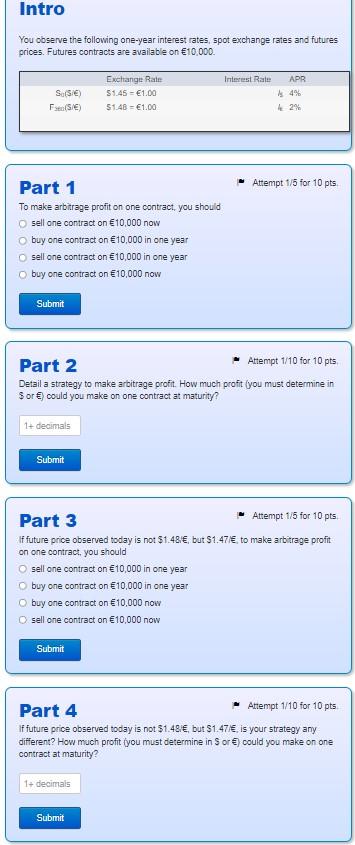

Intro You observe the following one-year interest rates, spot exchange rates and futures prices. Futures contracts are available on 10,000. Interest Rate APR SOSIE) F(SE) Exchange Rate 51.45 - 1.00 51.48 - 1.00 42% Attempt 1/5 for 10 pts Part 1 To make arbitrage profit on one contract, you should sell one contract on 10,000 now o buy one contract on 10,000 in one year sell one contract on 10,000 in one year buy one contract on 10,000 now Submit Part 2 Attempt 1/10 for 10 pts Detail a strategy to make arbitrage profit. How much profit (you must determine in Sor ) could you make on one contract at maturity? 1+ decimals Submit Part 3 Attempt 1/5 for 10 pts If future price observed today is not 51.48, but S1.47/. to make arbitrage profit on one contract, you should sell one contract on 10,000 in one year o buy one contract on 10,000 in one year buy one contract on 10,000 now O sell one contract on 10,000 now Submit Part 4 Attempt 1/10 for 10 pts if future price observed today is not $1.481, but $1.47/ is your strategy any different? How much profit (you must determine in S or ) could you make on one contract at maturity? 1+ decimals Submit Intro You observe the following one-year interest rates, spot exchange rates and futures prices. Futures contracts are available on 10,000. Interest Rate APR SOSIE) F(SE) Exchange Rate 51.45 - 1.00 51.48 - 1.00 42% Attempt 1/5 for 10 pts Part 1 To make arbitrage profit on one contract, you should sell one contract on 10,000 now o buy one contract on 10,000 in one year sell one contract on 10,000 in one year buy one contract on 10,000 now Submit Part 2 Attempt 1/10 for 10 pts Detail a strategy to make arbitrage profit. How much profit (you must determine in Sor ) could you make on one contract at maturity? 1+ decimals Submit Part 3 Attempt 1/5 for 10 pts If future price observed today is not 51.48, but S1.47/. to make arbitrage profit on one contract, you should sell one contract on 10,000 in one year o buy one contract on 10,000 in one year buy one contract on 10,000 now O sell one contract on 10,000 now Submit Part 4 Attempt 1/10 for 10 pts if future price observed today is not $1.481, but $1.47/ is your strategy any different? How much profit (you must determine in S or ) could you make on one contract at maturity? 1+ decimals Submit