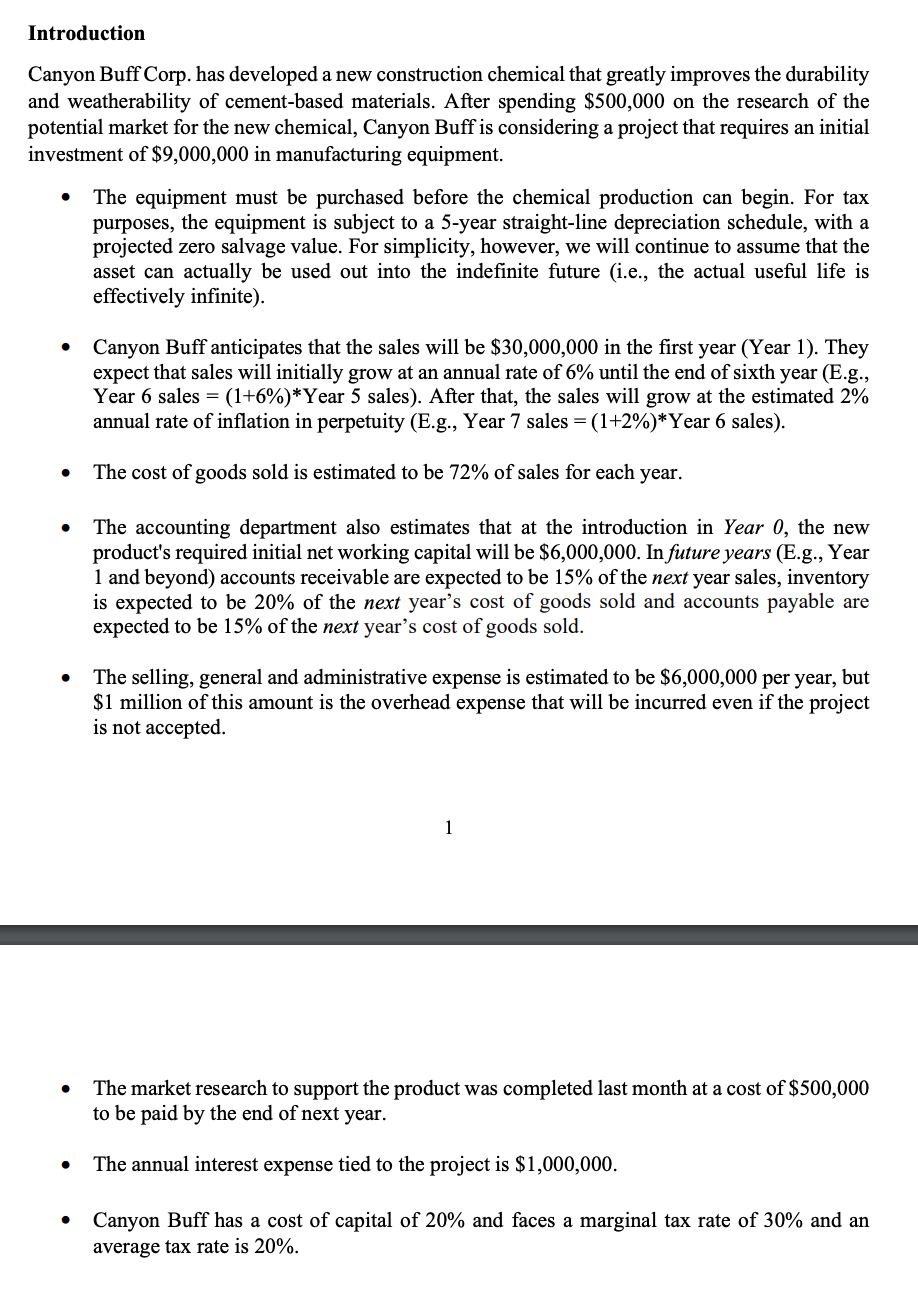

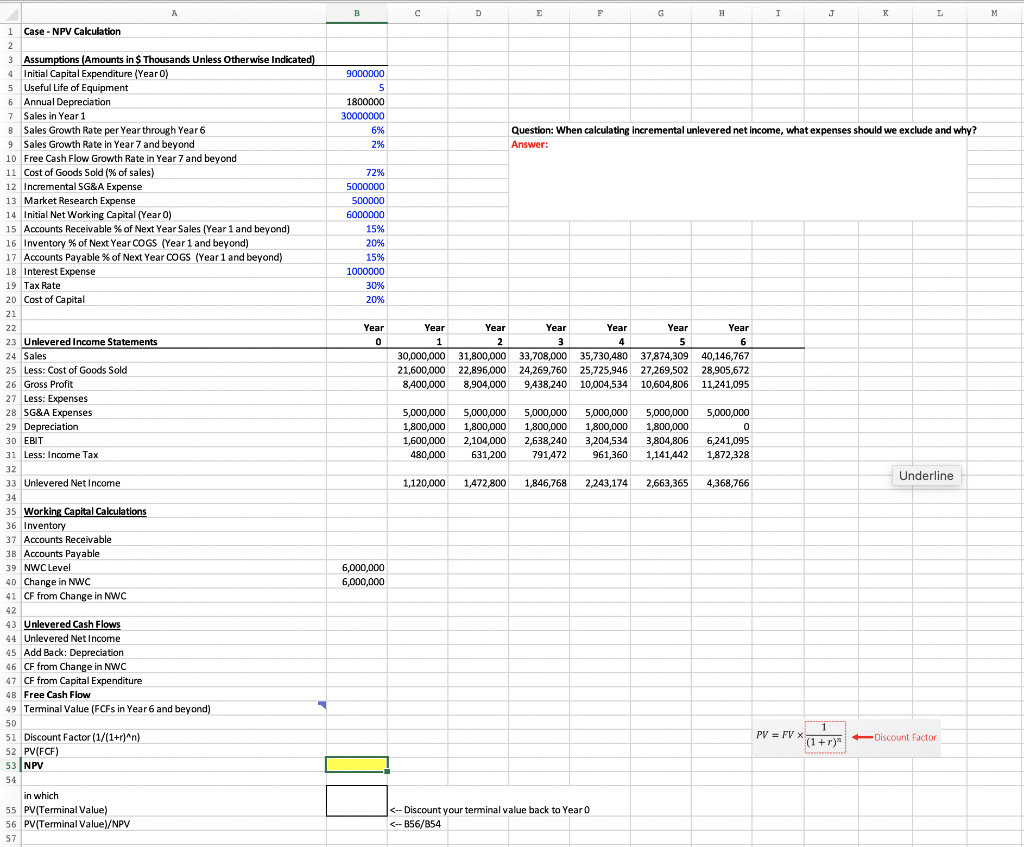

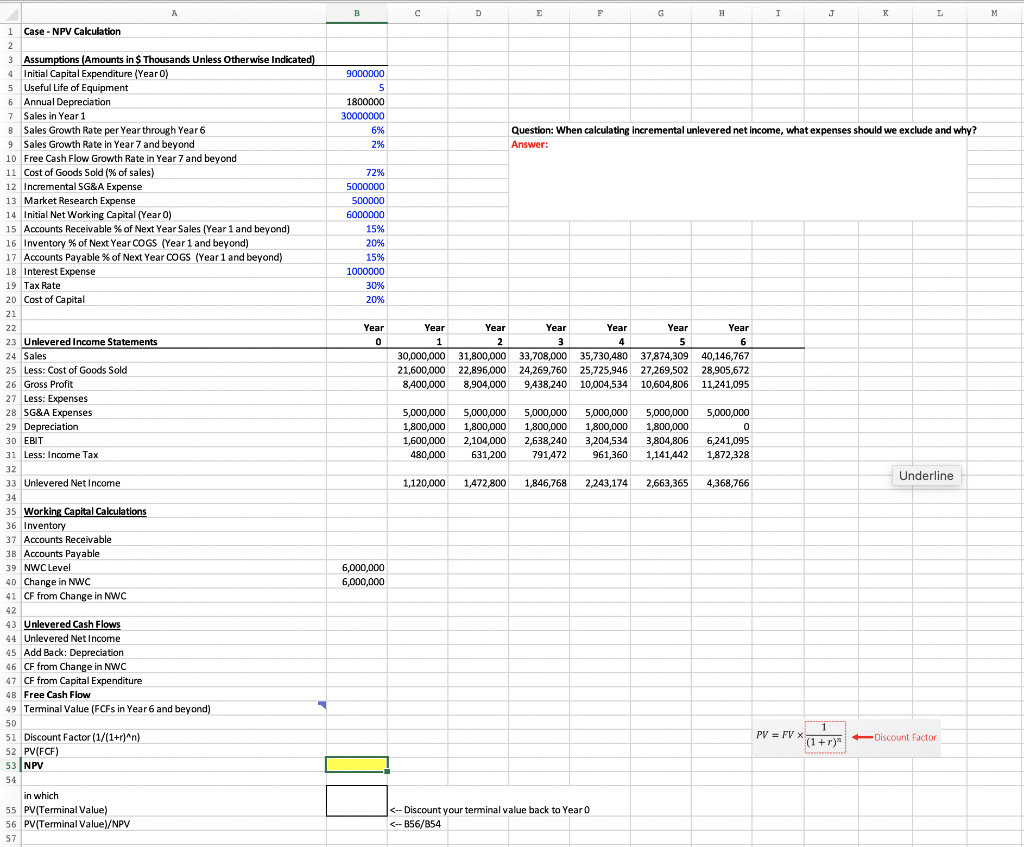

Introduction Canyon Buff Corp. has developed a new construction chemical that greatly improves the durability and weatherability of cement-based materials. After spending $500,000 on the research of the potential market for the new chemical, Canyon Buff is considering a project that requires an initial investment of $9,000,000 in manufacturing equipment. The equipment must be purchased before the chemical production can begin. For tax purposes, the equipment is subject to a 5-year straight-line depreciation schedule, with a projected zero salvage value. For simplicity, however, we will continue to assume that the asset can actually be used out into the indefinite future (i.e., the actual useful life is effectively infinite). . Canyon Buff anticipates that the sales will be $30,000,000 in the first year (Year 1). They expect that sales will initially grow at an annual rate of 6% until the end of sixth year (E.g., Year 6 sales = (1+6%)*Year 5 sales). After that, the sales will grow at the estimated 2% annual rate of inflation in perpetuity (E.g., Year 7 sales = (1+2%)*Year 6 sales). The cost of goods sold is estimated to be 72% of sales for each year. The accounting department also estimates that at the introduction in Year 0, the new product's required initial net working capital will be $6,000,000. In future years (E.g., Year 1 and beyond) accounts receivable are expected to be 15% of the next year sales, inventory is expected to be 20% of the next year's cost of goods sold and accounts payable are expected to be 15% of the next year's cost of goods sold. The selling, general and administrative expense is estimated to be $6,000,000 per year, but $1 million of this amount is the overhead expense that will be incurred even if the project is not accepted. 1 . The market research to support the product was completed last month at a cost of $500,000 to be paid by the end of next year. The annual interest expense tied to the project is $1,000,000. Canyon Buff has a cost of capital of 20% and faces a marginal tax rate of 30% and an average tax rate is 20%. B D E E G H 1 J K L M 9000000 5 1800000 30000000 6% 2% Question: When calculating incremental unlevered net income, what expenses should we exclude and why? Answer: 72% 5000000 500000 6000000 15% 20% 15% 1000000 30% 20% Year 0 Year Year Year Year Year Year 1 2 3 4 5 6 30,000,000 31,800,000 33,708,000 35,730,480 37,874,309 40,146,767 21,600,000 22,896,000 24,269,760 25,725,946 27,269,502 28,905,672 8,400,000 8,904,000 9,438,240 10,004,534 10,604,806 11,241,095 A 1 Case - NPV Calculation 2 3 Assumptions (Amounts in $ Thousands Unless otherwise Indicated) 4 Initial Capital Expenditure (Year O) 5 Useful Life of Equipment 6 Annual Depreciation 7 Sales in Year 1 8 Sales Growth Rate per Year through Year 6 9 Sales Growth Rate In Year 7 and beyond 10 Free Cash Flow Growth Rate in Year 7 and beyond 11 Cost of Goods Sold (% of sales) 12 Incremental SG&A Expense 13 Market Research Expense 14 Initial Net Working Capital (Year) 15 Accounts Receivable % of Next Year Sales (Year 1 and beyond) 16 Inventory % of Next Year COGS (Year 1 and beyond) 17 Accounts Payable % of Next Year COGS (Year 1 and beyond) 18 Interest Expense 19 Tax Rate 20 Cost of Capital 21 22 23 Unlevered Income Statements 24 Sales 25 Less: Cost of Goods Sold 26 Gross Profit 27 Less: Expenses 28 SG&A Expenses 29 Depreciation 30 EBIT 31 Less: Income Tax 32 33 Unlevered Net Income 34 35 Working Capital Calculations 36 Inventory 37 Accounts Receivable 38 Accounts Payable 39 NWC Level 40 Change in NWC 41 CF from Change in NWC 42 43 Unlevered Cash Flows 44 Unlevered Net Income 45 Add Back: Depreciation 46 CF from Change in NWC 47 CF from Capital Expenditure 4B Free Cash Flow 49 Terminal Value (FCFs in Year 6 and beyond) 50 51 Discount Factor (1/(1+r)^n) 52 PV(FCF) 53 NPV 54 in which 55 PV(Terminal Value) 56 PV(Terminal Value)/NPV 57 5,000,000 1,800,000 1,600,000 480,000 5,000,000 1,800,000 2,104,000 631,200 5,000,000 1,800,000 2,638,240 791,472 5,000,000 1,800,000 3,204,534 961,360 5,000,000 1,800,000 3,804,806 1,141,442 5,000,000 0 6,241,095 1,872,328 Underline 1,120,000 1,472,800 1,846,768 2,243,174 2,663,365 4,368,766 6,000,000 6,000,000 PV = FV X 1 (1+r) Discount Factor