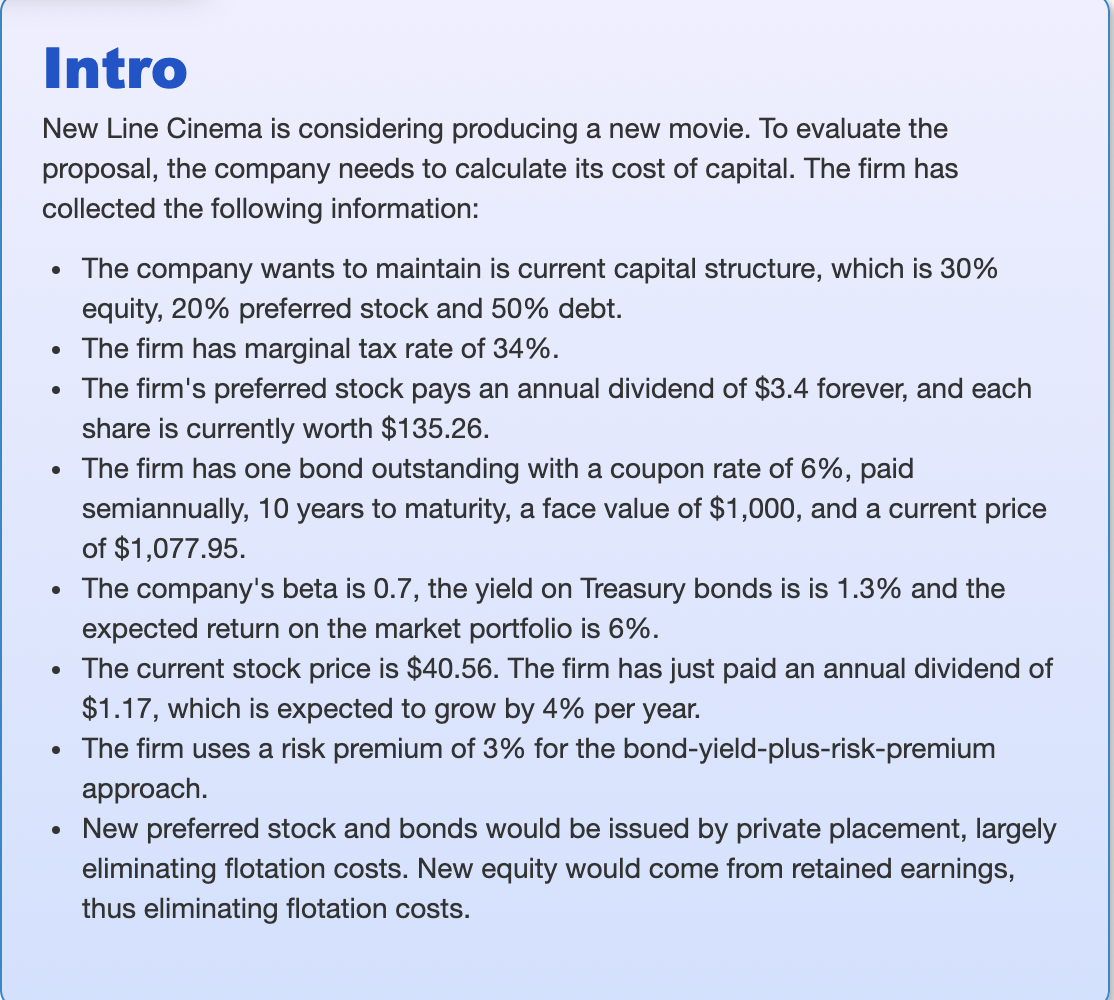

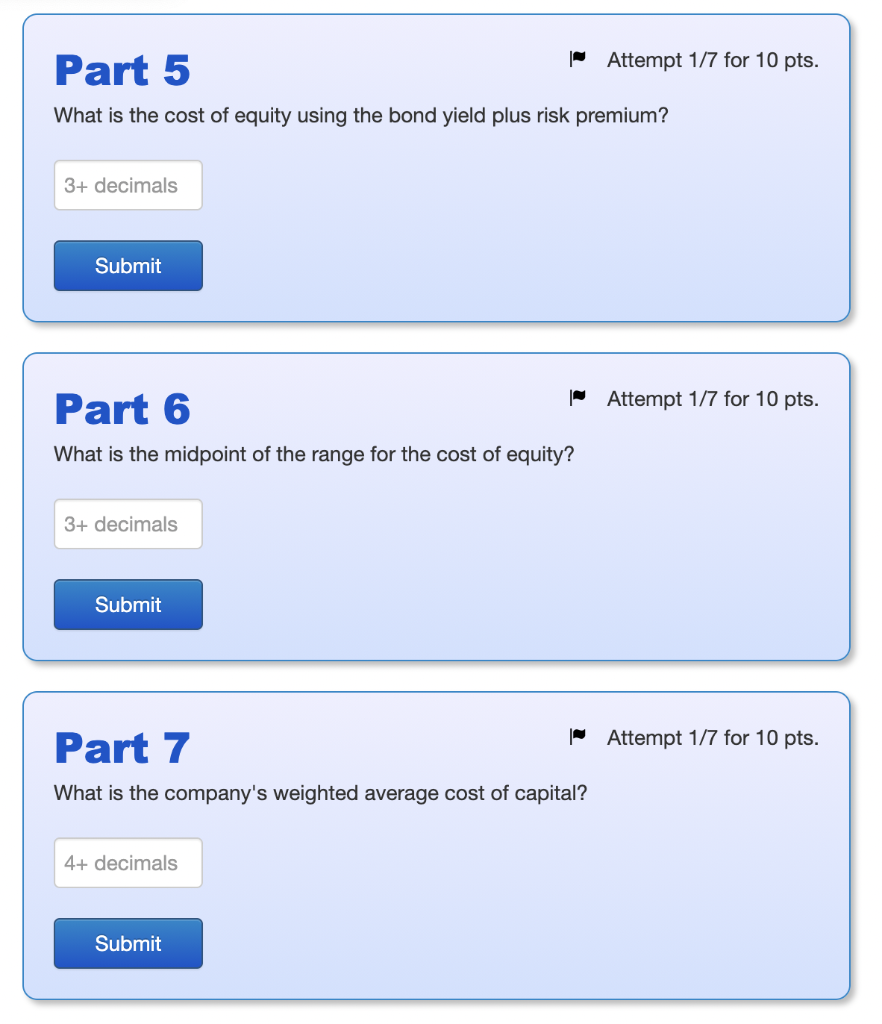

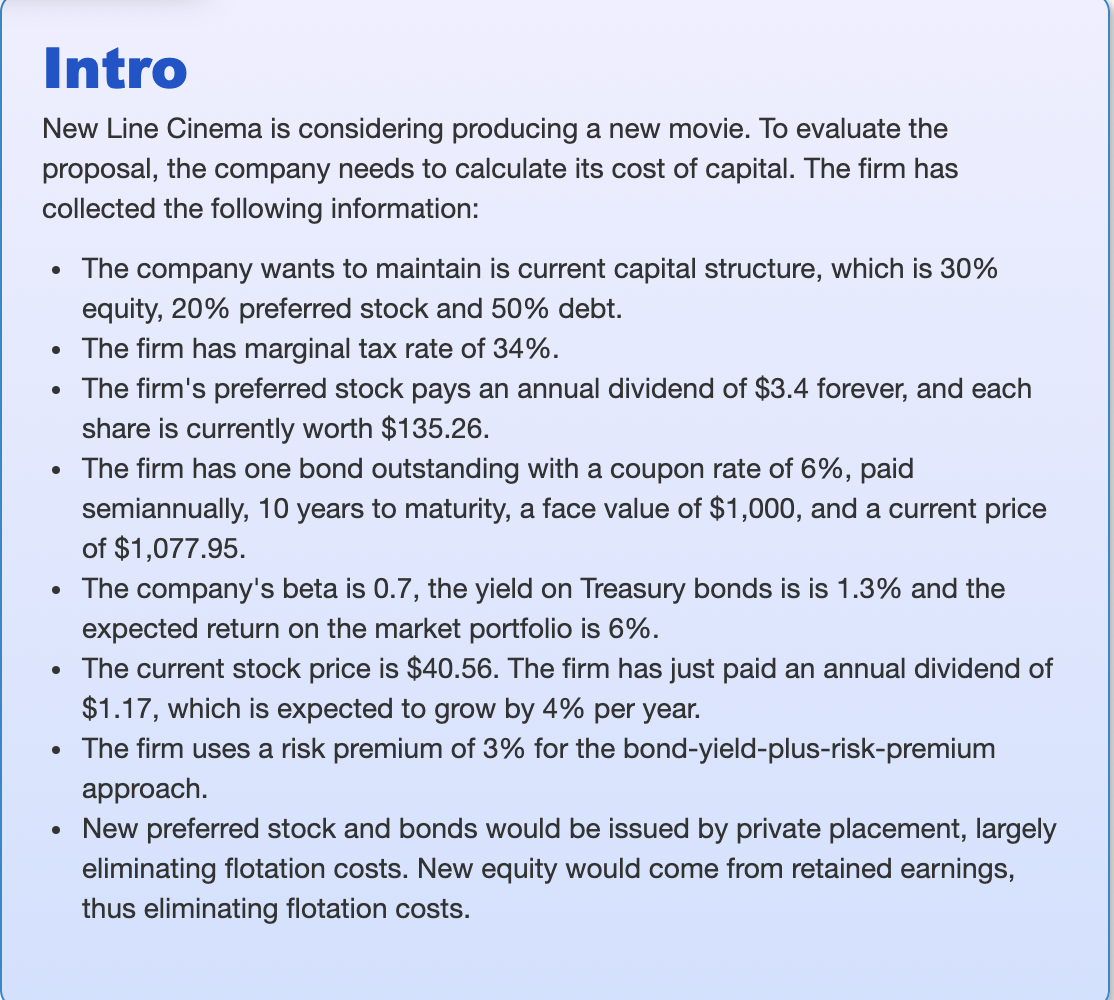

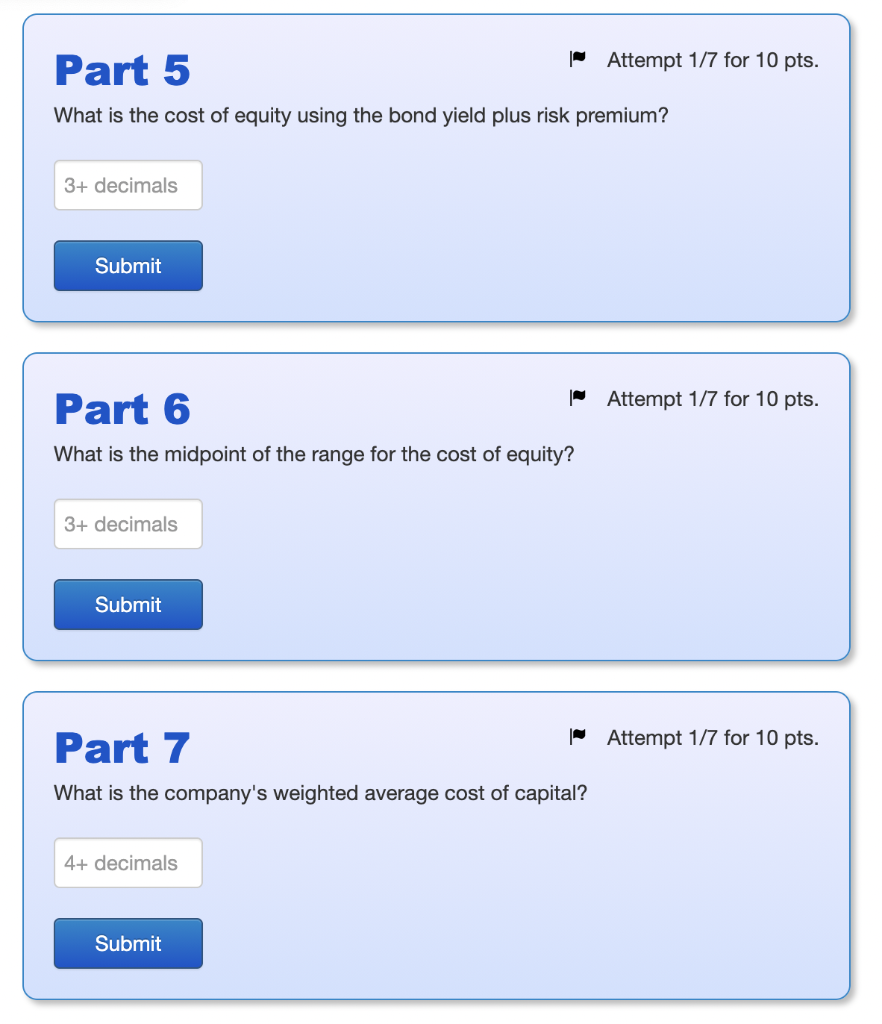

Intro New Line Cinema is considering producing a new movie. To evaluate the proposal, the company needs to calculate its cost of capital. The firm has collected the following information: The company wants to maintain is current capital structure, which is 30% equity, 20% preferred stock and 50% debt. The firm has marginal tax rate of 34%. The firm's preferred stock pays an annual dividend of $3.4 forever, and each share is currently worth $135.26. The firm has one bond outstanding with a coupon rate of 6%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,077.95. The company's beta is 0.7, the yield on Treasury bonds is is 1.3% and the expected return on the market portfolio is 6%. The current stock price is $40.56. The firm has just paid an annual dividend of $1.17, which is expected to grow by 4% per year. The firm uses a risk premium of 3% for the bond-yield-plus-risk-premium approach. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. New equity would come from retained earnings, thus eliminating flotation costs. Part 5 | Attempt 1/7 for 10 pts. What is the cost of equity using the bond yield plus risk premium? 3+ decimals Submit Part 6 | Attempt 1/7 for 10 pts. What is the midpoint of the range for the cost of equity? 3+ decimals Submit Attempt 1/7 for 10 pts. Part 7 What is the company's weighted average cost of capital? 4+ decimals Submit Intro New Line Cinema is considering producing a new movie. To evaluate the proposal, the company needs to calculate its cost of capital. The firm has collected the following information: The company wants to maintain is current capital structure, which is 30% equity, 20% preferred stock and 50% debt. The firm has marginal tax rate of 34%. The firm's preferred stock pays an annual dividend of $3.4 forever, and each share is currently worth $135.26. The firm has one bond outstanding with a coupon rate of 6%, paid semiannually, 10 years to maturity, a face value of $1,000, and a current price of $1,077.95. The company's beta is 0.7, the yield on Treasury bonds is is 1.3% and the expected return on the market portfolio is 6%. The current stock price is $40.56. The firm has just paid an annual dividend of $1.17, which is expected to grow by 4% per year. The firm uses a risk premium of 3% for the bond-yield-plus-risk-premium approach. New preferred stock and bonds would be issued by private placement, largely eliminating flotation costs. New equity would come from retained earnings, thus eliminating flotation costs. Part 5 | Attempt 1/7 for 10 pts. What is the cost of equity using the bond yield plus risk premium? 3+ decimals Submit Part 6 | Attempt 1/7 for 10 pts. What is the midpoint of the range for the cost of equity? 3+ decimals Submit Attempt 1/7 for 10 pts. Part 7 What is the company's weighted average cost of capital? 4+ decimals Submit