Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Siena is 38 years old and unmarried. Siena had her first child, Wilson, in June 2020. Quincy, Siena's brother, moved in with her in

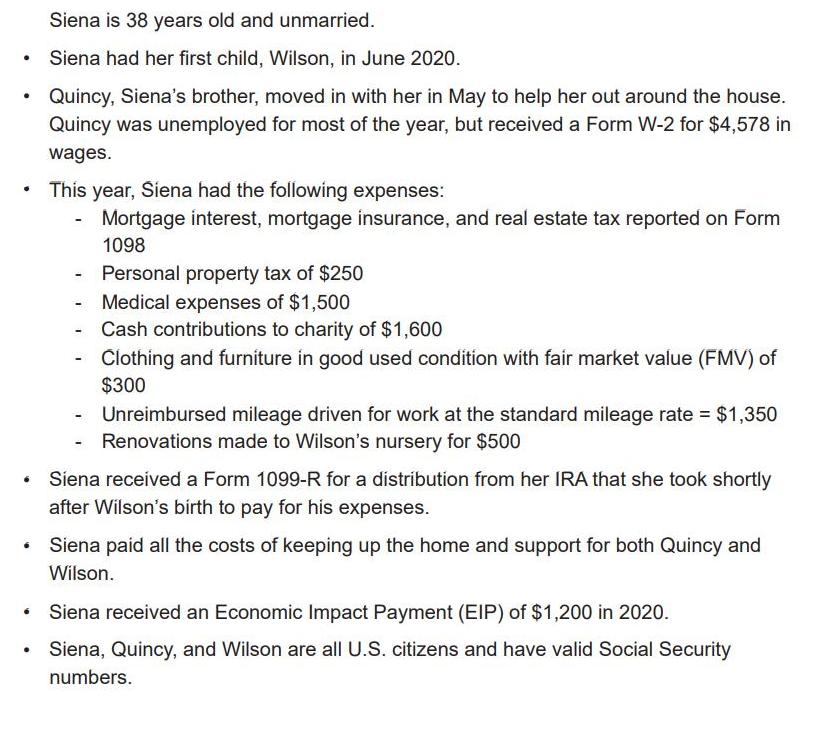

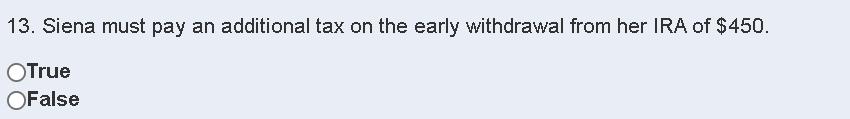

Siena is 38 years old and unmarried. Siena had her first child, Wilson, in June 2020. Quincy, Siena's brother, moved in with her in May to help her out around the house. Quincy was unemployed for most of the year, but received a Form W-2 for $4,578 in wages. This year, Siena had the following expenses: Mortgage interest, mortgage insurance, and real estate tax reported on Form 1098 Personal property tax of $250 Medical expenses of $1,500 Cash contributions to charity of $1,600 Clothing and furnture in good used condition with fair market value (FMV) of $300 Unreimbursed mileage driven for work at the standard mileage rate = $1,350 Renovations made to Wilson's nursery for $500 Siena received a Form 1099-R for a distribution from her IRA that she took shortly after Wilson's birth to pay for his expenses. Siena paid all the costs of keeping up the home and support for both Quincy and Wilson. Siena received an Economic Impact Payment (EIP) of $1,200 in 2020. Siena, Quincy, and Wilson are all U.S. citizens and have valid Social Security numbers. 13. Siena must pay an additional tax on the early withdrawal from her IRA of $450. OTrue OFalse

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

False as Siena had not pay t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started