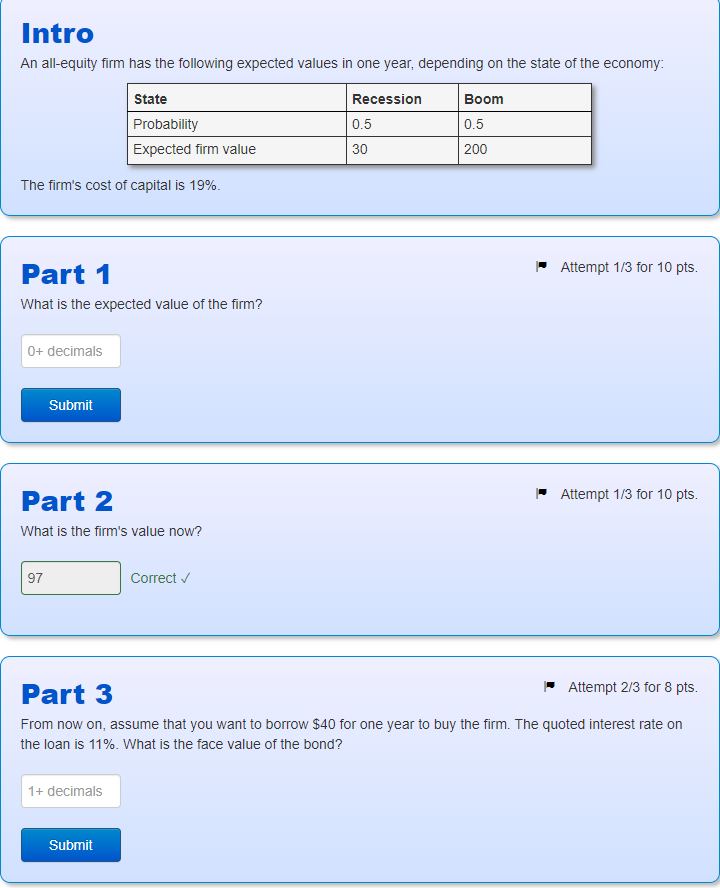

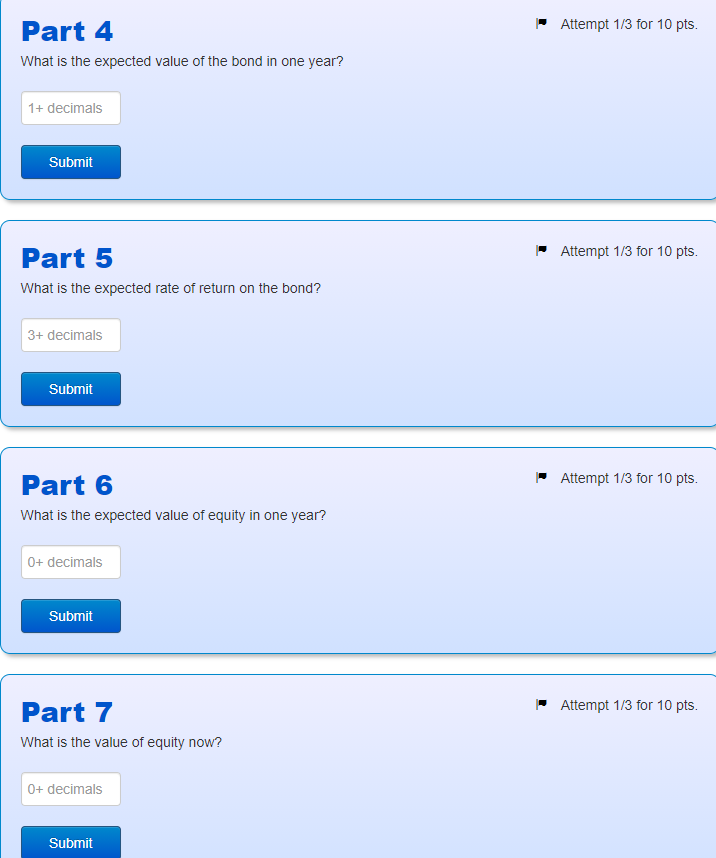

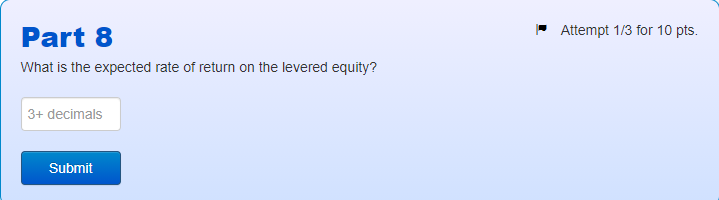

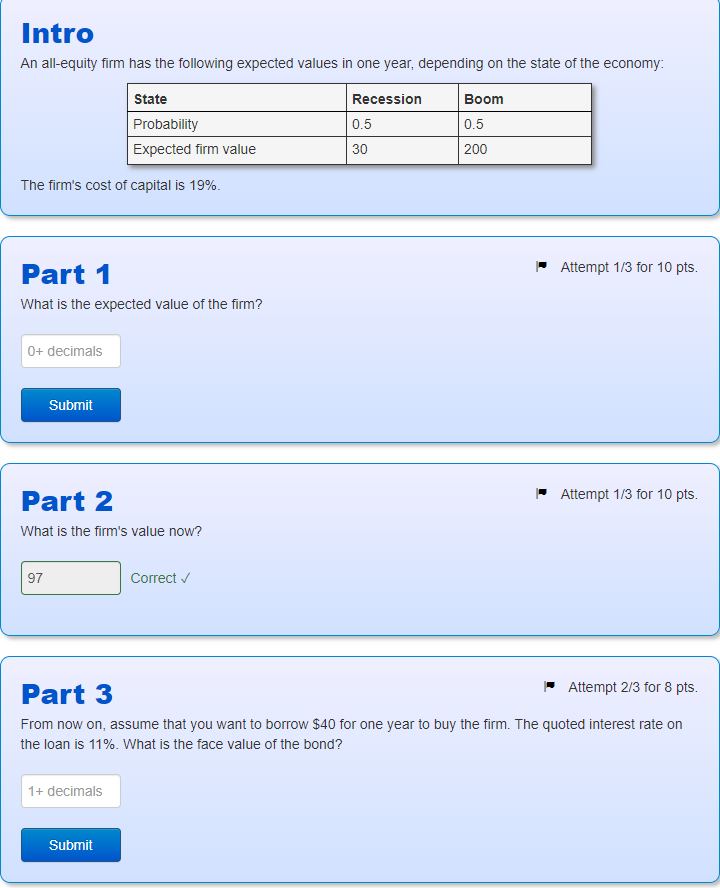

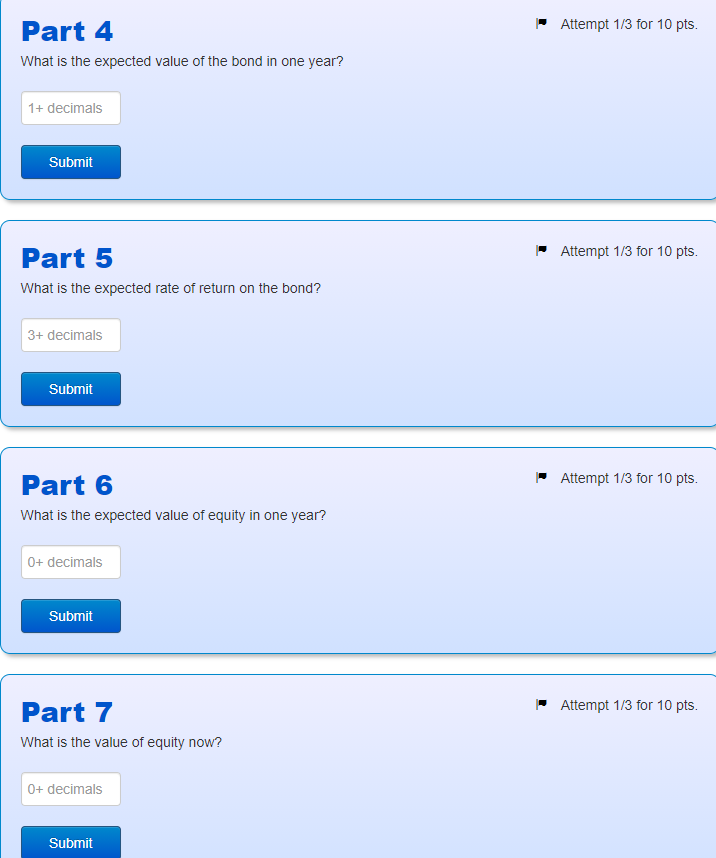

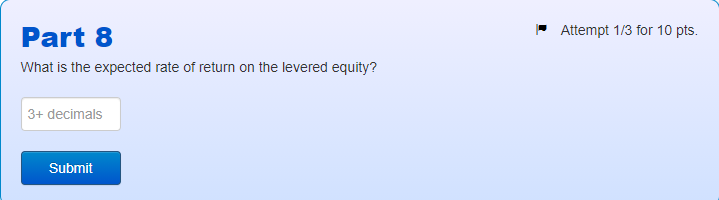

Intro An all-equity firm has the following expected values in one year, depending on the state of the economy: Boom State Probability Expected firm value Recession 0.5 30 0.5 200 The firm's cost of capital is 19%. Attempt 1/3 for 10 pts. Part 1 What is the expected value of the firm? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 2 What is the firm's value now? 97 Correct Part 3 Attempt 2/3 for 8 pts. From now on, assume that you want to borrow $40 for one year to buy the firm. The quoted interest rate on the loan is 11%. What is the face value of the bond? 1+ decimals Submit Attempt 1/3 for 10 pts. Part 4 What is the expected value of the bond in one year? 1+ decimals Submit Attempt 1/3 for 10 pts. Part 5 What is the expected rate of return on the bond? 3+ decimals Submit Attempt 1/3 for 10 pts. Part 6 What is the expected value of equity in one year? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 7 What is the value of equity now? 0+ decimals Submit - Attempt 1/3 for 10 pts. Part 8 What is the expected rate of return on the levered equity? 3+ decimals Submit Intro An all-equity firm has the following expected values in one year, depending on the state of the economy: Boom State Probability Expected firm value Recession 0.5 30 0.5 200 The firm's cost of capital is 19%. Attempt 1/3 for 10 pts. Part 1 What is the expected value of the firm? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 2 What is the firm's value now? 97 Correct Part 3 Attempt 2/3 for 8 pts. From now on, assume that you want to borrow $40 for one year to buy the firm. The quoted interest rate on the loan is 11%. What is the face value of the bond? 1+ decimals Submit Attempt 1/3 for 10 pts. Part 4 What is the expected value of the bond in one year? 1+ decimals Submit Attempt 1/3 for 10 pts. Part 5 What is the expected rate of return on the bond? 3+ decimals Submit Attempt 1/3 for 10 pts. Part 6 What is the expected value of equity in one year? 0+ decimals Submit Attempt 1/3 for 10 pts. Part 7 What is the value of equity now? 0+ decimals Submit - Attempt 1/3 for 10 pts. Part 8 What is the expected rate of return on the levered equity? 3+ decimals Submit