ride share business: 42,157 miles driven while transporting customers Ride share fee: $2,000 Airport fee: $365 GPS device fee: $120 . His recordkeeping application shows he also drove 4,873 miles between rides and 2, 134 miles driven between his home and his first and last customer of the day. Kendall started using his car for business on September 1, 2019. He kept receipts showing he spent $150 on tolls and $2,761 on gasoline. Kendall also provided the Form 1099-NEC and Form 1099-K that he received from Widget. See Form 1099-NEC and Form 1099-K included with the test scenario on page 202. Kendall tested positive for COVID-19 and was required to self-quarantine from April 6 through April 24. As a result, he could not work during that time. Scenario 4: Retest Questions 9. What is Kendall's total self-employment expense? $_ 10. Kendall's expenses exceed the scope for VITA/TCE for tax year 2020. a. True b. False 11. Kendall is eligible for the credit for sick leave for certain self-employed individuals. a. True b. FalseReturn Preparation Scenario: Retest Questions Directions Read the information for Siena Spelman beginning on page 204. 12. What is Siena's standard or itemized deduction on her tax return? $ 13. Siena must pay an additional tax on the early withdrawal from her IRA of: a. $0 b. $270 C. $300 d. $450 14. Siena has the option to recontribute any portion of the IRA distribution that she took to pay for Wilson's expenses as a rollover contribution. a. True b. False 15. How many dependents may Siena claim? a. 0, neither Wilson nor Quincy qualifies b. 1, only Wilson qualifies c. 1, only Quincy qualifies d. 2, both Wilson and Quincy qualify