Answered step by step

Verified Expert Solution

Question

1 Approved Answer

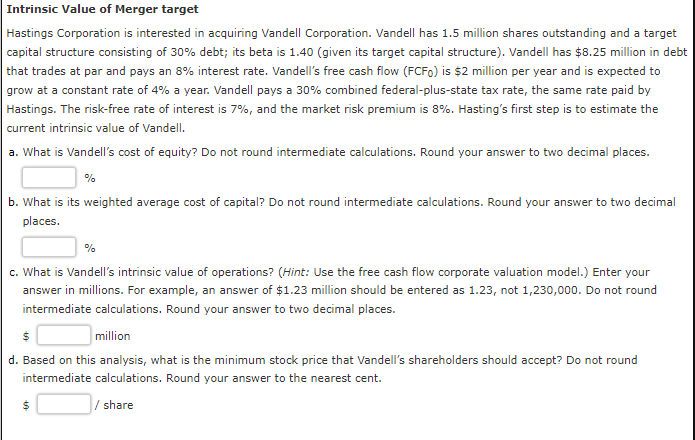

Intrinsic Value of Merger target Hastings Corporation is interested in acquiring Vandell Corporation. Vandell has 1 . 5 million shares outstanding and a target capital

Intrinsic Value of Merger target

Hastings Corporation is interested in acquiring Vandell Corporation. Vandell has million shares outstanding and a target

capital structure consisting of debt; its beta is given its target capital structure Vandell has $ million in debt

that trades at par and pays an interest rate. Vandell's free cash flow is $ million per year and is expected to

grow at a constant rate of a year. Vandell pays a combined federalplusstate tax rate, the same rate paid by

Hastings. The riskfree rate of interest is and the market risk premium is Hasting's first step is to estimate the

current intrinsic value of Vandell.

a What is Vandell's cost of equity? Do not round intermediate calculations. Round your answer to two decimal places.

b What is its weighted average cost of capital? Do not round intermediate calculations. Round your answer to two decimal

places.

c What is Vandell's intrinsic value of operations? Hint: Use the free cash flow corporate valuation model. Enter your

answer in millions. For example, an answer of $ million should be entered as not Do not round

intermediate calculations. Round your answer to two decimal places.

$

million

d Based on this analysis, what is the minimum stock price that Vandell's shareholders should accept? Do not round

intermediate calculations. Round your answer to the nearest cent.

$

share

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started