[Introduction]:

Auditee: "Foot Fault"

"Foot Fault" is a small wholesaler and service supplier concentrating on the tennis market. They are located in the Hamilton, Ontario area and carry on business in South-Central Ontario.

In the course of regular business, Foot Fault sells supplies to local sports and athletic clubs (for retail sale in the club's "Pro Shops", meaning the in-club retail stores) as well as servicing the physical needs of clubs (tennis net repairs, tennis court surface repairs, etc.).

Some of Foot Fault's products are manufactured in the Hamilton location (Foot Fault Racquets, Foot Fault tennis balls, Foot Fault tennis clothing and accessories such as head-bands and caps) and some products are purchased from third-party suppliers to add to inventory (same types of products: racquets, balls, clothing and accessories).

Teper and Lubetsky LLP is a Public Accounting firm located in Hamilton, Ontario and Foot Fault is one of their clients.

NOTE: Foot Fault's year end is October 31; Teper and Lubetsky are auditing Foot Fault for the year ended Oct. 31, 2020. [i.e. the "current time" for your role in this Group Assignment is after November 1, 2020].

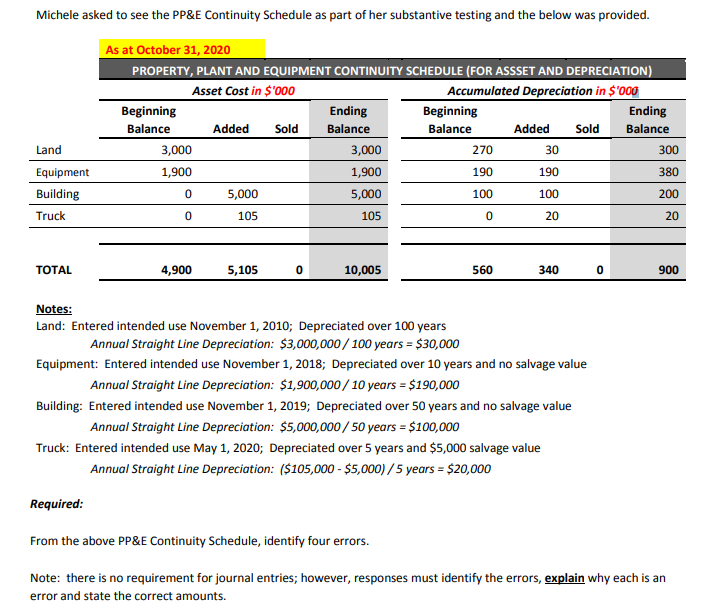

Michele asked to see the PP&E Continuity Schedule as part of her substantive testing and the below was provided. As at October 31, 2020 PROPERTY, PLANT AND EQUIPMENT CONTINUITY SCHEDULE (FOR ASSSET AND DEPRECIATION) Asset Cost in $'000 Accumulated Depreciation in $'000 Beginning Ending Beginning Ending Balance Added Sold Balance Balance Added Sold Balance Land 3,000 3,000 270 30 300 Equipment 1,900 1,900 190 190 380 Building 5,000 5,000 100 100 200 Truck 105 105 0 20 20 TOTAL 4,900 5,105 0 10,005 560 340 0 900 Notes: Land: Entered intended use November 1, 2010; Depreciated over 100 years Annual Straight Line Depreciation: $3,000,000/ 100 years = $30,000 Equipment: Entered intended use November 1, 2018; Depreciated over 10 years and no salvage value Annual Straight Line Depreciation: $1,900,000 / 10 years = $190,000 Building: Entered intended use November 1, 2019; Depreciated over 50 years and no salvage value Annual Straight Line Depreciation: $5,000,000/ 50 years = $100,000 Truck: Entered intended use May 1, 2020; Depreciated over 5 years and $5,000 salvage value Annual Straight Line Depreciation: ($105,000 - $5,000) /5 years = $20,000 Required: From the above PP&E Continuity Schedule, identify four errors. Note: there is no requirement for journal entries; however, responses must identify the errors, explain why each is an error and state the correct amounts.Michele is next considering Foot Fault's Fixed Assets, specically its Property Plant and Equipment [PP&E} tracking. Foot Fault' s PFE lContinuity Schedule includes the companfs Fixed Asset and Accumulated Depreciation. Note that. from the depreciation calculated in the below document, a certain amount is allocated to inventory because of the use of the Fixed Assets in the production of goods ltennis shirts, etc.l. Michele has learned that John Smith, the former coordinator for PPE tracking. had left the company. Smith had based the creation and maintenance of the PP&E Continuity Schedule on these facts: Foot Fault uses Straight Line Depreciation for all PP&E Assets. Foot Fault's Land was purchased November 1, 2010 for $3,000,000. Smith had a casual conversation with some of Foot Fault's loading dock employees who said this piece of land is in a good location ,' it will be good for something like 100 years". Smith decided to use this statement in his calculations of the PPSE Continuity Schedule. All equipment currently used by Foot Fault was originally purchased on November 1, 2010. Acquisition costs were $1,900,000 and all other costs combined used to bring the equipment to its intended use were $100,000. The equipment has an estimated useful life of 10 years and no salvage value. (in November 1, 2019, Foot Fault moved into a new building which included all production, distribution and administrative functions the all functions}. Foot Fault paid $5,000,000 for the building's construction and to bring it to its intended use. The building has an estimated useful life of 50 years and no salvage value. Foot Fault recently purchased a truck, an asset they had never before owned. This eliminated most of the expense of paying shipping companies to move nished good to customers. The truck was purchased on May 1, 2020. Foot Fault paid $105,000 for the truck and to bring it to its intended use. The truck has an estimated useful life of 5 years and a $5,000 salvage value