Question

INTRODUCTION Assume that you are working for KW Consultants. Your team receives two tasks relating to Crystal Group and UTA University, respectively. Task one: Crystal

INTRODUCTION

Assume that you are working for KW Consultants. Your team receives two tasks relating to Crystal Group and UTA University, respectively.

Task one: Crystal 1

Crystal Ltd. is a subsidiary of Crystal Group, a large manufacturer of glass products headquartered in Europe. Although initially established as an industrial-glass producer, Crystal reinvented itself after World War II as a producer of fine glass and crystal ware, including tableware and other similar products. The company is known for high-quality glass at affordable prices. This reputation comes from the skills of its master craftsmen and innovative technology in the manufacturing process. Crystal-ware is used in fine restaurants, hotels, and residences throughout the world. Several years ago, management at Crystal Group recognized that the glass tableware market's growth was beginning to slow, forcing the company to search for other growth opportunities.

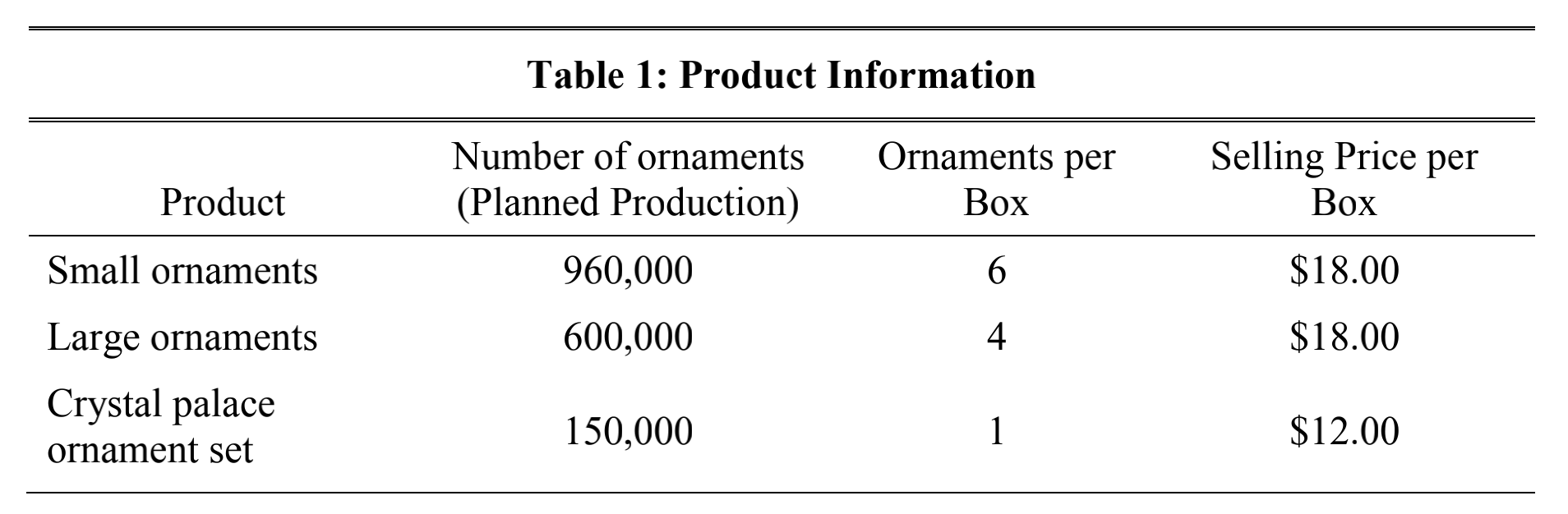

After extensive research, management concluded that expanding into glass ornaments would allow the company to continue growing, take advantage of Crystal Group's unique capabilities, and capitalize on its high-quality reputation and innovative technology. The company started Crystal Ltd and leased a small manufacturing facility in Australia. Crystal Ltd produces three products at this manufacturing facility: small glass ornaments, large glass ornaments, and crystal palace ornament sets. Some basic information about the three products is in Table 1.

Costing at Crystal

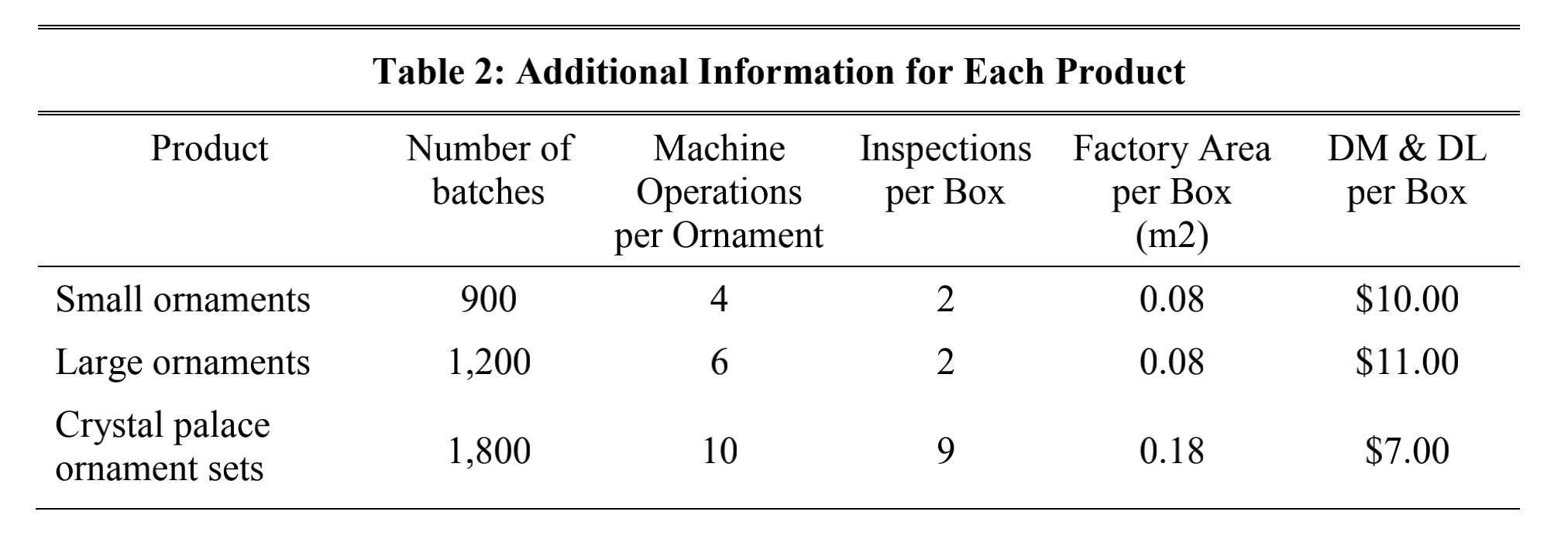

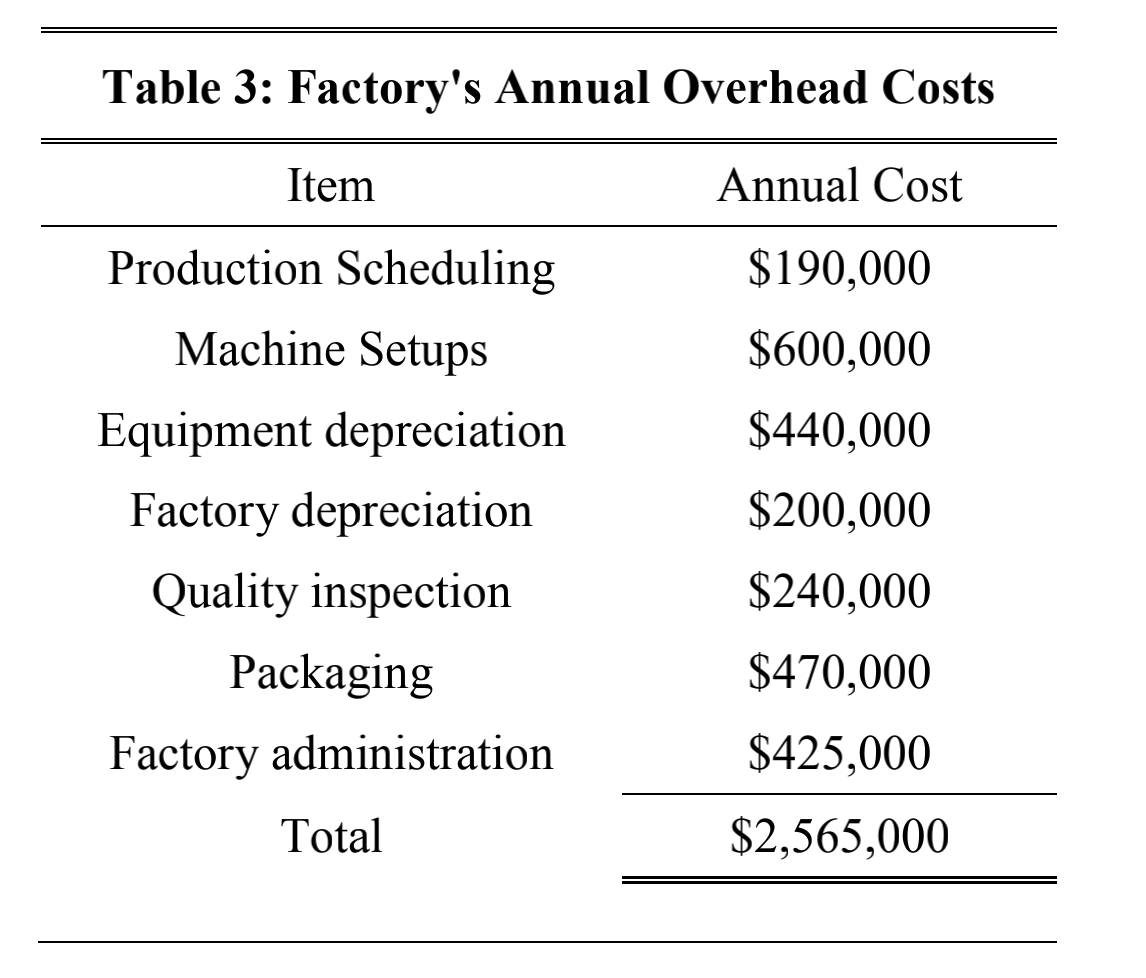

Currently, the sales department sets Crystal's prices for the three products after benchmarking against the prices of similar products available in the marketplace. The General Manager of Crystal, Sean Smith, is searching for measures to improve profits. Possible approaches include: (1) increase the production of profitable products, (2) stop producing the unprofitable products, (3) if keeping the unprofitable products, search for approaches to reduce costs or increase revenues. These decisions rely on accurate costing information. Sean asks Jim, an intern at Crystal, to collect information to prepare an analysis report. Jim starts collecting the detailed production process information on each of the three products (Table 2) and the factory's annual overhead cost (Table 3). He presents these tables to Sean.

After seeing all the information, Sean thinks Jim should speak to the manufacturing department. Jim speaks to John, the head of the manufacturing department. The discussion between Jim and John yields more understanding of the production process. First, while all three types of ornaments are made on the same production lines, Crystal palace ornament sets require an additional painting process. This process is conducted by 24 workers who only work for hand-painting intricate designs inside each Crystal palace ornament. These 24 workers stay in the painting department.

Second, John discusses the types of overhead at Crystal and the specific activities that could generate the company's overhead costs. Both production scheduling and machine-setup costs appear to be driven primarily by the number of batches required for the annual production volume. Because the number of batches varies by product type, John concludes that total yearly batches might be an appropriate means of allocating production-scheduling and machine-setup costs to the different product lines. John also mentions that they accept expedite orders only for Crystal palace ornaments. Taking expedite orders is Crystal's advantage over other competitors. However, expedite orders often result in batch rescheduling and increasing in the number of batches. John suggests that the number of machine operations performed per ornament is the better indicator of equipment depreciation than machine hours used. John also thinks that factorydepreciation could reasonably be based on the factory area that is used to manufacture, paint, and store each box. Each of the three types of products has its factory areas. Furthermore, John says that the number of inspections performed drives inspection costs, while the number of boxes used drives packaging costs.

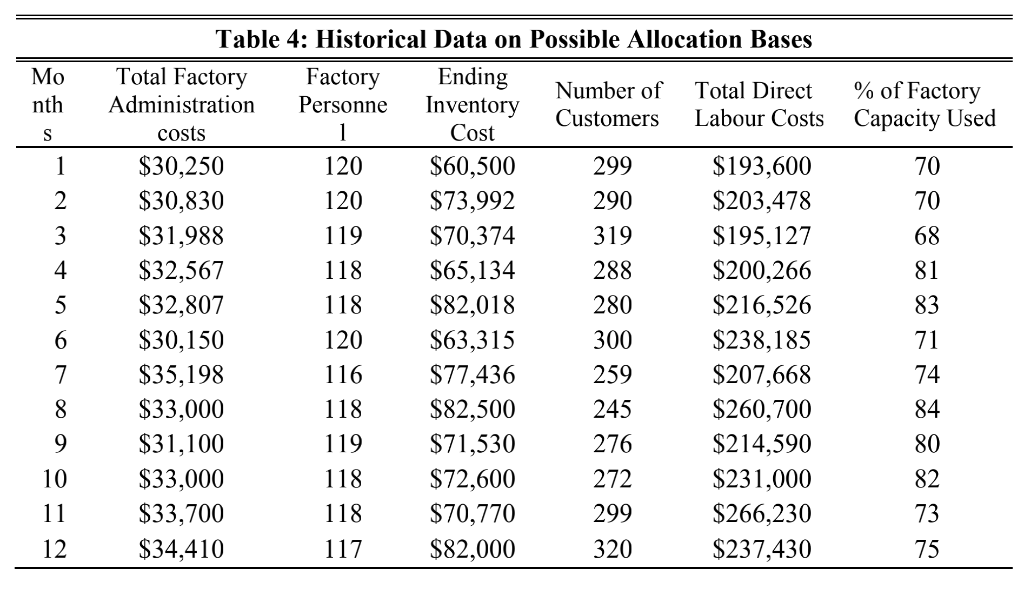

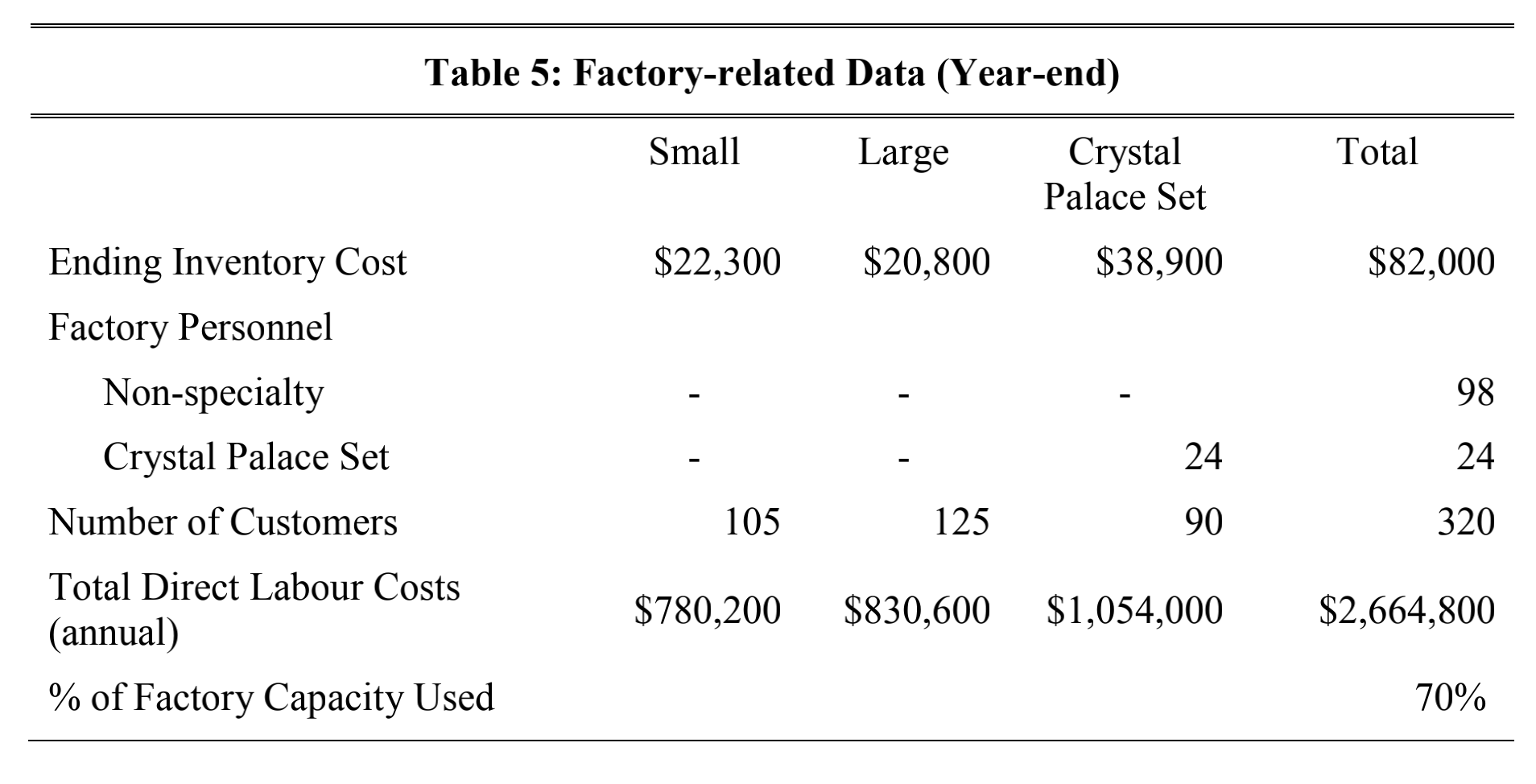

Third, while he gives suggestions on which factors drive the costs for many types of overhead costs, John has difficulties in identifying the driving force for factory administration costs. These costs include costs for facilities management, clerical costs, costs for warehouse personnel and activities, and security costs. John provides Jim with some historical data to identify the best cost driver (Tables 4 and 5).

After the discussion with John, Jim talks to Joyce, the book-keeper, to gather more insights into the manufacturing process and the costing of the products. Joyce tells him that Crystal uses a volume-based costing system to calculate the cost per box of each product. Specifically, budgeted overhead costs have been allocated to each product line based on the planned production of ornaments. Joyce thinks that another, probably better, approach is to allocate budgeted overhead costs to each product based upon the total of direct material and direct labor costs. Jim returns to Sean's office with all the information. Sean decides to enlist outside help. Sean calls Axel Baker, the principal of KW Consultants, to set up a meeting to discuss Crystal's situation. Axel assigns this task to your team.

REQUIREMENTS

Identify the most appropriate cost allocation base for factory administration costs, using Table 4 that presents historical data on the possible five cost allocation bases. Discuss how the selected cost allocation base meets all the evaluation criteria and why this is the best option.

If you also want to include the results from a statistical package, please have them in the appendix.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started