Answered step by step

Verified Expert Solution

Question

1 Approved Answer

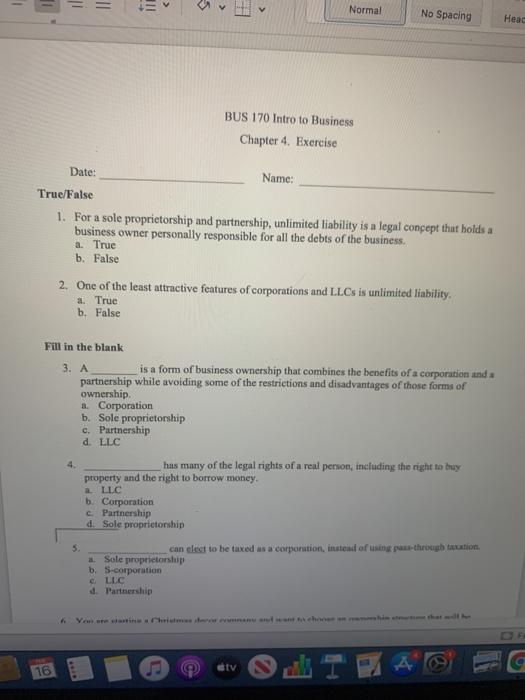

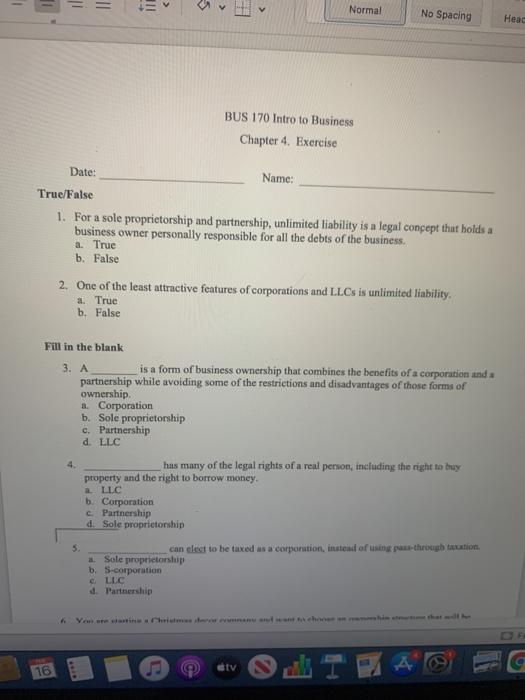

*INTRO TO BUSINESS * - il = 5 Normal No Spacing Head BUS 170 Intro to Business Chapter 4. Exercise Date: Name: True/False 1. For

*INTRO TO BUSINESS *

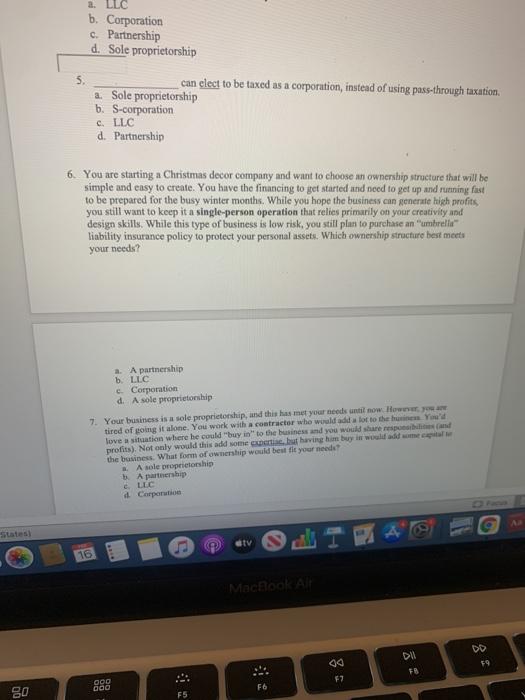

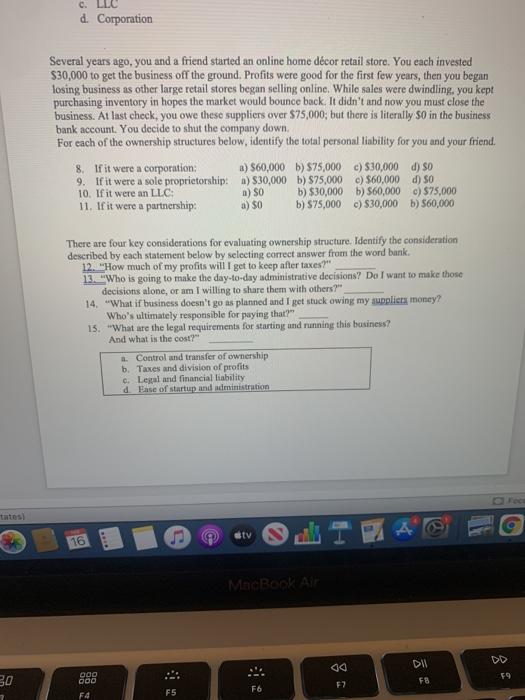

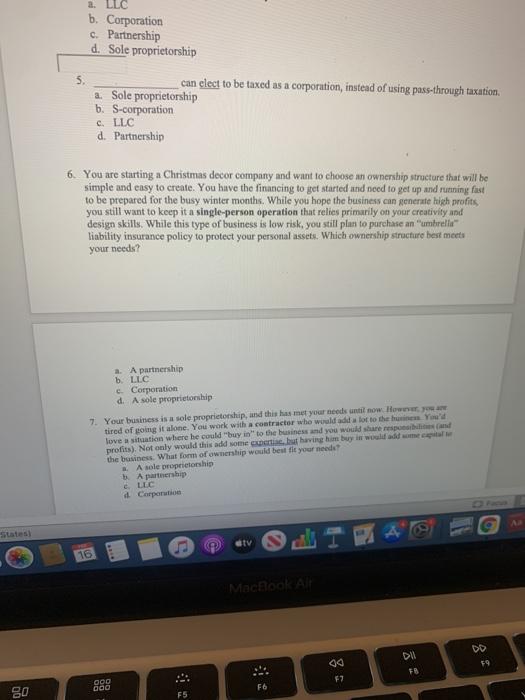

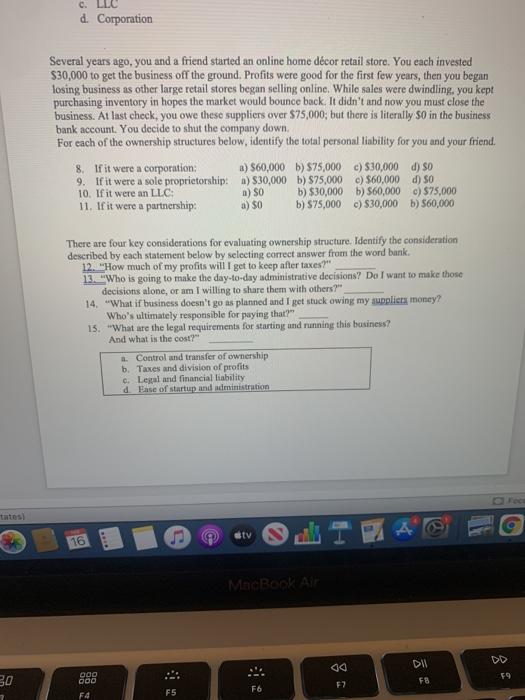

- il = 5 Normal No Spacing Head BUS 170 Intro to Business Chapter 4. Exercise Date: Name: True/False 1. For a sole proprietorship and partnership, unlimited liability is a legal concept that holds a business owner personally responsible for all the debts of the business. a. True b. False 2. One of the least attractive features of corporations and LLC is unlimited liability. a. True b. False Fill in the blank 3. A is a form of business ownership that combines the benefits of a corporation and a partnership while avoiding some of the restrictions and disadvantages of those forms of ownership 2. Corporation b. Sole proprietorship c. Partnership d. LLC has many of the legal rights of a real person, including the right to buy property and the right to borrow money. LLC b. Corporation c. Partnership d. Sole proprietorship 5 can clect to be taxed as a corporation, instead of using pass through action a Sole proprietorship b. S-corporation LLC d. Partnership ty 16 a. LLC S. b. Corporation c. Partnership d. Sole proprietorship can clect to be taxed as a corporation, instead of using pass-through taxation. a. Sole proprietorship b. S-corporation d. Partnership c. LLC 6. You are starting a Christmas decor company and want to choose an ownership structure that will be simple and easy to create. You have the financing to get started and need to get up and running fust to be prepared for the busy winter months. While you hope the business can generate high profits, you still want to keep it a single-person operation that relies primarily on your creativity and design skills. While this type of business is low risk, you still plan to purchase an umbrella liability insurance policy to protect your personal assets. Which ownership structure best meets your needs? 1. A partnership bLIC Corporation d. A sole proprietorship 7. Your business is a sole proprietorship, and this has met your needs until now. However, tired of going it alone. You work with a contractor who would add for to the end love a situation where he could "buy into the business and you would share responsibilities and profits). Not only would this add some exertia, but having him buy in would come the business. What form of ownership would best fit your needs? A sole proprietorship Apartnership a Corporation LC 16 MacBook All DO DIL 9 00 52 FB 000 80 DOO F6 F5 C. LLC d. Corporation Several years ago, you and a friend started an online home dcor retail store. You each invested $30,000 to get the business off the ground. Profits were good for the first few years, then you began losing business as other large retail stores began selling online. While sales were dwindling, you kept purchasing inventory in hopes the market would bounce back. It didn't and now you must close the business. At last check, you owe these suppliers over $75,000; but there is literally 50 in the business bank account. You decide to shut the company down, For each of the ownership structures below, identify the total personal liability for you and your friend. 8. If it were a corporation a) $60,000 b) $75,000 c) $30,000 d) SO 9. If it were a sole proprietorship: a)$30,000 b) $75,000 $60,000 d) 80 10. If it were an LLC b) $30,000 b) $60,000 c) $75,000 11. If it were a partnership: b) $75,000 ) $30,000 b) $60,000 a) SO a) 50 There are four key considerations for evaluating ownership structure. Identify the consideration described by cach statement below by selecting correct answer from the word bank. 12. How much of my profits will I get to keep after taxes?" 13_"Who is going to make the day-to-day administrative decisions? Do I want to make those decisions alone, or am I willing to share them with others?" 14. "What if business doesn't go as planned and I get stuck owing my suppliers money? Who's ultimately responsible for paying that? 15. "What are the legal requirements for starting and running this business? And what is the cost?" Control and transfer of ownership b. Taxes and division of profits 4. Legal and financial liability d. Fase of startup and administration sty 16 MacBook Air 000 Dll F8 19 30 QO0 F2 F5 F6 7 F4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started