Question

Interview Notes Mark and Barbara are married and want to file a joint return. Mark retired and began receiving retirement income on March 1, 2017

Interview Notes

Mark and Barbara are married and want to file a joint return.

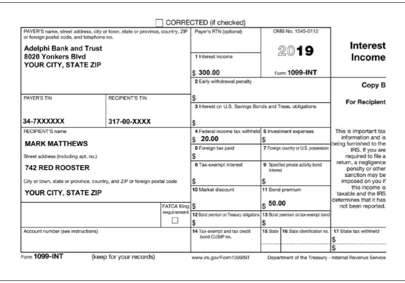

Mark retired and began receiving retirement income on March 1, 2017 . No distributions were received prior to his retirement . Mark selected a joint survivor annuity for these payments . The plan cost at annuity start date was $14,500 . Mark has already recovered $1,029 of his cost in the plan .

The Matthews received a $125 state income tax refund from their 2018 state tax return . The Matthews do not have enough deductions to itemize for 2019 and they have never itemized deductions .

Mark and Barbara stated if they are entitled to a refund, they want half of it deposited into their checking account and the other half deposited into their savings account . The checking account number is 123456789 and the savings account number is 987654321 . Both accounts are from Adelphi Bank and Trust .

| |||||||||||

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started