Answered step by step

Verified Expert Solution

Question

1 Approved Answer

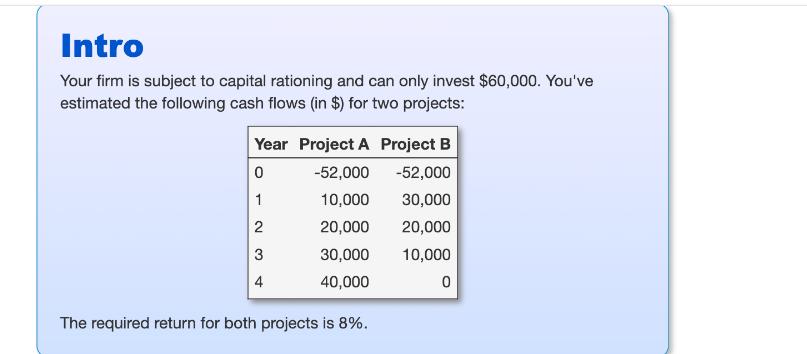

Intro Your firm is subject to capital rationing and can only invest $60,000. You've estimated the following cash flows (in $) for two projects:

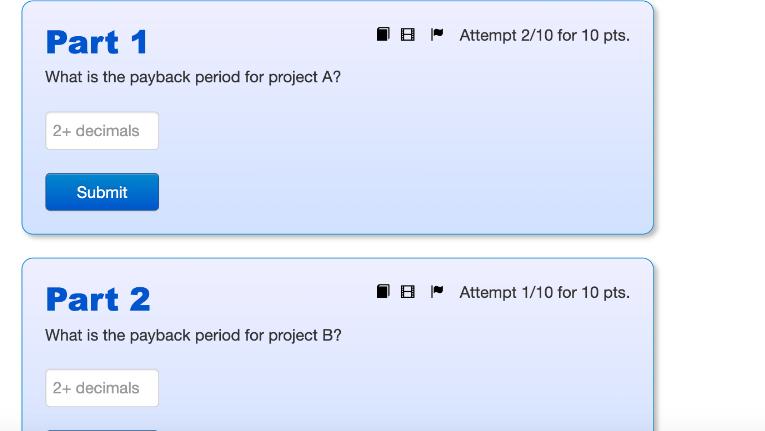

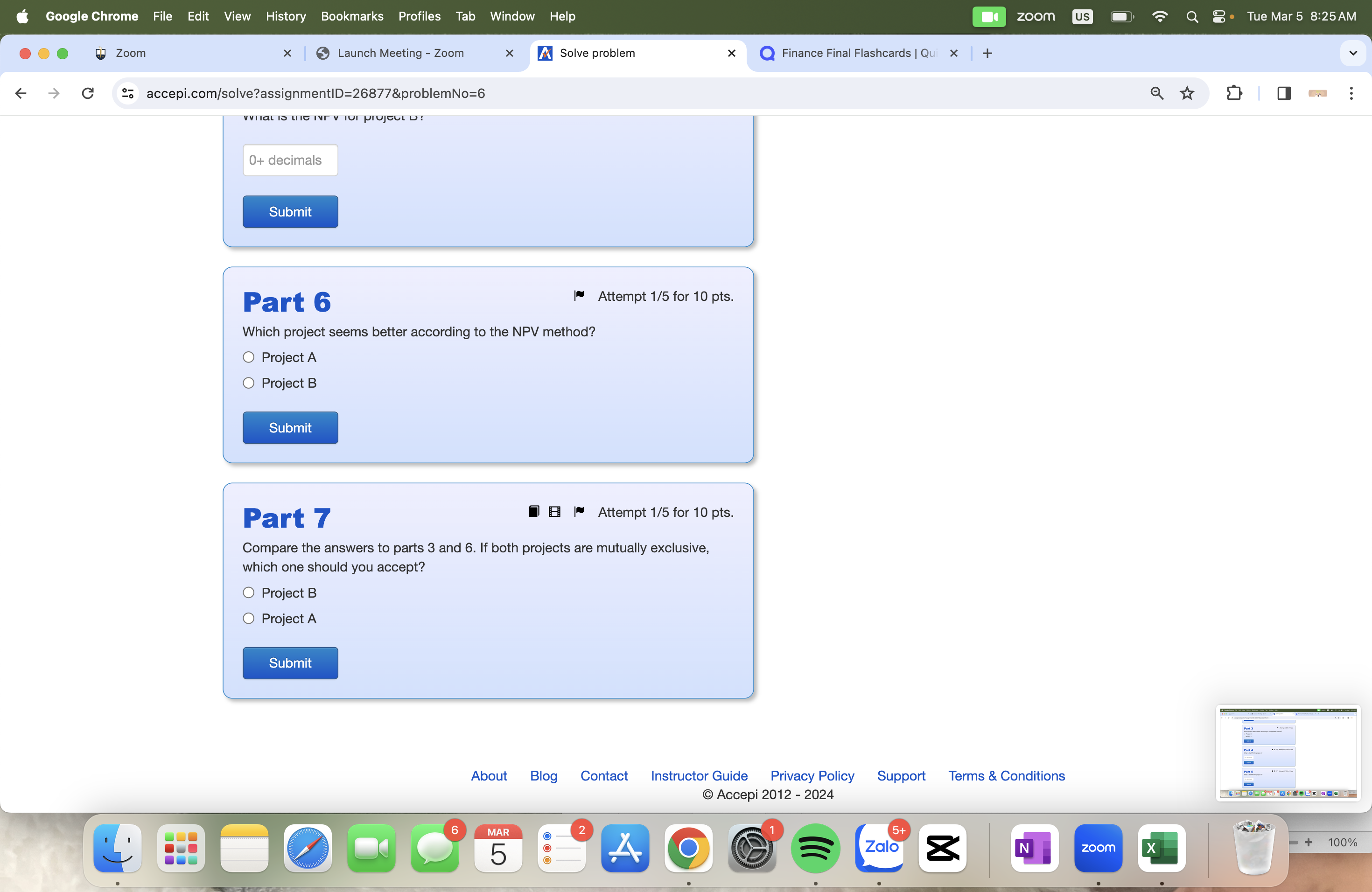

Intro Your firm is subject to capital rationing and can only invest $60,000. You've estimated the following cash flows (in $) for two projects: Year Project A Project B 0 -52,000 -52,000 1 10,000 30,000 2 20,000 20,000 3 30,000 10,000 4 40,000 0 The required return for both projects is 8%. Part 1 What is the payback period for project A? 2+ decimals Submit Attempt 2/10 for 10 pts. Part 2 What is the payback period for project B? Attempt 1/10 for 10 pts. 2+ decimals Google Chrome File Edit View History Bookmarks Profiles Tab Window Help Zoom Launch Meeting - Zoom accepi.com/solve?assignmentID=26877&problemNo=6 zoom US Tue Mar 5 8:25 AM A Solve problem Finance Final Flashcards | Qui | + Attempt 1/5 for 10 pts. Part 3 Which project seems better according to the payback method? Project B Project A Submit Part 4 What is the NPV for project A? 0+ decimals Submit Part 5 What is the NPV for project B? 0+ decimals Submit 6 MAR O LO 5 2 Attempt 1/10 for 10 pts. Attempt 1/10 for 10 pts. 1 A ))) Zalo 5+ + 100% N zoom X Google Chrome Zoom File Edit View History Bookmarks Profiles Tab Window Help Launch Meeting - Zoom accepi.com/solve?assignmentID=26877&problemNo=6 VITAL IS LITE NAV Tor projecID! 0+ decimals Submit zoom US A Solve problem Finance Final Flashcards | Qui | + Part 6 Which project seems better according to the NPV method? Project A Project B Submit Attempt 1/5 for 10 pts. Part 7 Attempt 1/5 for 10 pts. Compare the answers to parts 3 and 6. If both projects are mutually exclusive, which one should you accept? Project B Project A Submit 6 About Blog Contact Instructor Guide MAR 5 2 A Privacy Policy Accepi 2012 - 2024 1 })) Support Terms & Conditions 5+ Zalo N zoom X Part 5 Tue Mar 5 8:25 AM D + 100%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started